Global Macro Summary

Resilience: In 2023, GDP growth surprised to the upside in several Emerging Market (EM) countries and recovered in China. In 2024, EM ex-China should remain supported as the Chinese GDP soft-landing resumes. Developed Market (DM) growth has also been more resilient than feared, but EM macro stability remains the bright spot. In our opinion, the better fiscal and monetary policy stance post-Covid of EM countries allowed EM inflation to decline faster. With real interest rates elevated, the EM monetary easing cycle that started in 2023 is likely to accelerate in 2024.

Tails: After the most aggressive hiking cycle since 1980, global inflation has declined significantly and, in the absence of shocks, should continue to come down in 2024 led by service sector inflation. Despite economic growth resilience and declining inflation, the spotless ‘goldilocks’ scenario implied by the rate curve should carry less weight than most assume, in our view. If weak credit links break down (high yield companies, low-income households, real estate, etc.), then policy makers will cut rates by more than priced. At this stage in the cycle, we think that more cuts is more likely than no cuts, hence we like rates in 2024.

Inflection Points: Countries representing more than 60% of global GDP will have elections in 2024. The most consequential ones in EM for financial markets will be Taiwan, Indonesia, India, South Africa, Mexico, Malaysia, and Romania. Elections often lead to policy inflections. The rise of the far-right in Argentina and the Netherlands has set the scene for the elections in the European Union (EU) and the US. Geopolitical inflections are also possible. The status of the conflicts in Gaza and Ukraine will evolve. Presidential elections in Taiwan will likely keep tension with China elevated, at least until elections take place. In terms of climate, the El Niño seasonal phenomenon may bring agricultural price volatility.

Emerging Market Summary

Resilience was the main 2023 EM theme. EM debt has outperformed despite depressed sentiment in China, an aggressive US Federal Reserve (Fed) rate hiking cycle, 10-year US Treasuries (USTs) hitting 5.0% and the Dollar rallying as well as poor global fixed income returns. EM equities had positive returns despite poor sentiment in China.

Fundamentally, EM was anchored by what we saw as sound fiscal and monetary policy. Despite starting an easing cycle ahead of the Fed, real interest rates remained elevated across EM. Furthermore, most large EM countries with large shares in the EM debt indices are safe havens to geopolitical risks and have been less affected by political risks than feared.

Technically, outflows from EM dollar-denominated debt were more than compensated by the second consecutive year of negative net issuance. Local currency flows were close to flat year-to-date (ytd), meaning the foreign holdings of local bonds kept declining. EM equities had modest inflows.

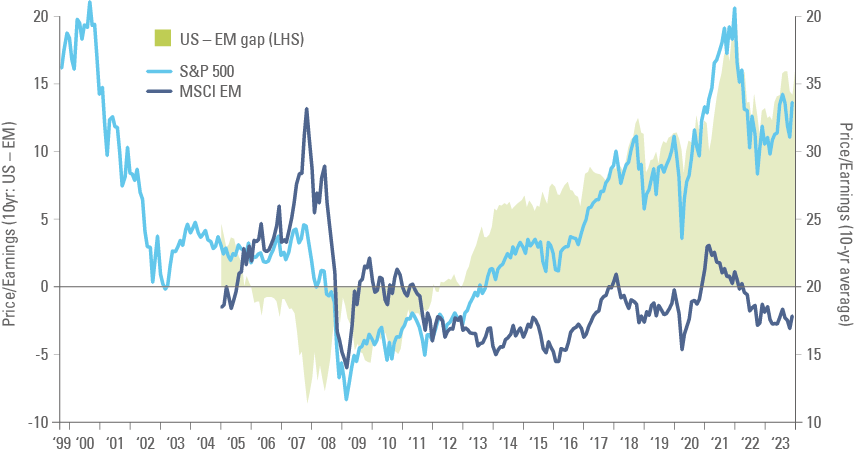

Valuations remain attractive. EM equities trades at the widest discount to US stocks in 10 years. An inflection in EM earnings is the last catalyst needed for EM stocks to outperform. Investment grade and high-quality high yield EM bonds spreads are tight, but yields are elevated. The distressed part of high yield retains a lot of optionality, where selective exposure can lead to extraordinary returns.

In our view, this resilience is likely to continue in 2024, in the absence of a hard landing. EM equities underperformed in 2023 and await the rebound in earnings. We are monitoring earnings in the EM technology sector, which could provide the catalyst for a powerful secular re-rating.

1. A Brief 2023 Review

What a decade so far! The 2020s started with a major worldwide health shock, which alongside a divided society, led to a surge in populist policies and rising geopolitical conflicts.1 The response to Covid-19 led to a spectacular economic recovery (2020-2021), followed by a major inflation shock (2021-2022) and the most aggressive monetary policy tightening since the 1980s (2022-2023).

The recession anticipated in 2023 has not materialised in the US, mostly, in our view, due to the imbalances built into the labour markets from the Covid-19 policy response, alongside pro-cyclical fiscal expansion, and liquidity expansion from bank bailouts in the US and Switzerland. Nevertheless, DM GDP growth softened, and goods inflation declined sharply. The service sector inflation remained somewhat elevated due to the resilience of the labour markets. According to JP Morgan, global inflation declined by 420bps to 3.7%, while services inflation slowed by only 70bps to 4.9%.

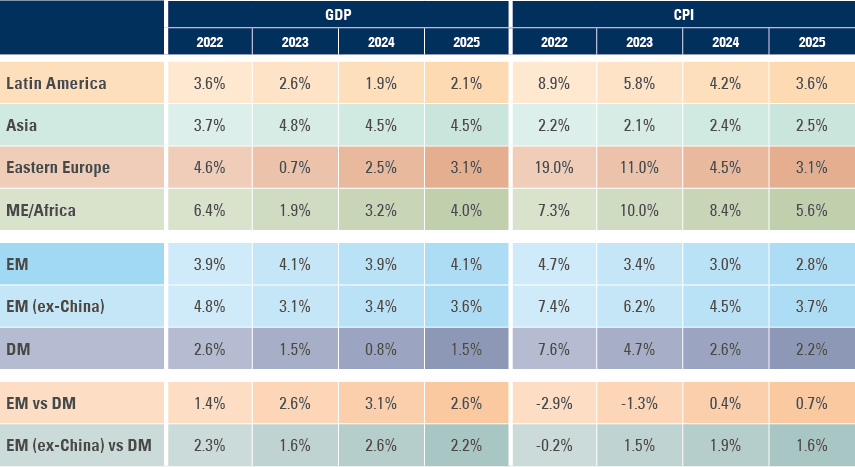

If current sell-side consensus projections materialise, DM GDP growth will have declined from 2.6% in 2022 to 1.5% in 2023 (see Fig. 1). Over the period, GDP growth will have accelerated only in Japan (+90bps to 1.9%) and the US (+20bps to 2.3%). The Swedish and German economies moved into recession in 2023, contracting 0.6% (-340bps) and 0.3% (-210bps), respectively. The largest declines in GDP growth took place in the Netherlands (-390bps to +0.4%) and the UK (-360bps to +0.5%), with overall EU GDP growth likely slowing to 0.5% in 2023 from 3.3% in 2022.

The Fed hiked its policy rates by more than expected at the beginning of the year to 5.5%. The initial UST rally driven by bank failures reversed sharply and global yields widened from April to October. Yields started to increase after the bank bailouts in the US and Switzerland (mitigating a systemic problem) and higher than expected GDP growth. The subsequent vast increase in UST issuance post debt ceiling suspension led to a sharp increase in the term premium until October. From mid-October, the softer labour market and inflation allowed market participants to price the end of the Fed, European Central Bank (ECB), and Bank of England (BoE) hiking cycles, and to begin speculating on when policymakers would cut rates.

The Dollar was relatively strong throughout most of the year, particularly against the Japanese Yen, which remained unanchored by the Bank of Japan’s (BoJ) negative interest rate policy and yield curve control (YCC). The reversal of the sell-off in USTs in October alongside the end of YCC in Japan brought the Dollar lower again. The EUR had a choppy 2023 but is up against the USD at the end of November.

Against this backdrop, it is remarkable how resilient EM asset prices remained. EM local currencies remained robust throughout the year, despite the strong dollar environment. In our view, EM currencies were anchored by three fundamental factors:

- Policy stability: no ‘helicopter money’ and early hikes

- Better than feared fiscal results in a few countries, including Colombia, Brazil, and South Africa

- Resulting in higher GDP growth and lower inflation

Overall, EM growth remained close to 4.0% in 2023, and the gap between EM and DM GDP growth increased by more than 100bps to around 2.5%. EM ex-China growth decelerated by 180bps to 3.1%. Despite the slowdown, EM ex-China GDP growth was twice the pace of DM growth.

GDP growth increased sharply in China (from 3.0% in 2022 to 5.1% in 2023), Hong Kong (from -3.5% to +3.5%) and Thailand (+20bps to 2.8%). One of the biggest economic surprise of 2023 was the Brazilian GDP which increased by 10bps to 3.0% (consensus was closer to 1.0% early in the year). The Saudi Arabian economy slowed the most (-840bps to +0.4%), followed by Colombia (-590bps to 1.4%), and Malaysia (-470bps to 4.0%). Recession hit Argentina (-770bps to -2.8%), Hungary (-510bps to -0.5%), Czechia (-250bps to -0.2%) and Chile (-260bps to -0.2%) in 2023.

Against this backdrop, several EM central banks started cutting policy rates already in Q2 2023, as inflation converged towards the target and real interest rates became excessively elevated. High relative real yields mean EM central banks that eased monetary policy gradually suffered only temporary currency headwinds.

The EM resilience allowed EM local currency bonds to outperform global fixed income (Bloomberg Global Aggregate) for the second consecutive year, with local currency bonds up 9.2% ytd to November while the Bloomberg Global Agg. rose only 1.5% over the same period. EM investment grade (Corporate up +4.3% ytd; Sovereign 2.2% ytd) outperformed the US Global Aggregate (+1.8% ytd) and EM high yield bonds also did well (Corporates +8.0%; Sovereign +10.2% ytd), in line with US Corporate HY at 9.4% ytd. MSCI EM returned 6.6% weighed lower by MSCI China (-9.6%) with MSCI EM ex China up 13.4%.

2. Review of our 2023 Outlook Calls

Good calls

- End of China zero-Covid earlier than consensus

- EM growth outperformance vs DM accelerating led by EM Asia

- Latin America, GCC, EM Asian, GDP growth outperforming consensus

- Faster disinflation than consensus, particularly within EM countries that hiked early

- Scenario Analysis: EM LC out-performed EM HC

- Within EM hard currency: Hold a barbell of IG with distressed:

- As of 30 Nov, the CCC bucket of the JP Morgan EMBI GD (EM sovereign) was up 36% ytd and non-rated credits were up 8.2%. However, the latter has a zero weight in Venezuela, which rose 155% ytd. IG sovereign rose only 2.2% ytd

- A portfolio with 80% in IG bonds and 20% in distressed (15% CCC, 2.5% in non-rated and 2.5% in Venezuela) would have delivered 11.2% returns ytd, while the EMBI GD rose 5.7% ytd

- Even 90% IG, 7.5% CCC and 1.25% in each NR and Venezuela would have returned 6.7%, thus outperforming the EMBI GD (50% HY and 50% IG)

Bad calls

- Year of Two Halves: US recession around mid-year did not happen.

- What went wrong? Resilient labour market meets US fiscal expansion.

- We expected fiscal contraction post Democrats losing the mid-term elections.

- Scenario: Something akin to a ‘soft landing’ scenario (slowdown, but no recession) played out.

- Returns close to expected in IG, but high yield spreads tightened less than factored.

- Foreign exchange (FX) returns in local currency bonds lower than expected at 1.2% ytd vs +7.5% in the scenario analysis.

- Higher Fed Funds Rates than conjectured and JPY weakness.

- Positive inflection for EM equities and outperformance vs DM stocks:

- EM equities had a positive 2023, after a negative 2022, but no outperformance vs DM.

- Our base case for EM equity returns was +18%. China negative returns was the main drag vs. our base case scenario.

3. 2024 Macro Outlook

Until recently, it felt like the US economy was “un-land-able”. However, interest rates moving higher than expected and staying there for longer, and the current US fiscal consolidation has started to show in the most levered corners. For example, default rates are increasing in European corporates, real estate, global CCC-rated bonds, and levered loans.2 Thus, in our view, some sort of landing ought to be expected in 2024, barring another major fiscal expansion, or early rate cuts.

An increase in defaults is likely to bring weaker economic activity across DM, in line with forecasts. Consensus expectations are incorporating a further soft landing as inflation finally returns to the 2.0% area on DM economies as per Fig. 1. Overall, DM growth is forecast to halve to 0.8% in 2024, whereas major EM GDP growth remains resilient at just under 4.0%.

Fig. 1: GDP Weighted Economic Forecasts: CPI vs. GDP

Where consensus can be wrong?

It is rare for inflation to decline from 7.6% to 2.6% in two years without a recession. For DM activity to soft-land, central banks may need to ease policy rates earlier than currently expected, or fiscal policy will have to turn expansionist again. Fiscal consolidation under discussion both in the US Congress and the Bundestag can force policymakers to cut rates. Like in 2023, EM growth may remain more resilient due to a few factors:

- EM Asia hiked policy rates slower and to a much more moderate level.

- Latin America and Eastern Europe central banks started to ease and have more room to stimulate the economy in the event of a stronger slowdown.

- Endogenous sources of GDP growth: Economic reforms in Brazil, Indonesia and India increased these countries’ potential GDP growth.

- Supply chain de-risking increasing foreign direct investment (FDI) across EM ex-China.

EM Asia

China: Analysts have revised GDP growth in China to around 4.5% in 2024 and 2025 from 5.1% in 2023. A recovery in capital flows to China and/or an increase in RMB as a trade mechanism can have a positive impact on Hong Kong. Most economists see more downside risks for the Chinese economy. We concur downside risks exist, but there are a few notable underappreciated upside risks:

Downside risks: A resolution of the real estate crisis is critical, as it is a systemically important sector that has been distressed for nearly two years. Overall, consumer and business sector sentiment has remained depressed, despite the reopening of the economy nearly 12 months ago. The deleverage of the shadow banking system, including wealth management products and local government financing vehicles, is another risk to monitor. Recent meetings between regulators and financial institutions suggest the government is starting to grasp the seriousness and depth of the problem and are considering committing financial resources to support the real estate sector and manage the shadow banking liabilities.

Upside risks: Foreign companies investing in China are likely to get a reprieve following the Xi Jinping charm offensive in San Francisco. China remains the world leader in the volume and quality of manufactured goods and components for the energy transition, artificial intelligence (AI), and robotics, among other technological frontiers, alongside executing large-scale infrastructure projects at unrivalled costs and speeds. While multinational companies are willing to diversify exposure from China, no viable substitute can yet match China on volume, speed, and efficiency.

India and Indonesia: GDP growth is forecast to remain stable in India at 6.2% and Indonesia at 5.0%. There are more upside risks to growth in India, where political risks appear to be limited, and structural reforms have positioned the country as a major beneficiary from the reshuffling of supply chains away from China. Indonesia has more political risks, as Jokowi ends his mandate in late October 2024. Both Indonesia and India have endogenous growth drivers and will likely benefit from their neutral positioning in geopolitical conflicts.

South Korea, Malaysia, Philippines, and Thailand: Other Asian countries offer more upside than downside in our opinion. The KRW and MYR have been under pressure due to a weakening of the JPY and RMB. However, the JPY is likely to strengthen in 2024 as the Bank of Japan (BoJ) has already given up on YCC and will likely hike its policy rates from negative levels next year, due to higher GDP growth leading to wage inflation. The recovery in Korean and Taiwanese exports of electronic products also bodes well for GDP growth across these medium-sized but also very open and competitive economies. Thailand and the Philippines should also benefit from a larger number of Chinese tourists traveling abroad.

Latin America

As in 2023, there is room for (more modest) upside surprises in Latin America, in our view.

Brazil: Brazil’s GDP is forecast to slow to 1.7% in 2024 from 3.0% in 2023. We believe the potential for GDP growth has increased due to structural reforms since 2015. The central bank will likely cut its policy rate further to between 7.5% and 9.5% by the end of 2024. The exact level will depend on the inflation evolution, which on itself is contingent on the government consolidating the fiscal deficit to achieve a balanced primary account in 2024. The central bank target is 3.0% with a tolerance interval of 1.5% and today the sell-side consensus is for consumer price index (CPI) inflation closer to 4.0%. Should inflation decline to the centre of the target, in our view, the Selic should converge towards 8.0%.

Mexico: Mexican activity is expected to slow to 2.0% in 2024 from 3.3% in 2023. This is a reasonable scenario considering the likely slowdown of the US economy and the Mexican central bank keeping monetary policy restrictive for longer. Nevertheless, Mexico could benefit from nearshoring capex to a larger extent than currently expected. A political transition in 2024 is also likely to boost sentiment towards investments in the country. On the other hand, the return of Donald Trump could bring noise in Q4 2024.

Elsewhere in Latin America, the Chilean and Peruvian economies are expected to recover from around 0% towards 2.0% and 2.5% respectively. The wild card in Latin America is Argentina. Consensus is for a 1.0% contraction, a modest improvement from -2.8% in 2023. There is a possibility of a stronger recovery, driven by a better harvest in 2024 (2023 was a very poor harvest due to a severe drought) and an increase in exports of energy. The key question is whether president-elect Javier Milei will manage to rebalance Argentina’s massive 4.8% fiscal deficit, which today is fully funded by the central bank (monetisation) and restore macroeconomic stability. Counterintuitively, a front-loaded fiscal consolidation could be positive for Argentinian GDP growth, as inflation would likely decline faster than expected, lifting investors’ confidence.3

Lastly, lifting the sanctions in Venezuela could boost oil production in the beleaguered South American country, with potential positive spillovers on Colombia’s economic performance. Colombian President Gustavo Petro is struggling to implement his progressive agenda as the Colombian Peso was the best performing currency in 2023 and could repeat the solid performance in 2024. Even if the economic performance disappoints, asset prices are too low to ignore in Colombia, and Latin America in general in our opinion. Investors sitting out over wariness of leftist politicians are ignoring the fact that these countries have been delivering macro stability and strong returns, in our view.

Middle East & Africa

Economic growth is expected to accelerate in the Middle East. The slowdown in 2023 was driven by weaker oil prices (c. 20% on average) vs 2022 and lower production in Saudi Arabia. Whereas the non-oil economy remains supported, downside risks remains if global demand for oil declines.

In the non-oil sector, the United Arab Emirates is benefiting from a large capital pilgrimage as Dubai consolidates itself as a major low-tax jurisdiction financial hub. Saudi Arabia’s Vision 2030 has been implemented more swiftly than sceptics anticipated. The large increase in the workforce allowed by the social reforms have transformed the Saudi economy. Saudi is likely to benefit from investments in infrastructure, mining and consolidate its position as the lowest marginal oil producer in the world.

The war in Gaza is unlikely to heavily disrupt the balance of power in the region, in our view. OPEC+ is likely to keep the oil supply tight, as demand is likely to decline on a temporary basis in early 2024. Overall, we still believe oil prices (and resources in general) have more upside than downside over the next years.

Eastern Europe

The wild card for Eastern Europe is the conflict in Ukraine. If in the past it was a source of downside risks, today the upside and downside risks appear to be more balanced. Any ceasefire and reconstruction effort in Ukraine (see Geopolitics) will support neighbouring countries and trade partners, such as Poland.

4. Markets: EM Debt Resilience. EM Equity Hope

Global rates and fixed income: Haves vs. Have-Nots

US sovereign debt was close to reaching a record of three consecutive years of negative nominal returns until the strong rebound in November. From peak to trough, 30-year USTs (the long bond) sold off by c. 50% in nominal terms, which is close to a 70% depreciation in real terms over the same period.

We expect 2024 to be different. The aggressive hiking cycle is already weighing on the credit market with defaults on CCC-rated US corporate debt and levered loans increasing. Moreover, the maturity profile of US high yield issuers and levered loans is set to increase meaningfully in 2025 and 2026 as companies struggle to access the market to roll their debt or are forced to do so at prohibitive costs.

Therefore, if interest rates remains elevated, the 2024 credit market will see an even larger dispersion between the ‘haves’ versus the ‘have-nots’. On one hand, investment grade corporations and wealthier households in the US took advantage of cheap funding post-Covid to extend the debt maturity at record low interest rate levels. On the other hand, smaller companies with lower credit ratings have faced tough competition from disrupters, pandemic-related challenges, higher labour (and other) costs, and higher interest rates. However, the degree of damage on the economy is path dependent.

The risks of accidents will increase if interest rates increases again after a sharp rally in November. The credit cycle could be cut short if defaults are met with aggressive liquidity injection or fast fiscal expansion (Covid-19 muscle memory or funding for global wars). Overall, the credit crunch on the ‘have-nots’ amidst a backdrop of strong disinflation means that the policy rate has likely peaked, rotating the discussion towards the timing and magnitude of policy rate cuts.

The implied Fed Funds Rate by the overnight index swaps (OIS) currently has 75-100bps of cuts for 2024. Several analysts make the mistake of adopting this as the base case scenario, pricing very high odds of the implied pricing, and low odds of alternative scenarios. In our view, it is more likely that the Fed will either keep policy rates unchanged, for example, due to fiscal expansion or be forced to cut rates much more aggressively (credit cycle). In the second scenario, the Fed is likely to cut rates by 200-300bps, to 2.5%-3.5% area.

EM Debt

Emerging Market debt has had a good performance in 2023 and the 2024 outlook is favourable, aided by the fact that there is more room for policy easing than tightening globally.

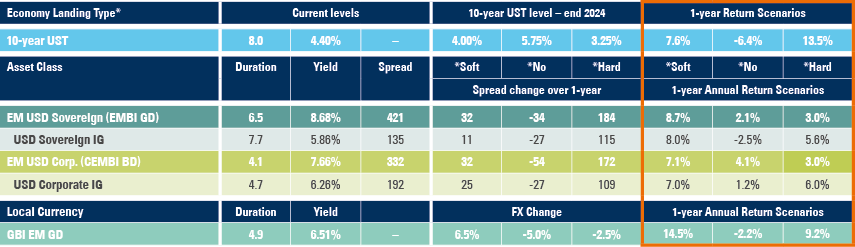

At the start of the year, credit spreads looked tight (130-190bps) in the investment grade space but yields at 5.9%-6.3% are very attractive for long-term investors. The broader indices have a similar set-up today with attractive yields at 7.7% to 8.7%, but relatively tight credit spreads at 330-420bps. Fig. 2 has the traditional 12-months ahead scenario analysis contemplating three possible outcomes for UST yields and the mechanic impact on credit spreads, assuming the historical correlations hold.

Local currency bonds may offer the most upside, as central banks have room to ease monetary policy in the case of a hard landing, but EM currencies can outperform in a scenario where the Fed cuts policy rates early, which is likely to be dollar negative.

Investment grade bonds offer high total returns for both a soft and hard landing, but would struggle if the economy rebounds, forcing the Fed to keep interest rates unchanged during 2024.

Two sell-side banks (Morgan Stanley and Bank of America) have a much higher base case scenario for EM sovereign debt, at 2-digit levels in 2024. The asset class can rise by 14% if 10-year UST rallies slightly below 4.0% and credit spreads tighten to 375bps (last 10-year low was around 250bps in 2014 and highs around 700bps in 2020) – a wholly reasonable scenario in our opinion. Seasonally, EM debt outperformed after the end of the Fed hikes a few distressed credits offer more upside than downside as debt restructuring processes have been progressing, from Sri Lanka to Ghana and Zambia. The outcome of the Argentinian election increases the risk of a front-loaded fiscal consolidation, a scenario that would be very supportive for bonds. In our view, a barbell approach between investment grade and distressed debt will do well again in 2024.

Fig. 2: EM Debt Scenario Analysis 12-months ahead

*Default assumptions: Base case = average of 10yrs / Bear case: worst 10yr / Bull case = best 10yr (rolling 5yr defaults).

**Spread: Bear: Spreads widen to Covid-19 levels / Bull: spreads tighten to last 5yr lows / Base: c. 50bps wider.

***GBI EM GD: Yields at 6.35%, 7.25% and 5.50% on soft, no landing, or hard landing.

Technicals

The outperformance of EM debt defied cumulative outflows of close to USD 100bn from EM debt in 2022 and 2023 combined. The last year when the asset class had outflows was in 2008, but the numbers were much smaller, both in absolute and relative to AUM terms.

Balancing the net outflows was the fact that many issuers opted to repay their debt instead of refinancing at higher interest rates. Cumulative negative net issuance in 2022 and 2023 was close to USD 350bn when adding up dollar-denominated sovereign and corporate debt. Several high yield credits were ‘priced out’ of the market with yields that are unsustainable and had to rely on alternative source of finance.

EM Equity

The valuation gap between the S&P500 and the MSCI EM widened further in 2023, with MSCI EM trading 18x earnings relative to the S&P500 at 34x on a price to 10-year average ratio, as illustrated in Fig 3. The gap also widened on a price to 12-month blended forward earnings ratio with EM unchanged at 11.5x while the US re-rated from 16.9x in December 2022 to 18.9x on 28 November 2023. Higher costs of labour and elevated interest rates kept earnings virtually unchanged in the S&P500, but earnings declined by 7.2% in EM. Most of the earnings decline took place in Asia ex-China and Latin America. The notable narrow market leadership in US stocks in 2023 and the eye-watering valuation levels makes the sustainability of US stocks performance fragile, in our view.4

Fig. 3: S&P500 vs MSCI EM price to 10-year average earnings

In cyclical terms, EM equity tends to be one of the first and primary beneficiaries of an improving macro-economic cycle. Furthermore, an improvement in investor sentiment towards China would positively impact EM equity and see multiples rerate. The People’s Bank of China (PBoC) has been taking steps to increase targeted stimulus to tackle the spiralling debt problems in the real estate sector, which continue to depress sentiment. In 2024, greater policy momentum and stimulus packages that reinspire confidence in the real-estate sector, coupled with wider positive ramifications for consumption and spending patterns can lead to a meaningful inflexion point for EM stocks, in our view.

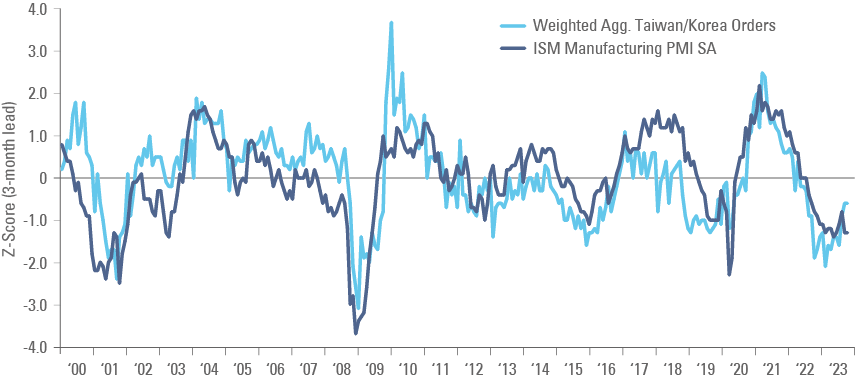

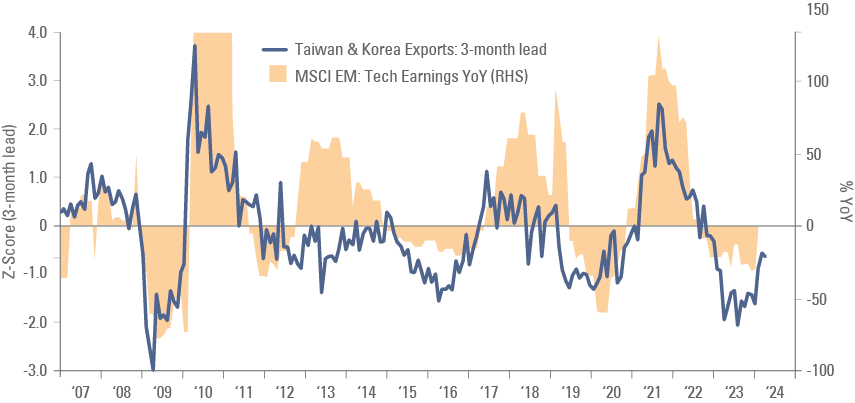

Looking ahead, the key for the EM multiple re-rating will be an eventual rebound in earnings. Export numbers for Taiwan and South Korea are leading indicators for both the global manufacturing cycle and for EM technology earnings-per-share, as seen in Figs 4 and 5. The rebound in export orders from both countries signal a recovery phase in manufacturing and EM technology earnings, a positive sign for overall EM earnings improvement as technology represents more than 20% of EM equities today.

Fig 4: US ISM Manufacturing PMI vs Taiwan and Korean exports (z-score 3m lead)

Fig. 5: MSCI EM Technology earnings (%yoy) vs Taiwan and Korean exports (z-score 3m lead)

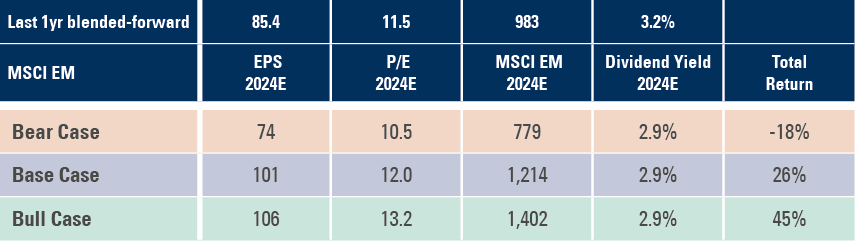

A simple scenario analysis shows the upside bias in EM equities future returns. EM equities have already seen an earnings recession, from USD 103 to USD 81, and are currently USD 85. The cyclical backdrop guides our expectations for 1-year forward earnings to recover towards USD 100 by the end of 2024. The EM equities valuation multiple has de-rated from 15.0x to 11.5x which can re-rate back to its long run average of 12x. On this base case scenario, EM equities would return 26% over the next 12 months. On the downside, EPS would decline just shy of the 2015 and Covid lows and P/E one standard deviation below its mean, leading to a 18% drawdown. On the bull case, we assume EPS and P/E one standard deviation above their average trend lines, implying 45% returns (Fig 6).

Fig 6: Scenario Analysis MSCI EM

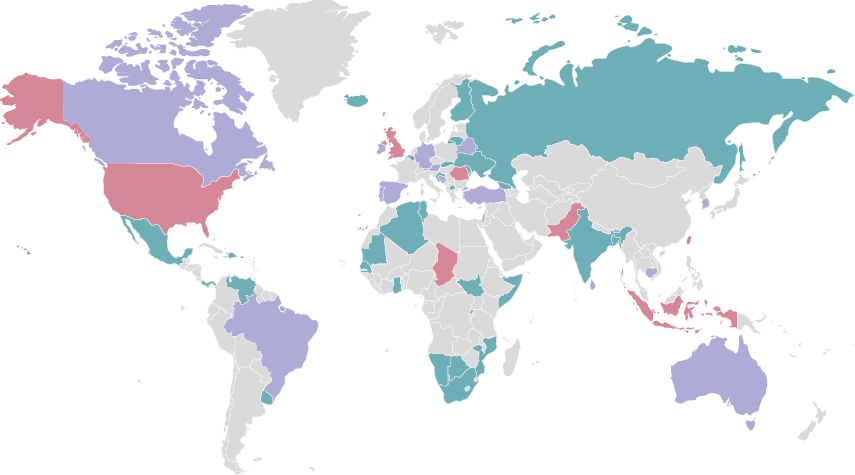

5. Political Calendar

Countries representing approximately 52% of the global population and 61% of global GDP have elections in 2024 (Fig. 7). It follows a momentous period in 2023 when notable political events took place in China, Türkiye, Thailand, Argentina, and the Netherlands.

Fig 7: Map of General and Local Elections

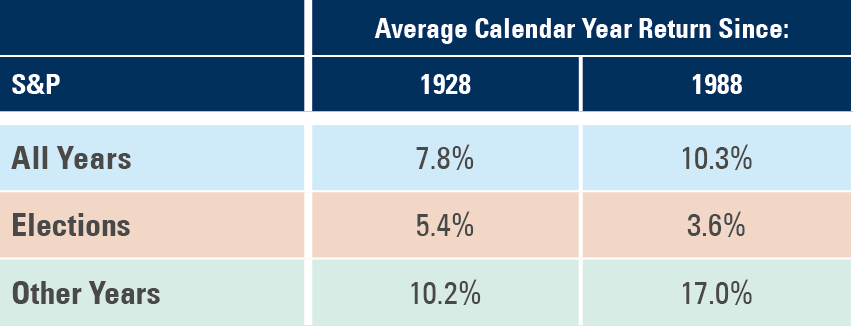

The overall impression is that politics is getting more binary. The trend of polarisation between far-right and far-left is firmly in place. In principle, that should increase the tail risks in policy matters, meaning higher market volatility, presenting both risks and opportunities for active managers. A potentially meaningless but notable statistic is how the S&P500 average performance was poorer in election years:

Fig 8: S&P500 performance during US election years

In this section, we offer an overview of the state of play in the main elections, and our views, which we will update as the year progresses.

Q1-2024

Taiwan (13 January)

NATIONAL AND LOCAL ELECTIONS

The ruling Democratic Progressive Party (DPP), led by William Lai, will face off against Hou Yu-ih representing the Kuomintang (KMT) and Ko Wen-je of the Taiwan People’s Party (TPP) in the upcoming presidential election. After KMT and TPP initially announced they would be forming a coalition, they subsequently failed to form a unified opposition to rival the DPP. As both candidates have trailed Lai thus far in the polls, the disintegration of the coalition has raised the likelihood that the DPP remains in power come January.

The elections are significant for Taiwan and the world, given the heightened tensions with China over the past few years. While a DPP victory in the election is unlikely to result in an immediate escalation or invasion by China, under the DPP, China-Taiwan relations have remained frosty. Moreover, DPP candidate Lai has been labelled as a 'separatist' by China for his pledges to pursue ‘Taiwan independence’. Both candidates from the opposition coalition have said that upon taking office they would endeavour to resume dialogue with China, lessening of the threat of escalation.

Pakistan (8 February)

NATIONAL AND LOCAL ELECTIONS

Since Pakistan’s founding, the army has kept its grip on power, controlling the election proceedings and the Prime Minister’s remit. Currently, the ‘minus one’ mantra is referred to within the political domain, meaning former Prime Minister Imran Khan should not run in the upcoming elections. Imran was deemed as opposing stability after he challenged the military stronghold. Imran is currently in prison for leaking an official document to foreign media, a situation that makes him ineligible.

The other key figure is Nawaz Sharif. Following a self-imposed exile, Sharif has returned to Pakistan and has announced his intention to resurrect his party, the Pakistan Muslim League’s (PML), which has struggled under Imran’s growing influence in previously PML-dominated regions of the country. Nawaz served as Prime Minister for three terms but was previously removed from office after increasingly infringing on the military stronghold in Pakistan. As it stands, Nawaz may still be able to campaign for the PML, but not without significant challenges. Ultimately, the scenario in which Nawaz successfully gains a majority depends on his reparation efforts with the army. The next president will face the challenge of consolidating the country’s large fiscal deficit to avoid facing debt distress like other frontier economies.

Indonesia (14 February)

NATIONAL AND LOCAL ELECTIONS

Presidential elections will take place on 14 February, with a 26 June runoff if no candidate receives over 50% of the vote. Jokowi’s legacy has been positive and he leaves office with strong approval ratings currently above 80%. His list of achievements is long and includes improvements to health and unemployment insurance, transport and energy infrastructure development, and a balanced macro-economic policy keeping fiscal deficits and debt levels at bay.

There are three main candidates to watch. Current Defence Minister Prabowo Subianto is the favourite after selecting Jokowi's son Gibran Rakabuming as his running mate. Prabowo is the son-in law of former President Suharto. The incumbent PDI-P Party is unhappy with Jokowi, and will be represented by his loyal cadre, former Governor of Central Java, Ganjar Pranowo. Polls currently have Prabowo and Ganjar close together at the top of the contest so far. Both leading candidates advocate policy continuity, but Prabowo has also expressed aspirations to raise the defence budget. The third contender is Anies Baswedan, former Governor of Jakarta, who is not a member of any political party, and currently trails Pranowo and Ganjar in the polls. He has diverged the most from the incumbent after poor implementation of policies when he was a minister in Jowoki government.

Overall, we assume the risk of a major change in economic policy to be relatively small. The main risk is for the political system to become more fractured again. Jokowi consolidated power when he brought General Prabowo into the government. The fact that his son is running with Prabowo will likely feel like disloyalty by his own party, which may become opposition to Prabowo. This is not necessarily bad in the short term, but it may make it harder for swift policy implementation that market participants became accustomed under Jokowi.

Russia (17 March)

NATIONAL ELECTIONS

Putin will be re-elected. Surveys show that many Russians ultimately crave stability and like in previous elections, there will be no competitive opposition. The international community will monitor the participation rate and any meaningful social protests coming around the ballot. The result is unlikely to yield any changes in policy, unless there is serious social unrest around or following the election, which is also unlikely, in our view.

Türkiye (Local on 31 March)

LOCAL ELECTIONS

Local elections can have an impact on national policy. After retaining a majority in parliament and being re-elected for another term, President Recep Tayyip Erdoğan implemented swift economic reforms and shifted his attention to the municipalities.

Erdoğan’s Law and Justice (AKP) Party lost control of the country’s four largest cities, including Ankara and Istanbul, to the opposition CHP Party in 2019. Erdoğan started his political career as Mayor of Istanbul and has a deep personal connection with the city, which is vital to his political stability. A recent piece by Alper Coşkun of the Carnegie Endowment argues: “[The] AKP have nurtured a system of patronage within their municipalities through the distribution of in-kind aid, social welfare programs, and favouritism in city tenders.”5

Most importantly, the local political saga may hold the key for an important policy matter. Since re-elected, Erdoğan surprisingly u-turned on economic and monetary policies, appointing Simsek as Finance Minister, and a capable Governor in the Central Bank of Türkiye, who brought policy rates from 8.5% in May to 40.0% in November 2023, to reign-in rampant inflation caused by pre-electoral stimulus. One can argue that Erdoğan is more likely to allow for independent economic policy if he believes he will benefit politically from them. Retaking control of the cities maybe seen as bad for democracy from some, but likely positive for economic stability if it solidifies the current work done by technocrats from the finance ministry and central bank.

Q2-2024

South Korea (10 April)

LOCAL ELECTIONS

Both general and legislative elections are set to be held in 2024. As of June, President Yoon Suk-Yeol’s approval rating had dropped to 35% with his disapproval rating reaching 57%. Support for the opposing Democratic Party (DP) was 32%. Yoon’s dwindling approval rating has been motivated by public discontent with his approach to state affairs, where his ‘one-sided’ approach to statecraft and managing foreign affairs has not endeared him to the population. However, a key limitation to the efficacy of his term has been the fact that the DPK holds a majority in the National Assembly and have hindered the approval of President Yoon’s key bills. Overall, as indicated by the approval ratings for both parties, the political landscape is characterised by apathy, with neither offering much inspiration as we enter 2024.

India (April-May; ends on 16 June)

NATIONAL ELECTIONS

The largest democracy in the world has general elections set for May 2024. The incumbent Bharatiya Janata Party (BJP) led by Narendra Modi as Prime Minister is likely to remain in power, buoyed by strong economic performance and Modi's stand in foreign policy. The leader of the 26-party alliance opposition Rahul Ghandi has struggled to form a concise narrative against the incumbent president.

The Indian economy is set to remain one of the fastest growing major economies. Structurally, India's GDP growth is supported by favourable demographics, including a growing working age population and higher labour participation rate. Post-elections policies are likely to focus on accelerating economic growth. The enhancement of India’s manufacturing base and a significant increase in FDI inflows to primary industry and the information technology (IT) services sector, may enable GDP growth to increase from 6% to 8% levels, in our view. Thus, India may overtake China as the largest contributor to global GDP growth.

Panama (5 May)

NATIONAL ELECTIONS

General elections are scheduled to be held in May 2024, current President Laurentino Cortizo will be ineligible for a second term. Five candidates have thus far been announced: Romulo Roux; Jose Gabriel Carrizo (current Vice-President); Ricardo Lombana (former presidential candidate); Ricardo Martinelli (former President); and Martin Torrijos (also a former President). The initial opinion polls have Martinelli in the lead, trailed by Torrijos. However, Martinelli has been accused of money laundering in a trial set to be held after the elections, which the opposition hope will weigh on his chances. Panama has been in the headlines with a referendum in December proposing scrapping the contract with Canadian miner First Quantum to operate an open pit copper mine.

South Africa (date to be set, likely May)

NATIONAL ELECTIONS

Polls suggests the three decades of dominance of the African National Congress (ANC) is under threat. Should the ANC vote fall below the 45% threshold, it will need to seek a coalition to remain in power. The latest Social Research Foundation (SRF) poll has the ANC with exactly 45%, followed by the centre-right Democratic Alliance (in power before ANC’s Mandela) getting 31% of vote intentions (from 24% in March) and the Inkatha Freedom Party rising to 6%. The two large centrist opposition parties agreed with three other parties to form a coalition called the Multiparty Charter for South Africa. An alliance with any centrist parties would be positive for South African risk premium as it would increase the odds of market-friendly policies. On the other hand, investors will be worried if the ANC chooses to partner with the Economic Freedom Fighters (EFF) – an offshoot from the ANC advocating more radical socialist policies. The EFF has 9% of vote intentions in the SRF poll, down from 12% in July last year, but above 6.0% in March. Overall, we believe there is more upside than downside with the ANC more likely to form an alliance with centrist parties than the EFF given superior success in select local governments from these coalitions, relative to the latter.

The ANC has been losing popularity over the past 15 years, largely as a consequence of ineffective policies and corruption scandals under Jacob Zuma that his successor, current President Cyril Ramaphosa, has not rectified fast enough. Nevertheless, the polls tend to be volatile and the large debt/GDP levels and uncomfortable fiscal deficits means we may see volatility heading to the polls as political speculation increases.

Mexico (2-June)

NATIONAL ELECTIONS

Incumbent Andres Manuel Lopez Obrador (AMLO) is unable to run for re-election. His Morena Party has named the former Mayor of Mexico City Claudia Sheinbaum as candidate. Considering AMLO’s popularity, the election is Sheinbaum’s to lose. The three main opposition parties (PAN, PRI, and PRD), which used to be adversaries, merged in a coalition called Frente Amplio por Mexico and will be represented by Senator Xóchitl Gálvez.

The opposition may have a chance if the US economy slows down early in the year, as this is likely to impact the Mexican economy. However, even if elected, the Congress is very likely to remain controlled by the Morena Party. Sheinbaum is unlikely to have the same gravitas as AMLO within Morena, making it harder for her to control the different factions of the party; while Gálvezis unlikely to have a majority in Congress if elected. Thus, the risk of significant deviation from AMLO’s policies is limited under both scenarios. The main political risk instead will arise from a return of Donald Trump to the White House in 2024.

In the short term, the main concern is the small deterioration of Mexico’s fiscal accounts, driven by the need to support state-owned oil and gas company Pemex. AMLO’s interventions in the regulated sectors have also been negative for confidence. On the other hand, Mexico is already benefiting massively from nearshoring. AMLO also approved a pension reform which will increase the size of its pension plans to close to 40% of GDP from less than 20% today, thus transforming the country’s ability to undertake long-term investments.

European Parliament: (6-9 June)

PAN-NATIONAL ELECTIONS

Central government parliaments, in general, tend to be far away from the daily problems of their own constituencies. It is not unusual for people to feel unrepresented by their own parliaments. This problem is compounded in the European Parliament. The fact that voters feel EU parliamentary decisions are too far removed from their lives is made clear by voter turnout, which has declined from 58% in 1989 to 50% in 1990 and 43% in 2014, before increasing to 51% in 2019. In comparison, the voter turnout for national elections was 78% in 1989, 72% in 1990 and 68% in 2014.6

The sharp increase in turnout in 2019 was led by young voters, perhaps frightened by Brexit. Ironically, surveys show that most Europeans have favourable views of the main EU institutions, such as the common currency, and are in favour of a common set of policies that strengthen the bloc, but they do not feel represented by its own supranational parliament. The low turnout is a threat to the main European bloc as more radical voters from both the left and right are more willing to come out and vote for a ‘cause’. Politics are increasingly being dominated by extreme views encouraged by the rise in inequality since the 1980s, the pandemic, inflation, rising geopolitical tensions inflaming immigration concerns.

Against that backdrop, far-right politician Geert Wilders gained the most seats in the Dutch Parliament at the end of November. While it remains uncertain that Wilders will form a coalition to become Prime Minister or even have a role in a future Dutch government, obtaining a quarter of the vote matters. Immigration has become the key topic in Europe; even where people are sympathetic to the plight of immigrants, they fear the numbers are too large to absorb and would change society for the worse.7 For context, in the Netherlands, of the 17.6m residents on 1 January 2022, 2.6m (14.5%) were born abroad, and 0.9m (5.2%) were born in Netherlands but from foreign parents.

The European Parliament elections are likely to bring a larger representation from national far-right movements and this has policy implications from the world’s second-largest economic bloc.8 This could affect policy decisions related to energy security and transition, defence spending (Ukraine), and immigration.

Q3-2024

Sri Lanka (before September)

LOCAL ELECTIONS

The 2024 presidential elections will mark a critical step for Sri Lanka on its path back towards stability and prosperity. Following a period of intense investment funded by international loans, Sri Lanka was forced to default on its foreign debt in 2022. The subsequent period was marked by social discontent, culminating with the resignation of President Gotabaya Rajapaksa. Since then, the new government of Ranil Wickremesinghe pursued an agreement with the International Monetary Fund (IMF) for a USD 2.9bn programme. Sri Lanka subsequently failed its first IMF review, failing to remobilise revenue growth to support its debt sustainability targets. Subsequently, President Ranil laid out the nation's bankruptcy budget to meet the IMF's demands while remaining amenable to the public given the macroeconomic challenges following the default.

Under Wickremesinghe, there have been significant improvements in Sri Lanka's macroeconomic position, including turning the 2021 budget deficit into a primary surplus in the first half of 2023; drastically bringing inflation under control and an improvement in the country’s FX reserves. However, the austerity allowing these positive changes kept the economy under pressure. Going into the elections next year, the extent to which the population feel some respite and improvement to their quality of life will be critical.

Romania (Tentative dates: Local in September; General in November)

NATIONAL AND LOCAL ELECTIONS

This would be the first time since 2004 that local, parliamentary, and presidential elections are all organised in the same year. In the general elections, all 330 seats in the two Chambers of the Romanian Parliament will be contested. The current coalition features a ‘marriage of convenience’ between the social-democrats (PSD) and the liberals (PNL), which has survived longer and fared better than most expected. The incumbent President Klaus Iohannis is not eligible for another candidacy, so the ruling parties will have to find a new common candidate to support.

The history of Romanian presidential elections suggests independent candidates are more likely to gain broad level of popular support compared to those running as heads of the main parties. Local opinion polls current shows Mircea Geoana, deputy head of NATO, as the favourite independent candidate with just over 25%, followed by current Prime Minister Marcel Ciolacu, from the PSD.

Romania is the largest NATO country bordering Ukraine, thus responsible for significant part of logistics of military items into and grain exports from Ukraine. Poland and Romania have played an important role ensuring that Ukraine receives EU support. However, the initial pro-Ukraine sentiment in Eastern Europe has been slowly eroding. This allows Russia to exploit opportunities to promote its own narrative via populist parties which are gaining momentum across the region. The same type of populist narrative is also gaining momentum in Western Europe and possibly in the US, suggesting the Romanian electorate will be targeted by more than just the local political parties.

In local matters, Romania must address the substantial fiscal costs from the recent pension reform bill which led to risks of credit ratings downgrade in 2019-2020. However, the reform has been adjusted in close cooperation with the World Bank, and includes key measures such as higher retirement age. The spirit of the reform is thus likely endorsed by the European Commission, though the execution will need to be recalibrated to ease the cost in the next two years.

Q4-2024

United States (October)

NATIONAL AND LOCAL ELECTIONS

The most consequential election will be in the world’s largest economy. President Joe Biden's approval rating is tracking that of one-term presidents, such as Trump, Bush I, Carter, Ford and is below Nixon and Johnson's approval rating.9 Today, a Biden vs Trump rematch is the base case scenario. Despite his age and lack of popularity, there seems to be no viable alternative candidate able to bring progressive and conservative corners of the Democrat Party together, particularly if Trump is the candidate. Trump remains the front runner to get the Republican nomination, even if he is convicted in any one of the various trials that he faces. Nevertheless, the race is unlikely to be a straight line. Florida Governor Ron DeSantis’s spectacular fall from grace after picking a fight with Disney is a good example of how things may change. An eventual Trump indictment could shake the Republican Party to find an alternative candidate. What is key is for the Republicans that favours an alternative agree on a single candidate. Nikki Halley seems to be getting ample support lately. If that happens, the Democrats would also be forced to change their ticket, in our view. This will be a key election, in our view, as there is a much higher likelihood of Trump being a much less centrist president in his second term, particularly after a difficult year when his family has been exposed to public trials.

Brazil (Municipal: 17 October)

LOCAL ELECTIONS

Municipal elections have limited political impact, aside for who is controlling the largest cities in the country (São Paulo, Rio de Janeiro, Brasilia, Fortaleza, Salvador, Belo Horizonte, and Manaus). Together those cities account for only c. 30% of the population, but are the capital cities of regions representing more than 60% of GDP. In the largest city, São Paulo, the race is wide open as the traditional parties need to elect their successors. The far-left leader of the ‘landless movement’, Guilherme Boulos, moved to the ruling Workers’ Party and is the front-runner in a city that has been mostly managed by pragmatic politicians.

The ideal policy scenario for markets would be for the centrist coalition, including the Brazil Democratic Movement (MDB) Party and others to keep or increase its presence, while the Workers’ Party does not take over managing too many large cities, enabling the centrist and reformist Congress to remain in control of the agenda.

United Kingdom (undefined date)

NATIONAL AND LOCAL ELECTIONS

A general election must be announced before the end of 2024. The failure to reach a new equilibrium post-Brexit has slowly undermined the credibility of the incumbent Conservative Party. The question of Brexit once again fragmented the party as four Prime Ministers shared power over the last eight years. Current polls indicate a landslide for the opposition Labour Party, led by the former Director of Public Prosecutions, Sir Keir Starmer. Labour’s advantage over the Conservative Party solidified following the Liz Truss’s fiasco in late 2021 and remained at around 45% vs 24% since December 2022. Starmer has centred on reforming the Labour Party’s image after his predecessor Jeremy Corbyn shifted the party back towards its far-left roots, which was markedly different to the centrist-model since former Prime Minister Tony Blair.

Polls suggests that a significant amount of the public does not know much about Labour's policy positions. Starmer’s main challenge is to address his own party divisions, including the thorny Palestine issue. Nevertheless, the 2024 election is for the Labour Party to lose.

Ghana (undefined date)

NATIONAL ELECTIONS

A bleak economic backdrop continues to form ahead of the elections expected in December 2024, with Ghana’s debt burden weighing on the national accounts, CPI inflation running at 35% yoy as of October, and poverty continuing to rise. Current President Akufo-Addo cannot run for office again and the likelihood that his New Patriotic Party (NPP) remains in power will in part depend on the country’s progress in reaching an agreement with external creditors for its external debt restructuring with the IMF. Even if Ghana manages to implement a successful debt restructuring, it may be too late for current Vice-President and former central bank governor, Mahamudu Bawumia, representing the incumbent NPP against the opposition National Democratic Congress candidate John Dramani Mahama.

Venezuela (undefined date)

NATIONAL ELECTIONS

In October, the US government struck a deal with Venezuela, effectively lifting US sanctions on energy and mining investments in the country as well as secondary bond trading, leading to a surge in bond prices and new foreign investments in the oil and gas sector. Lifting sanctions makes sense for the US, both from an economic and a geo-strategic perspective.

The conflicts in Ukraine and the Middle East, and the lower level of strategic petroleum reserves in the US, has led to a higher risk of an energy shock. Securing additional supply makes sense, and it was not entirely coincidental that the deal was struck merely two weeks after Hamas’ attack against Israel. Strategically, the sanctions have not achieved their objectives. Nicolas Maduro’s government has been able to double-down on political control and has remained in power despite the collapse of the Venezuelan economy.

The bulk of the impact was borne by the population, which has been migrating en masse, to Latin America and to the US, where the presence of Venezuelan migrants in town centres has weakened Democratic Party leaders. For these reasons, it has become a strategic priority for the US administration to try and normalise relations with Venezuela.

One of the conditions for the permanent lifting of sanctions is to see tangible progress towards free and fair elections in Venezuela, but the language has been left relatively vague. A target date for the general election in H2 2024 has been set, and Maduro is expected to go ahead with the vote, but it is unlikely that the election will be entirely free and fair. The opposition’s self-organised primary election last month anointed Maria Corina Machado as the front-runner, but Venezuela’s top court, the Supreme Justice Tribunal, suspended the results over alleged electoral violations, financial crimes, and conspiracy. The key question is whether the US government can live with an imperfect normalisation of the political process. The silver lining is that Washington seems to understand that the blunt instrument of sanctions is not the way to resolve the issue.

5. Geopolitics

Financial analysts must consider geopolitical risks in their long-term asset allocation strategies, a topic we discussed in the November Asset Allocation piece.10 In this section, we offer a summary of the main state of play in different geopolitical fault lines in 2024 and why it matters for investors.

Ukraine

What does winning the war mean for Russia or Ukraine? The answer is not as simple as it appears, and could be shaped by events on the ground, politics, and diplomacy.

Ukraine’s President Volodymyr Zelenskyy’s position has remained strong despite much adversity in 2023. To him, victory means recovering all territories annexed by Russia since 2014, including Crimea. Nevertheless, the best way of describing the conflict today is a stalemate with high rates of attrition (high human and capital costs). Ukraine has managed to recover little territory, despite massive financial and weaponry support from the US and Europe. While Western support to Ukraine is likely to remain in place during 2024, Ukraine needs a substantial increase in resources to reclaim territory. This is becoming more elusive as the new US Congress leadership carved out Ukraine from its latest extraordinary budget discussion to avoid government shutdown.

Would Ukraine accept to (at least temporarily) cede territory in exchange for a ceasefire? On the one hand, this is unlikely due to mistrust of Russia. On the other hand, however, public support could turn if international guarantees and concerted diplomatic efforts alongside reconstruction investments are brought to the table.

What about Russia? The key red line for Putin has been NATO inclusion and EU ascension. Putin sees the former as a long-term threat to the integrity of Russia’s territory and the latter as a medium-term threat to Russia's political system. A potential compromise would be Ukraine not becoming a de-facto member of NATO, but having the ability to join the EU, which would be a long and complicated process.

The resolution matters to the world. A weakened Russia would bring short-term relief but could increase the instability within Russia and in other areas.

Russia is an un-investable asset class for most investors. The question is, under what scenario would a reconstruction of Ukraine benefit Ukrainian assets and bring strong tailwinds for its Eastern European neighbours? We are less sceptical that a ceasefire can take place. If Trump is back to the White House, he is likely to make it a priority.

Gaza

The Israeli Defence Minister has signalled that the second phase of the Gaza invasion will last for “at least” another two months. Of course, this is not linear, and can change as the situation evolves. For now, Hezbollah’s leadership appears comfortable with the political position it has achieved, and so seems unwilling to get involved, cautious that confronting Israel would pose an existential threat to both itself and Lebanon. Iran, likewise, has its own problems with most of the population avoiding a strong pro-Palestine stance to avoid emboldening the administration. Overall, the risk of escalation remains, but is smaller than initially feared.

However, a risky juncture will emerge if Israel keeps pushing its offensive in South Gaza as the number of civil casualties will continue to sour international public opinion. The other question is whether Israel will be willing to risk attacking Iran. At first that would seem to make little sense. Nevertheless, Israel has just suffered its worst terrorist attack in modern history at a time when the government is led by a far-right coalition that is more inclined to take a more aggressive approach.

China-Taiwan

Headlines about the risk of confrontation in the Taiwan Strait will be back early in the new year around elections in Taipei. China has remained committed to the ‘one China’ policy but is unwilling to take a very risky approach to unification. The main risk is if Taiwan continues to distance itself from the commonly accepted convention of one country, two systems, pushing China to make a move. This risk is higher with the incumbent party, which is so far leading into the elections. However, this remains a low likelihood, high impact event.

6. Energy Transition

Energy transition is likely to be one of the key disputes during elections in 2024. The risk of backtracking on policies is larger in DM, in our view. Donald Trump is threatening to “gut” Biden’s Inflation Reduction Act (IRA) giving subsidies to green energy sources after British Prime Minister Rishi Sunak backpedalled on some progressive targets to achieve net zero emissions by 2050.11 Furthermore, in Europe, the rise of far-right parties and Germany’s austerity drive could bring more backlash against energy transition. EM resilience can also be seen in this theme. In contrast with the DM uncertainties, the energy transition policies from EM policymakers should hold steadier. For example, in Brazil, the main political actors are focused on regaining superpower status when it comes to energy transition and nature preservation; similarly, the political transition in Mexico is likely to bring better policy direction relative to the AMLO administration.

Despite the risks for 2024, it is important that the private sector remains steady. It is natural that big policy changes are not implemented in a straight line: this is how things evolve in democracies. What matters is that whatever the result of elections and policy changes, the private sector maintains its focus on pursuing sustainable alternatives. Boosting efficiency and lowering the cost of renewable energy solutions remains a key quest for thoughtful engineers. It is also critical that asset allocators remain focused on solving the energy transition paradox in EMs. In our view, a just transition is only possible if the needs of Emerging and Frontier countries are addressed.12

7. El Niño

According to the US National Oceanic and Atmospheric Administration (NOAA) forecast, El Niño is expected to reach its peak between November 2023 and February 2024. The El Niño Southern Oscillation (ENSO) is a fluctuation between three different states of the Waker cell of atmospheric circulation: ‘neutral’, El Niño, and La Niña; with El Niño and La Niña phases characterised by a higher frequency of extreme weather events. Cycles typically occur every two to seven years with episodes lasting between nine and 12 months. El Niño events are characterised by a weakening of the Indian monsoon, a lessening of the seasonal rainfall experienced in southern Africa, and reduced rainfall in West Africa. At the same time, El Niño brings wetter than average conditions to South America, while drier and hotter-than-average conditions persist in Central and North America.

Broadly, El Niño events are estimated to impact at least 25% of global croplands due to the changing rainfall patterns and the impact on soil moisture.13 Global soybean yields tend to improve, while rice yields and wheat yields tend to decline. In 2022, central banks in both EM and DM grappled with spiralling inflation because of the shocks caused by the Russia-Ukraine conflict. Supply shocks caused by the El Niño weather phenomenon impacting crop yields may represent a challenge.

Summary and Conclusion:

In our view, the main themes for 2024 will be resilience, tail risks, and inflections.

The macroeconomic resilience in EM observed in 2023 – despite high interest rates, poor sentiment in China and continuous outflow in the asset class – was notable. The resilience was backed by more balanced fiscal and monetary policy stances, allowing EM local currency bonds to outperform for two consecutive years, a nascent trend that is likely to have more legs in 2024, in our view.

The main tails to watch are in the outcome of global interest rates. At the end of November, markets were implying a benign soft-landing scenario. While the pricing may be right, the likelihood of the ‘no landing’ and ‘hard landing’ tails is likely to be mispriced. There are significant tail risks given the heavy electoral calendar in 2024, with the rise of right-wing politics a likely theme within DM. This contrasts with the post-election policy continuity base case scenario in several large and important EM countries (Indonesia, India, Mexico, Brazil, and Türkiye). Other tail-risks are geopolitical and climate related (El Niño).

In terms of inflection, the most important one to watch in our opinion is EM equity earnings. A positive inflection could allow for a re-rating of one of the most undervalued asset classes in the equity space, where the upside tail is much higher and more likely to happen than the downside. Other inflections may take place post-election. In Latin America, there is an increased hope that Argentina and Venezuela may see a powerful policy inflection in 2024, a scenario that would matter both for Latin American population and EM investors.

The authors thank the contributions of Edward Evans, Adrian Petreanu, and Alexis de Mones.

1. See – https://www.pewresearch.org/global/2021/06/23/people-in-advanced-economies-say-their-society-is-more-divided-than-before-pandemic

2. See – https://ec.europa.eu/eurostat/de/web/products-eurostat-news/w/ddn-20230817-1, https://scoperatings.com/ratings-and-research/research/EN/175413, and https://www.reuters.com/markets/long-feared-corporate-debt-woes-start-hit-home-2023-07-18

3. See – ‘The narrowing path’, Weekly Investor Research, 27 November 2023.

4. See – ‘Rethinking TINA: The Emerging Eight’, The Emerging View, 15 August 2023.

5. See – https://carnegieendowment.org/2023/06/01/erdo-s-next-fight-pub-89873

6. See – https://www.eurac.edu/en/blogs/eureka/david-vs-goliath-of-voter-turnout-why-is-the-participation-in-eu-elections-so-low

7. See – https://www.cbs.nl/en-gb/dossier/asylum-migration-and-integration/how-many-residents-have-a-foreign-country-of-origin-

8. See – https://www.rosalux.de/en/news/id/51006/the-far-right-in-the-european-parliament

9. See – https://projects.fivethirtyeight.com/biden-approval-rating/

10. See – ‘Asset allocation considerations for new macro and geopolitical regimes’, The Emerging View, 2 November 2023.

11. See – https://www.ft.com/content/ed4b352b-5c06-4f8d-9df7-1b1f9fecb269

12. See – ‘Asset allocation considerations for new macro and geopolitical regimes’, The Emerging View, September 2023.

13. See – www.cropmonitor.org