China plays its trump card (rare earths); Trump replays his (tariffs)

- China announced export controls on rare earths, Trump threatened 100% tariffs in response.

- US government shutdown continues, labour markets still weak.

- Oil prices dropped to multi-month lows last week, and a ceasefire agreement in Gaza was achieved.

- Chinese exports resilient and growing, domestic consumption and property sector remain weak.

- US Treasury Secretary Bessent finalised the USD 20bn currency swap arrangement with Argentina and the Treasury started buying pesos.

- Brazil income tax reform passed through congress, and banks revised down inflation expectations for 2025/26.

- The Bank of Kazakhstan hiked rates 150bps.

- S&P upgraded Egypt’s sovereign credit rating to ‘B’ with a stable outlook, Moody’s upgraded Ghana’s rating to ‘Caa1’, with a stable outlook.

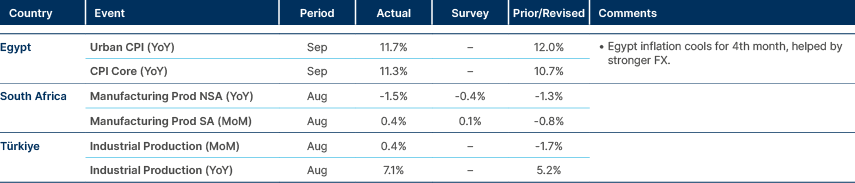

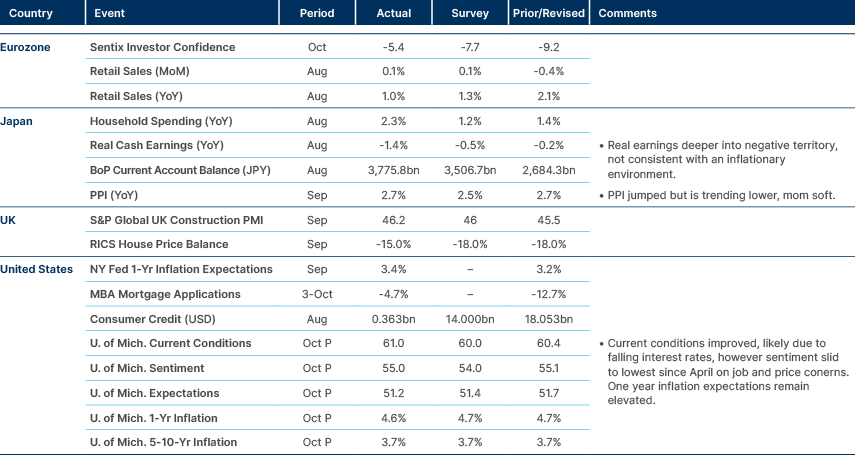

Last week performance and comments

Global Macro

Volatility spiked on Friday, with risk selling off sharply after trade tensions between the US and China escalated suddenly. China announced export controls around rare earths, banning them for military usage abroad, and decreed they would only be exported on a case-by-case approval for use in advanced chips or related facilities. In other cases, exports would need to be approved via a license singed off by the Ministry of Commerce.

US President Donald Trump replied furiously to this move by China, threatening an additional 100% of tariffs against China and export controls on “any and all critical software.” At a time where markets were beginning to expect an announcement of a grand deal on Sino American trade in the coming weeks, this was a significant negative shock. The S&P 500 recorded its worst day since April, down 3%. The Hang Seng Index is trading 3.5% lower than it was last Thursday. Bitcoin fell by as much as 12%. Importantly, US Treasury yields declined, signalling growth fears overpowering inflation concerns. One of the key reasons behind Trump delaying his ‘reciprocal’ tariffs back in April, was ‘yippy’ bond markets. Like in April, the Dollar sold off alongside high carry currencies and the EUR rallied on Friday.

The key question for markets now is whether this Chinese play represents a serious escalation into a deteriorating US/China relationship, or a bargaining move that may reignite the ‘TACO’ (Trump Always Chickens Out) trade and end up in US concessions. In our view, the key to answering this, is by asking another question. Why now? China has held the same monopolistic position in many rare earths since Trump took office last year. China could have used its leverage on rare earths sooner.

The answer to this question is certainly multi-faceted. But ultimately, if China was the first mover in this latest escalation of US-China tensions, the situation would be more concerning, in our view. Given Trump’s apparent negotiation style, he is unlikely to back down in the face of aggression but as we have seen, is more than willing to retract his own threats for a compromise.

It seems evident that the precedent for China’s new export controls now was likely an expansion of US export restrictions to China over the course of September. This culminated in a crackdown on subsidiaries of companies on the existing restricted export list, which would all now be subject to the same restrictions as their parent companies. This impacts thousands of Chinese owned firms both in China and abroad, which would need to attempt to obtain special licenses to import certain critical US electronic goods.

By pulling their rare earths card, China now hopes the US will reconsider the measure. "This move by the U.S. is extremely egregious in nature," the Chinese trade ministry said in a statement. "It seriously infringes upon the legitimate rights and interests of the affected enterprises, severely disrupts international economic and trade order and gravely undermines the security and stability of global industrial and supply chains."

Trump’s tweet over the weekend points towards the possibility of a de-escalatory scenario. “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” This is a totally different tone to the one he took on Friday, likely prompted by the large risk-off move in financial markets, In any case, investors breathed a collective sigh of relief on Monday; it seems the ‘Trump put’ is still in action.

There has been no sign of a compromise yet around the US government shutdown. Polymarket odds for an ending this week are negligible, and odds for a longest-ever 35-days-plus shutdown are now at 50%. At a time when the US economy is at an inflection point, with the Federal Reserve (Fed) beginning rate cuts again, a lack of data poses a considerable risk to monetary policy implementation. The Bureau of Labour Statistics, however, has recalled staff to prepare the September consumer price index (CPI) inflation release next Friday.

With the lack of data currently blurring the picture on labour markets somewhat, Fed Governor Christopher Waller reaffirmed his concerns, saying jobs growth was probably negative. Private data sources such as ADP employment report also suggest this is the case. Waller said that “something’s got to give. Either labour market rebounds to match GDP growth, or GDP growth is going to pull back.” His comments were balanced by more hawkish commentary from other Federal Reserve members, highlighting the rift in stances within the US central bank in the face of a highly uncertain outlook for both inflation and growth.

In our view, risks to jobs and growth currently outweigh risks to consumer-price inflation from tariffs. Firstly, while certain goods prices have risen significantly in recent months, tariff pass through to CPI has generally been mild so far with price increases spread through multi-stage supply chains. Secondly, the more tariffs that do pass-through to consumers, the more their spending power will be squeezed. In a strong labour market, this would be more likely to translate into wage inflation and then services inflation. But in a labour market as weak as today’s the risk of a one-off increase in goods prices leading to a broad inflation problem via the wages channel is lower, in our view.

Commodities

Oil prices dropped to multi-month lows last week, with spot Brent prices trading down to below USD 63 on Friday, as markets priced out of geopolitical risk and priced in risks to demand from a reignited trade war. A ceasefire in Gaza was confirmed, and trade tensions between the US and China spiked on the day. Risks to Chinese oil demand are particularly sensitive, as China has been supporting oil prices in recent months with resilient end-demand, and potential stockpiling. Gold and silver returned to all-time highs after tariff threats re-emerged.

Geopolitics

A ceasefire agreement between Israel and Hamas was reached, marking the most significant breakthrough since the onset of the conflict. Under the terms of the deal, Israel will release 2,000 Palestinian prisoners in exchange for all remaining Israeli hostages, alongside a partial military redeployment from Gaza. The first phase is expected to hold, representing a diplomatic success for Arab states, particularly Egypt, Jordan, and Qatar, that have been pressing for a negotiated solution.

The second stage, forming part of a broader 20-year roadmap, remains unsettled. Key issues include whether Hamas will fully disarm, how an international technocratic authority will assume governance in Gaza, and the composition of a multinational security force to guarantee long-term stability. Israel’s far-right coalition partners voted against the ceasefire, though they have not yet moved to collapse the government. Their continued opposition to the second phase, especially any framework implying permanent disarmament or Palestinian self-administration, poses a major political risk as a lasting ceasefire would likely trigger an early breakdown of Prime Minister Benjamin Netanyahu’s governing coalition.

Emerging Markets

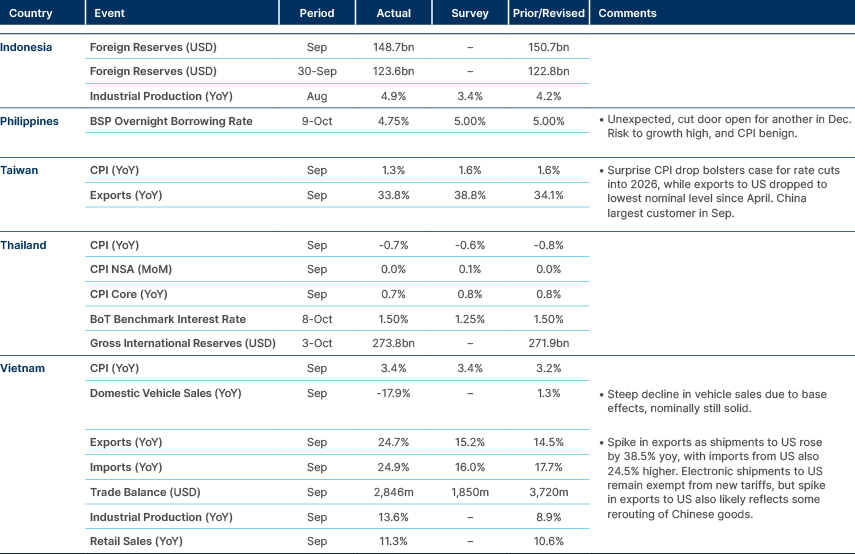

Asia

Inflation remained subdued across Asia. The Philippines cut policy rate by 25bps

China: The trade surplus narrowed to USD 90.5bn in September, below expectations of USD 98.1bn and the prior USD 102.3bn, as exports rose 8.4% yoy and imports increased 7.5% yoy. While headline trade data remained resilient, holiday indicators during the Golden Week suggested uneven domestic demand recovery.

Tourism activity was significant in volume but weak in value terms. Domestic trips reached 888m people, generating RMB 809bn in revenue. The daily average number of visitors rose 1.6% yoy and 12% above 2019 levels, yet tourism revenue per visitor fell 0.6% yoy, standing at 97% of 2019 levels—better than the 90% recorded during the May Day and Lunar New Year holidays. Cross-regional passenger turnover rose 6% yoy and 31% from 2019, with self-drive trips up 67% from 2019 (+7% yoy), railway traffic up 31% (+3% yoy), and civil aviation up 26% (+3% yoy).

Cross-border travel also picked up, with daily average travellers up 11.5% yoy—mainland visitors rising 9.6% and foreign visitors 21.6%—marking a milder recovery than Labour Day but stronger than during Lunar New Year.

Consumption indicators were more subdued. Retail sales of key retail and catering firms rose 2.7% yoy, slower than 6.3% during Labour Day and 4.1% during Lunar New Year. Value-added tax receipts in consumption-related sectors increased 4.5% yoy, down from 15.2% in May and 10.8% in February. Goods and services VAT revenue grew 3.9% and 7.6%, respectively.

Property sector weakness persisted, with 30-city sales down 12% yoy in early October after -6% in September and -10% in August. Sales in Tier-1 cities fell 12% yoy (from +16% in September), while Tier-2 cities saw a 20% decline (from -12% in September), underscoring ongoing housing demand fragility.

Taiwan: President Lai Ching-te announced the acceleration of Taiwan’s new T-Dome air-defence initiative, pledging to establish a “multi-layered defence system with high-level detection and effective interception.” The plan, revealed during National Day celebrations, aims to bolster deterrence capabilities amid increasing regional tension and continued US pressure for Taipei to enhance self-defence.

Lai said T-Dome would “weave a safety net to protect citizens’ lives and property” and reaffirmed that Taiwan would “maintain peace through strength.” Although he did not explicitly reference China, the initiative is widely viewed as a direct response to rising airspace incursions and missile drills near the island.

Vietnam: The index provider MSCI announced it will reclassify Vietnam from Frontier to Emerging Markets in September 2026. The announcement drove the MSCI Vietnam index up nearly 8% last week.

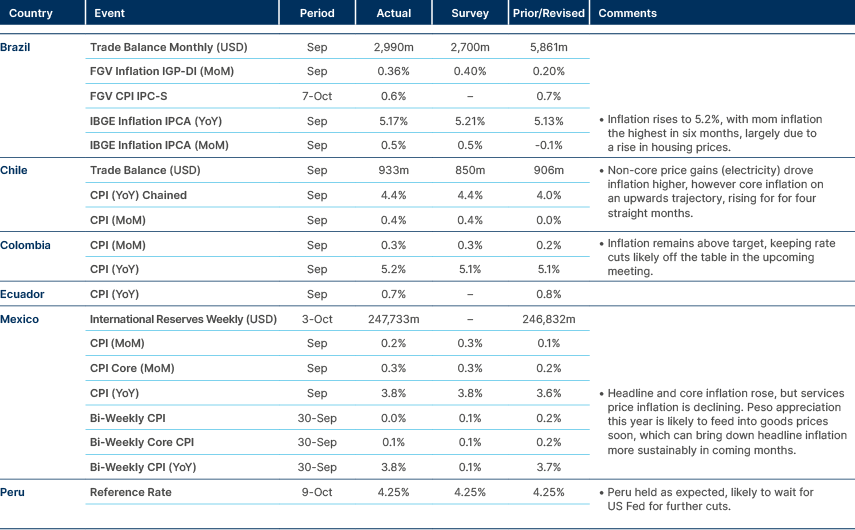

Latin America

Inflation declined more than expected in Brazil, prompting downward revisions on 2025 and 2026 forecasts.

Argentina: US Treasury Secretary Scott Bessent confirmed the USD 20bn currency swap arrangement with Argentina has been finalised, adding that the US Treasury bought pesos last week as part of the deal. Bessent argued that the peso is undervalued, insisting the US will not incur losses and rejecting accusations of a bailout. Bessent stressed that the Exchange Stabilisation Fund “has never lost money,” describing Argentina’s policies as “sound when anchored on fiscal discipline.” He also said Washington is determined to prevent Latin America from falling under Chinese influence, highlighting Argentina’s importance as a potential model for US-backed reform and its strategic reserves of uranium and rare earths.

The International Monetary Fund (IMF) separately confirmed that a new aid package is being developed between itself, the US Treasury, World Bank, and Inter-American Development Bank. One option under discussion is for the US to lend part of its Special Drawing Rights to Argentina, providing liquidity to meet external obligations over the next two years.

Brazil: The government announced a new fiscal package combining income tax relief for low earners with higher taxes on capital income to offset revenue losses. Individuals earning under BRL 5,000 per month will be exempt, at an estimated cost of BRL 25bn (c. 1% of GDP), while a 10% tax on dividends to foreign investors and high-income residents will help balance the budget. The reform aims to redistribute income toward lower-income groups with a higher marginal propensity to consume, which could marginally lift inflation.

A provisional measure to offset a prior financial transactions (IOF) tax cut expired after the Lower House failed to vote, costing an estimated BRL 17bn in 2026. The government is now exploring new options to stay on track with its fiscal target, including freezing parliamentary amendments and raising taxes on fintechs. President Lula also announced a new middle-class housing finance programme that will phase out the rule requiring 65% of savings deposits to be channelled into real estate credit. The initiative, viewed as an early campaign move for 2026, follows a rise in Lula’s approval rating to 48%, his highest this year, amid an improved communication and social media strategy.

Following broad-based disinflation, several banks revised 2025–26 IPCA forecasts down by 30–50 basis points (bps), with consensus now near 4.5% for 2025 and 4.1% for 2026. Equity markets may benefit: Goldman Sachs noted that historically, Brazilian equities have risen 12% within three months and 24% within six months after the first Selic cut, while a 100bps fall in five-year yields has typically added 5–6% to returns.

Colombia: The Constitutional Court upheld a ruling barring the left-wing Historic Pact coalition from registering candidates for its October 2026 presidential primary. President Gustavo Petro condemned the decision, calling it an attempt by “the right wing to sabotage democracy” and exclude his movement from legal political participation. The ruling deepens institutional friction and underscores the volatility surrounding Colombia’s pre-election landscape.

Panama: President José Raúl Mulino convened an emergency session of Congress after lawmakers proposed raising the 2026 budget by USD 1.5bn to boost funding for universities and research institutions. The government will revise its USD 34.9bn proposal accordingly, though finance officials warned that such spending increases could challenge deficit-reduction plans.

Peru: President Dina Boluarte was impeached and removed from office after lawmakers unanimously approved her dismissal amid surging violent crime and political scandals. Congress leader José Jeri assumed the presidency and pledged to complete the term through July 2026 while prioritising public safety and national reconciliation. Boluarte’s ousting followed a wave of controversy over her response to a mass shooting at a concert and remarks appearing to condone non-compliance with extortion threats during a transport strike, which deepened her unpopularity.

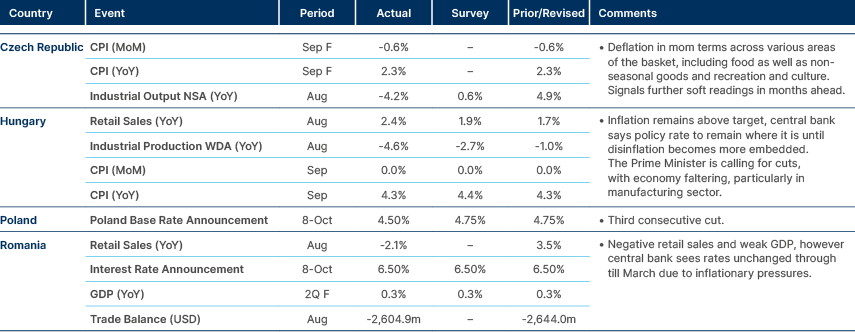

Central and Eastern Europe

Poland cut its policy rate by 25bps. Kazakhstan hiked by 150bps.

Kazakhstan: The National Bank of Kazakhstan (NBK) raised its base rate by 150bps to 18%, exceeding expectations for a 100bps move. Policymakers cited surging inflation, robust domestic demand, and expansionary fiscal policy as requiring a strong policy response. September CPI inflation accelerated to 12.9% yoy, above the central bank’s year-end target range, prompting officials to warn of wage-price spiral risks. The NBK signalled readiness to keep policy tight until inflation expectations and fiscal spending pressures stabilise.

Poland: National Bank of Poland Governor Adam Glapiński left the door open for another rate cut in November, though he said decisions will remain data dependent. With the policy rate at 4.5% and CPI inflation at 2.9%, real rates are considered high, creating scope for moderate easing toward 4.0%. Glapiński cautioned that uncertainty over fiscal policy and energy prices limits flexibility. A potential rise in electricity tariffs—from the capped PLN 500/MWh to PLN 573/MWh—could add 0.3–0.4 percentage points to inflation.

Romania: Average wages fell 2.4% mom in August to RON 5,387 (EUR 1,063), reflecting weaker labour-market conditions. Fitch Ratings warned that the government’s revised 2025 deficit of 8.4% of GDP, above the 7% target, underscores mounting fiscal risks and complicates debt stabilisation efforts. Despite wage and pension freezes and announced spending cuts, Fitch projects debt to rise to 59% of GDP in 2025 and 65.6% by 2027, above the median for ‘BBB’-rated peers.

Ukraine: Russia launched fresh missile and drone strikes on energy infrastructure, causing widespread blackouts in Kyiv and other regions. Authorities warned the attacks mark the start of a renewed winter campaign aimed at crippling power generation and testing Ukraine resilience ahead of the cold season.

Central Asia, Middle East, and Africa

Egypt and Ghana ratings upgraded as Moody’s ratings lags its peers across EM

Egypt: S&P Global Ratings upgraded Egypt’s sovereign credit rating to ‘B’ with a stable outlook—the first upgrade since 2018—reflecting reforms, FX liberalisation, and an improving external position. S&P expects interest expenditure to fall to 49% of revenue by FY2028 from a high of 73% in FY2025, though still elevated by global standards. The stable outlook highlights improving growth and balance-of-payments trends. Fitch affirmed its ‘B’ rating, while Moody’s remains the laggard at ‘Caa1’.

Ghana: Moody’s upgraded Ghana’s rating to ‘Caa1’ (stable) from ‘Caa2’, citing improved macroeconomic stability and credible fiscal reforms under the IMF programme. Debt is expected to fall below 60% of GDP by 2026, though fiscal discipline risks remain ahead of the 2028 elections. Growth is projected to moderate to around 4–5%, constrained by weak infrastructure and limited access to external finance.

Nigeria: Lawmakers launched an investigation into USD 18bn in refinery rehabilitation spending since 2010, focusing on allegations of waste and corruption. Findings are expected within two weeks. President Bola Tinubu also requested approval for USD 2.3bn in external borrowing to refinance Eurobonds, plug the 2025 budget deficit, and fund Nigeria’s first international sovereign Sukuk.

South Africa: A major corruption probe intensified as police raided senior law enforcement and political figures tied to a ZAR 2bn hospital-tender scandal. The investigation exposed extensive collusion between government officials and criminal networks, raising pressure on President Cyril Ramaphosa’s administration and undermining investor confidence in the country’s anti-corruption reforms.

Zambia: The government extended its suspension of the 10% copper export tax until December, citing ongoing smelter disruptions. Authorities said the measure aims to sustain export flows and foreign-exchange liquidity while repairs at key facilities continue. The move underscores Lusaka’s balancing act between fiscal needs and supporting the mining sector amid restructuring efforts.

Developed Markets

No payrolls data in the US due to shut down.

France: President Emmanuel Macron reappointed Sébastien Lecornu as Prime Minister just four days after he resigned the post. Lecornu is expected to present a budget on Tuesday. Markets have become somewhat desensitised to French political drama, with a risk premium already embedded in French government bond prices.

Japan: Opposition parties in Japan are in talks to build a coalition to seize control of parliament and block the new leader of the ruling Liberal Democratic Party (LDP), Sanae Takaichi, from becoming prime minister.

On Sunday, Yoshihiko Noda, leader of the Constitutional Democratic Party of Japan, which is the second-largest party in the Lower House with 148 seats against the LDP’s 196 — indicated he was open to backing a prime minister from outside of his own party. “This is a rare opportunity” Noda said in a TV interview: “We can change the government now if [the opposition] can co-operate by overcoming our differences and finding common ground.”

Noda appeared prepared to support a potential prime ministerial bid by Yuichiro Tamaki, a 56-year-old former Finance Ministry official, who leads the Democratic Party for the People, which controls 27 Lower House seats. In a TV interview on Sunday night, Tamaki said: “The collapse of the LDP-Komeito coalition, which has been the norm until now, marks a change that will go down in the history of Japanese politics. With so many changes happening in both the world and Japan right now, it seems that the style of politics that has continued until now may have reached its limits.”

UK: Chancellor Rachel Reeves is expected to build a larger buffer in the 26 November Budget to protect public finances from risks such as bond market swings and higher borrowing costs, according to the Sunday Telegraph. The Institute for Fiscal Studies said Reeves could raise tens of billions from tax reforms instead of simply hiking existing taxes to meet her fiscal targets.

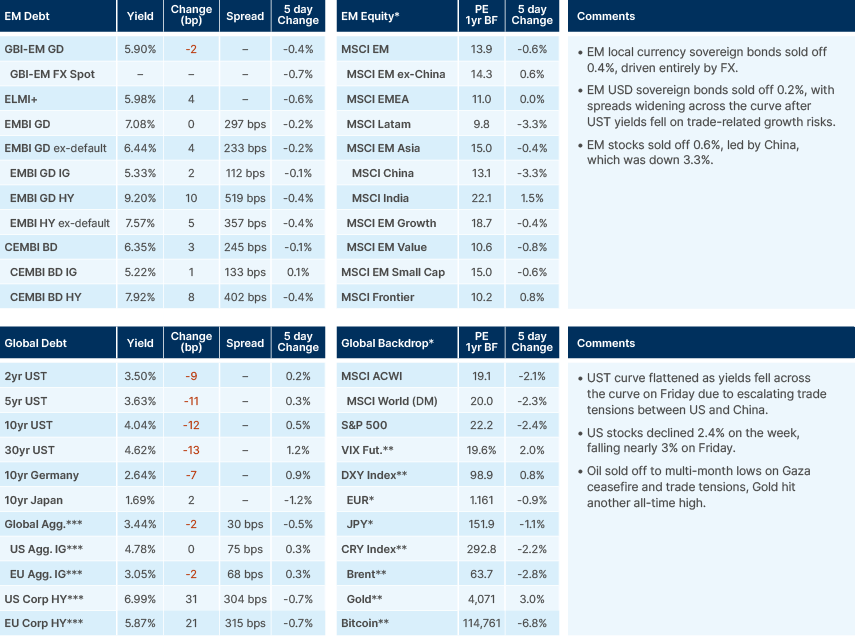

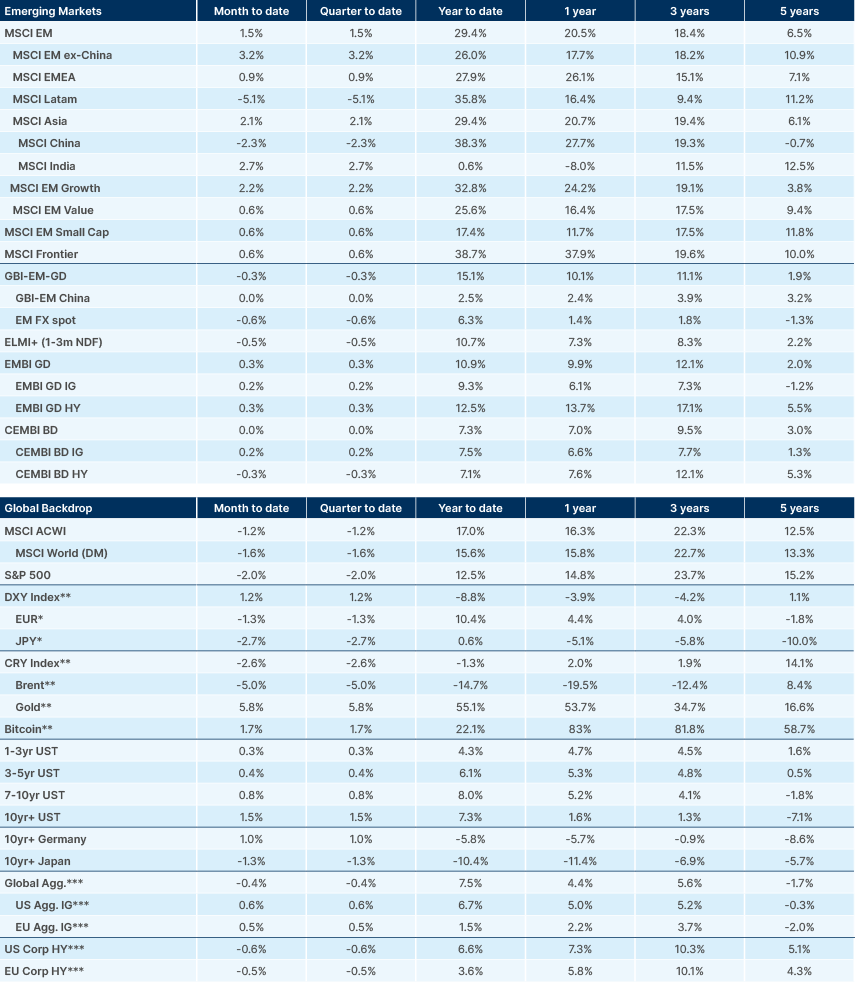

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.