- 2025 begins after a pronounced move higher in US real yields and term premium.

- Trump denied Wall Street Journal report that his tariff plans would be narrower and focus on key industries, leading to USD volatility today.

- Nine new countries, including Indonesia, join BRICS. Four more are yet to respond to invitations.

- EU engaged with new Syrian leadership to reduce Russian influence.

- China raised public sector wages for first time in several years, as 10-year bond yield falls to record lows.

- Indonesia scrapped plans to raise VAT from 11% to 12%.

- World Bank set to approve a USD 20bn, 10-year lending package to Pakistan.

- IMF board approved first review of Ecuador’s programme, disbursed USD 500m.

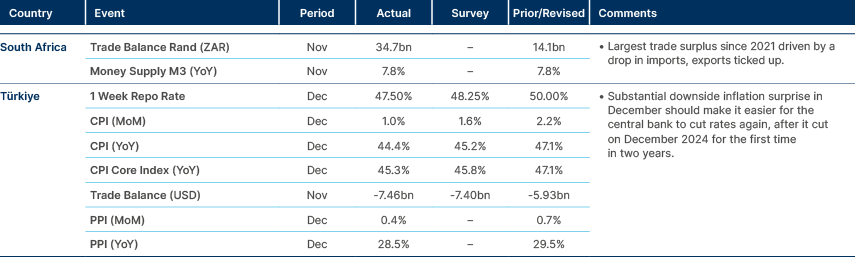

- Türkiye cut its reference rate by 250bps to 47.50%, with inflation surprising to downside.

- Mike Johnson re-elected as speaker of the US House of Representatives; Justin Trudeau expected to resign as Canadian Prime Minister.

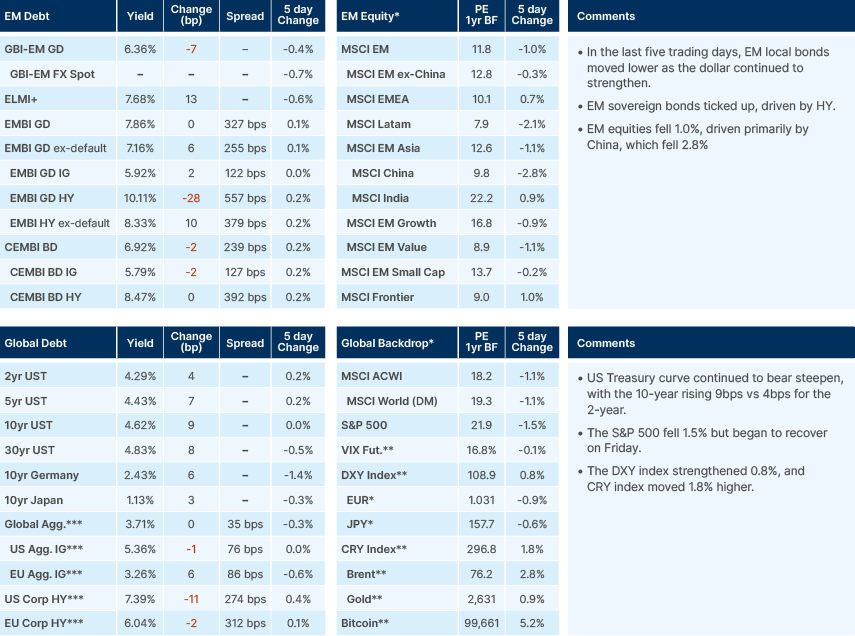

Last week performance and comments

Global Macro

Since the December Federal Open Market Committee (FOMC) meeting, the rise in US Treasury (UST) real yields has put pressure on risk assets with the 10-year yield climbing from 4.15% to 4.62%, sending equities lower. The S&P 500 is down 2% since the December meeting, and the equal-weighted index is down 6% since early December. With the dollar index (DXY) currently strongly correlated to US yields, and emerging market (EM) equities now exhibiting strong inverse correlation to the DXY index, this has also led to an extension in the EM equity sell-off, down a further 3.5% since December’s FOMC meeting. However, signs of recovery emerged on Friday, with the S&P breaking a five-day losing streak, advancing 1.3% following robust ISM manufacturing and jobless claims data. On an ex-China basis, EM equities have started January on the up, recovering 0.5% so far.

So where are we? UST yields remain elevated, with the 10-year up 100 basis points (bps) since the first rate cut in September, and the 2-year/10-year curve steepening by 30bps (from 10 to 40bps). Most of this move is explained by a rise in real yields and term premium. Markets are now pricing in only one rate cut for the first half of 2025 and 1.5 cuts for the entire year.

At this juncture, the market has rejected a deep cutting scenario. If the labour market continues to deteriorate, as is still currently the trend, this could change. But presently, this cycle resembles past ‘shallow cut’ scenarios, notably in 1995 and 1998, where the US Federal Reserve (Fed) implemented only 75bps of easing before pausing. In 1995, 2-year bond yields bottomed on the day of the first cut but rose 60bps in the subsequent six weeks, with a more pronounced sell-off after the controversial January 1996 cut. Similarly, in 1998, 2-year yields reached their low two weeks after the first cut, but rose 51bps within six months. In 2024, the low in 2-year yields occurred one week after the September cut, followed by an 80bps climb over two months. During these prior periods, the yield curve steepened modestly by 30bps before flattening again.

Historically, shallow-cut cycles have seen US equities resume bullish trends, while the DXY has strengthened post-cut. Inflation played a decisive role. In 1995, inflation remained low, keeping yields range-bound, whereas in 1998, rising inflation after the first cut drove yields significantly higher. In our view, a moderation in inflation would be the most decisive development for the current market to stabilise in this latest iteration of ‘shallow cuts.’ Alternatively, the Fed could adopt a neutral policy stance to anchor yields. However, if markets fully price out further cuts, front-end yields and potentially the entire curve could rise, creating headwinds. A 1995-style scenario, with inflation under control, would suggest the recent sell-off in risk assets could reverse, but excessive policy missteps – as seen with the rejected January 1996 cut – pose risks of further UST selloffs.

Of course, politics remains a big part of this cycle. The implementation of stimulative policies by the Republicans, as well as tariffs, could narrow the bandwidth for more cuts even further. Newly re-elected House Speaker Mike Johnson said President-elect Donald Trump was in favour of passing a single reconciliation bill that would address his priorities, including border security, energy and an extension of his signature 2017 tax law. Johnson also said he will aim to pass this bill before Memorial Day, on 26 May. The Washington Post reported this morning that this bill could potentially include a ‘universal’ tariff on imports, aimed to boost revenue rather than as a ‘leverage tool.’ However, this would reportedly only apply to specific critical imports and has been interpreted by markets as a narrowing of the ‘blanket tariffs’ that had been partially priced into FX and yield markets. The dollar spot index fell 1% on the news, its biggest drop since November, however a Trump post calling the article 'fake news' on Truth Social later in the day led to an unwind of some of this move.

Geopolitics

BRICS expansion

In January 2025, BRICS1 added Belarus, Bolivia, Cuba, Indonesia, Kazakhstan, Malaysia, Thailand, Uganda, and Uzbekistan as partner countries. The bloc now represents 50% of the global population and over 41% of global gross domestic product (GDP). Algeria, Nigeria, Türkiye, and Vietnam were invited in 2024, but have not yet provided formal responses. Russia stated in December 2024 that it expects replies from these countries "in the near future."

Syria

The European Union (EU) has engaged with Syria’s new leadership, Hayat Tahrir Al-Sham (HTS), to reduce Russian influence in the country. German and French foreign ministers visited Damascus for discussions. HTS, led by Ahmed Al Sharaa, was affiliated with al-Qaeda until 2016, but now claims to have moderated. The US recently lifted a USD 10m bounty on Al Sharaa, though HTS remains designated as a terrorist organisation by the US, EU, and UK.

Commodities

Natural Gas prices are up around 20% since the beginning of December, as markets fully priced in the final closing of the pipeline that carries Russian Gas through Ukraine to Europe. The contract with Gazprom expired on January the 1st. With weather on the continent currently very cold, and European natural gas reserves below average, some tightening in gas markets is likely in the coming months. For now, however, a severe price increase remains unlikely, as this cut has been anticipated for months, and already largely priced in. Eastern European countries such as Slovakia, Hungary and Moldova are most acutely affected, and will have to reorient LNG flows quickly to avoid supply stress.

Emerging Markets

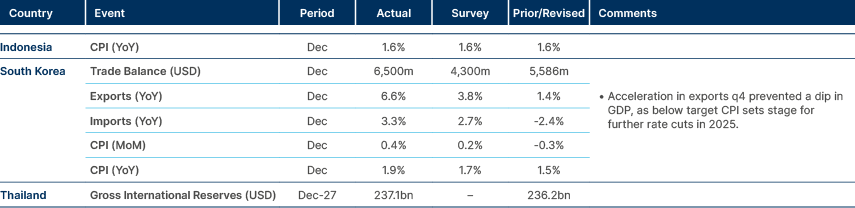

Asia

China: Indonesia’s CPI inflation near record lows, Korea exports strong in Q4.

China

The onshore yuan (RMB) weakened past 7.3 per dollar, a level that China had been defending throughout December, opening room for the managed currency to drop further as the economy remains sluggish. The widening bond yield discount to the US is exacerbating currency pressure, with the Chinese 10-year bond yield dropping below 1.6% last week for the first time ever.

As part of a push to raise domestic demand, China raised civil servant salaries for the first time in several years, with basic salaries of many employees rising at least 500 RMB, (USD 68) a month, with this wage hike backdated to July. The precise scope of this wage increase remains unclear, but it will extend to teachers, policemen and bureaucrats. Those who received the increase saw a lump sum of an extra RMB 3.5k in December payslips. Pay rises for civil servants alone is unlikely to have a huge macro impact, but this raises expectations of further stimulus to non-public sector households, particularly low-income groups, which would be a bigger benefit to consumer confidence.

China expects a record 90 million passenger trips during the upcoming Spring Festival travel season, an 8.4% increase over 2024. Ticket data indicates a sharp rise in demand for ski destinations in the north. International air travel is also poised for a surge.

Indonesia

Plans to increase the value added tax (VAT) rate from 11% to 12% for a wide range of goods were scaled back after public outcry. VAT will be increased from 11% to 12% only for premium goods and services like boats, jets and luxury property. This was a policy designed to help Indonesia towards its 2.5% fiscal deficit next year. VAT made up 25% of tax receipts in Indonesia last year, therefore the implementation of this policy would have raised significant funds. Policymakers will now go back to the table to find a new way to meet the target.

Pakistan

The World Bank is set to approve a USD 20bn innovative lending package for Pakistan. This 10-year initiative is to protect its funded projects from political transitions and to focus on six targeted areas. In a meeting on Sunday with PM Shehbaz Sharif, UAE President Mohammed bin Zayed Al Nahyan expressed interest in collaborating with Pakistan in the mining, minerals and agriculture sectors, according to the Pakistan Prime Minister’s Office.

Taiwan

Taiwan's Foxconn, the world's largest contract electronics maker, beat expectations to post its highest-ever revenue for the fourth quarter on continued strong demand for artificial intelligence (AI) servers. Taiwan's government says China is redoubling efforts to undermine confidence in the self-governing island’s democracy and close ties with the US through the spread of disinformation, especially online.

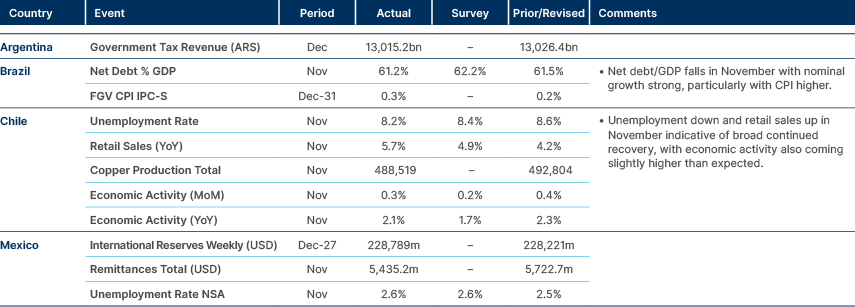

Latin America

Brazil net debt falls, Chile consumption stronger.

Ecuador

The board of the International Monetary Fund (IMF) approved the first review of the Extended Fund Facility (EFF), releasing SDR 375.9m (USD 500m), raising total disbursements to USD 1.5bn under the USD 4bn arrangement. This front-loaded programme schedules USD 2.75bn disbursements over 2024-2025 to offset USD 1.5bn in IMF amortisations, alongside annual multilateral financing of USD 2.1bn through to 2028.

Programme performance has been strong, with all end-August 2024 quantitative performance criteria (QPCs) and targets met, largely due to delayed capital budget execution. Progress on structural reforms is notable. However, risks remain high, including electricity crises, security challenges, low oil revenues, financial vulnerabilities, external financing shortfalls, and extreme weather events. While public debt is deemed sustainable, its outlook lacks high probability.

The programme aims for a bold 5.5% of GDP fiscal adjustment by 2028. A 2.1% adjustment occurred in 2024 through increased non-oil revenues (+2.5%) offset slightly by expenditure rises (+0.3%). For 2025, a 1% adjustment is targeted, balanced between revenue increases (+0.5%) and expenditure cuts (-0.4%). Key reforms include VAT maintenance at 15%, replacing transitory revenues with permanent sources, and subsidy targeting, though details remain sparse. Medium-term challenges include sustaining revenue growth, advancing structural reforms, and addressing public spending inefficiencies, with risks of political/social pressures delaying fiscal corrections.

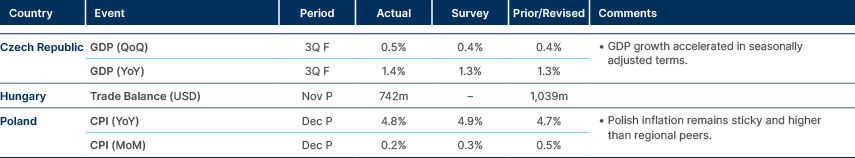

Central and Eastern Europe

Polish inflation remains sticky.

Central Asia, Middle East, and Africa

Türkiye cuts rates for first time in two years.

Türkiye

In the final monetary policy committee meeting of 2024, Türkiye’s central bank began easing as expected, cutting rates by 250bps to 47.5%, the higher end of estimations. The ‘rates corridor’, the difference between overnight borrowing and lending rates, was also halved from 600bps to 300bps.

In an accompanying statement, the central bank restated its commitment to keeping rates elevated until inflation and inflation expectations converge to its projected range, and to keep cuts data-dependent rather than aggressive and uninterrupted. Bringing inflation back to target will probably only be achieved if fiscal adjustments are also made. A key point is the minimum wage, which President Recep Erdoğan raised dramatically to win over voters in 2023 and 2024. However, the 2025 minimum wage has been set at USD 627 a month, a 30% increase on 2024, which constitutes a real reduction. This move has been welcomed by investors but labelled ‘unacceptable’ by Turkish labour unions. About a third of Turkish workers earn the minimum wage.

Developed Markets

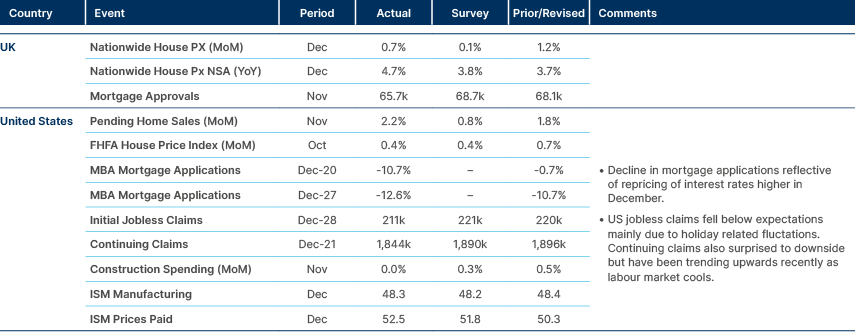

US mortgage applications fall, jobless claims surprise to downside.

US

Mike Johnson has been re-elected as Speaker of the House of Representatives in the new US Congress. On Sunday, he said he expects to pass Trump’s agenda through one big reconciliation package before Memorial Day, which falls on 26 May this year.

Canada

Prime Minister Justin Trudeau is expected to resign as Liberal Party leader this week. Canada is required to hold a federal election by October at the latest, and Trudeau’s Liberals are polling well behind the opposition Conservatives, with CBC’s poll tracker currently putting the Conservatives on 44%, and the Liberals on 21%.

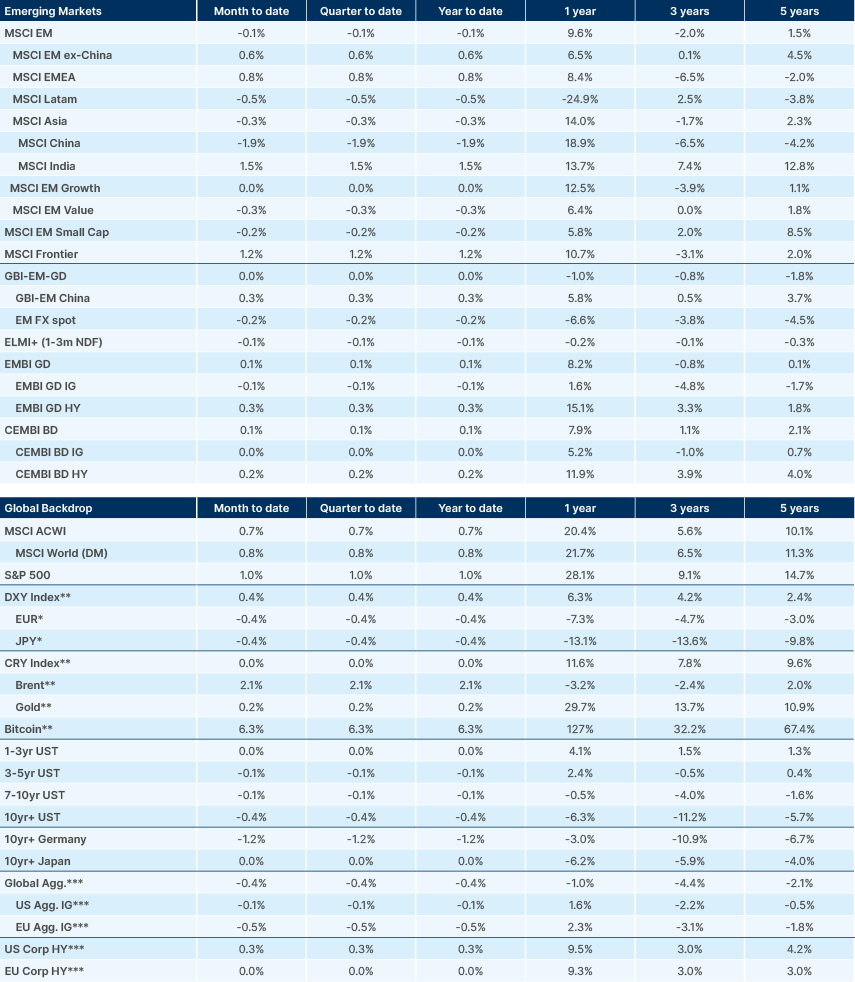

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia and the United Arab Emirates (UAE).