Noise vs. numbers: OBBBA + tariffs can deliver fiscal consolidation

- One Big Beautiful Bill Act (OBBBA) signed into law.

- Israel/Hamas ceasefire talks in Doha begin.

- The US plans new AI semiconductor restrictions on Thailand and Malaysia.

- Indian economic data shows renewed strength with looser monetary policy

- Trump announced a ‘trade deal’ with Vietnam.

- Argentina’s Finance Minister brushed off concerns about the peso being overvalued.

- Chile’s new left-wing coalition leader did better than expected in recent polls.

- IMF will fold Egypt’s fifth and sixth programme reviews into a single assessment in September.

- Dubai rolled out a new first-time home-buyer scheme.

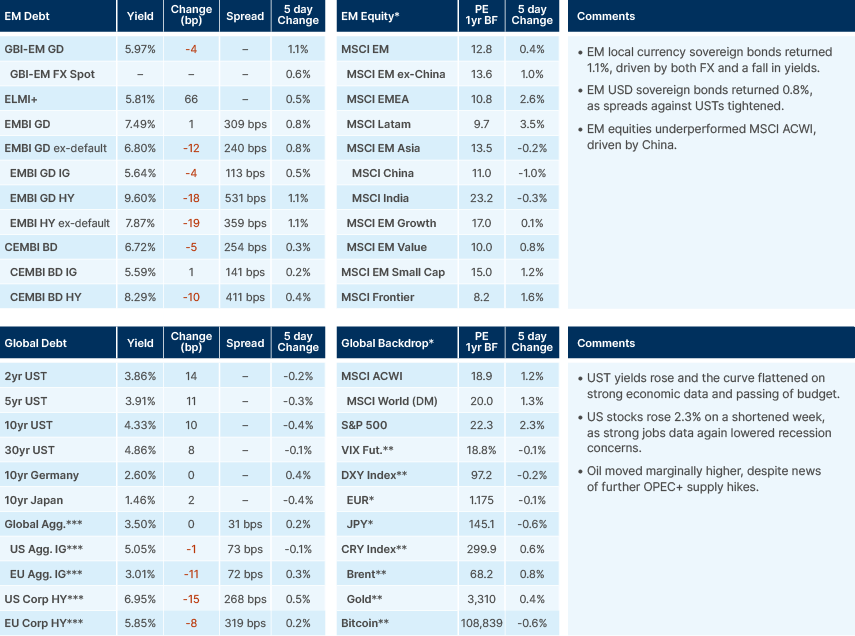

Last week performance and comments

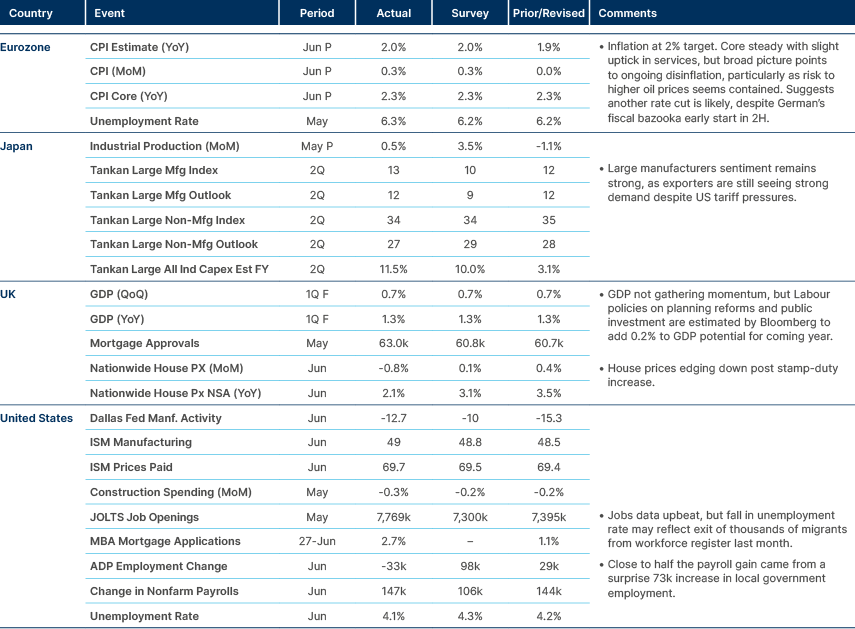

Global Macro

In the US, the One Big Beautiful Bill Act (OBBBA) was approved by both the Senate and the Lower House. In our view, the legislation has many flaws. The tax cuts on tips are likely to lower revenues more than expected due to an introduction of a new loophole for tax avoidance. OBBBA is also distributionally regressive: trimming Medicaid would tighten access to care for low-income and medically vulnerable groups, while lifting the cap on the state-and-local-tax (SALT) deduction delivers most of its savings to higher-earning households. This reverse “Robin Hood’ approach has understandably upset many in the US. However, we feel there is a collective hysteria and ‘groupthink’ developing about how it will affect the US fiscal trajectory, especially when considering projected revenue from tariffs.

While it is evident the fiscal dynamics are unsustainable, and that more thoughtful policies should have been pursued, we see the combination of the OBBBA with tariffs driving a fiscal consolidation which could potentially add up to c. 1% of GDP over the next year, depending on the eventual tariff level and economic activity.

A bird’s eye view of the OBBBA shows tax cuts and increase in defence and border control of USD 1.2trn, compensated for entirely, within the budget at least, by some narrow tax increases, the phase-out of clean energy credits/Electric vehicle (EV) subsidies and expenditure cuts to Medicaid and the Food Stamp programme.

So, the USD 3.3trn to USD 4.0trn increase in the headline deficit over the next 10 years that virtually all papers and pundits have been citing in recent weeks has not been driven by new policy, but predominantly by the extension of the Tax Cut and Jobs Act (TCJA) of 2017, which was set to expire this year. As we’ve posited before, this is not a new tax cut and therefore has no impact on 2025-26 revenues compared to now.

In our view, there has also been far too little coverage of the fact that OBBBA does not account for tariff revenues, which are still being negotiated via executive orders. Tariff revenues are turning out to be the most important item of the US fiscal package. Already, annualised tariff revenues are running at USD 330bn (1.1% of GDP), from USD 80bn or 0.3% GDP a year ago. Assuming a relatively conservative UBS assumption of effective tariffs of 5% to Mexico and Canada, 16% to Vietnam, 30% to China and 10% for the rest of the world, the US would be raising USD 450bn/year (1.5% GDP), which would amount to c. 1.2% of extra revenues in the first year. These tariff assumptions include highly uncertain estimates of sectoral tariff additions (i.e., steel and aluminium) and exemptions (i.e., electronic goods) and the maths do not incorporate imports substitution or transshipments, leaving both upside and downside room for the figure.

Despite the tariff uncertainty, the fact that the US administration postponed the effective date to “boomerang” tariffs from this Wednesday (9 July) to 1 August suggests the US Treasury is sensitive to not allowing major market disruptions like we had in April. Now, in our view, the best-case scenario for Treasury Secretary Scott Bessent (and risk assets) alongside this small fiscal consolidation would be an economic slowdown, (not a recession) leading to lower tariff (and dollar weakness) pass-through to inflation. This backdrop would likely allow the Federal Reserve (Fed) to cut policy rates by 100-150 basis points (bps) from this autumn. Indeed, despite better-than expected payrolls, the labour market is slowing down, with most non-farm payroll gains in the recent print driven by local government hiring. The residential home market is very depressed due to low affordability, while delinquency rates on office real estate are approaching 10%. Fed easing would also allow for a more balanced economy with small businesses and sectors exposed to rates (like real estate) outperforming.

The fiscal consolidation matters because, in our view, US economic ‘exceptionalism’ has been backed by the pro-cyclical fiscal expansion that began with the Tax Cuts and Jobs Act in 2017.1 Indeed, the USD 330bn is equivalent to 65% of US corporate income tax. In the unlikely scenario where corporates absorb all tariffs, Q125 profit margins would have fallen to 11.7% from 13.8%. The US marginal fiscal consolidation also contrasts with the picture in Europe and China, where expansionary fiscal policies are now being adopted.2

Geopolitics

Israel/Hamas

Ceasefire talks between Israel and Hamas are underway in Doha, albeit no progress was achieved in the first sessions over the weekend. According to Reuters, Palestinian officials have said the Israeli delegation in Doha are not “sufficiently authorised” to reach an agreement, due to a lack of seniority. Israel also reportedly again rejected Hamas’ conditions to return remaining hostages, which are based still around a full Israeli withdrawal from Gaza.

US semiconductor exports

The US is planning to restrict shipments of artificial intelligence (AI) semiconductor chips to Malaysia and Thailand, to crack down on technology transfer into China. Details on the exact scope of this regulation are light, and still could be subject to change. US Commerce Secretary Howard Lutnick told lawmakers last month that “The US will allow our allies to buy AI chips, provided they are run by an approved American data centre operator, and the cloud that touches the data centre is an approved American operator.”

Emerging Markets

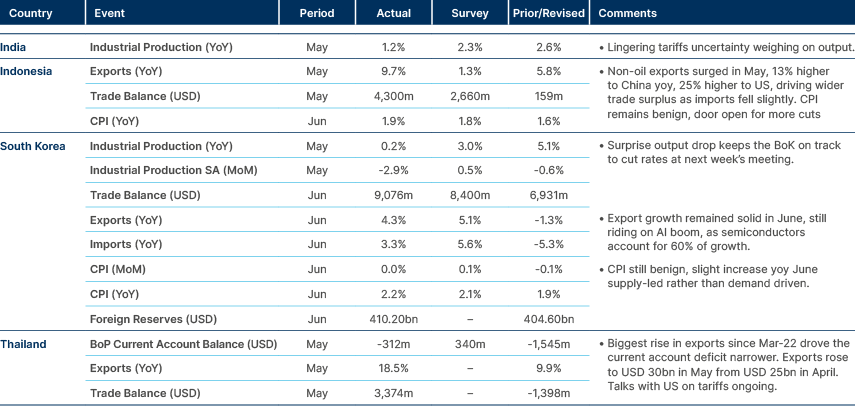

Asia

South Korean data pointing towards rate cuts.

China: Beijing will roll out a nationwide child allowance programme that pays families RMB 3,600 per child each year until the child’s third birthday. Costing an estimated 0.1% of GDP, the policy scales up pilot schemes already in place in several provinces and is meant to arrest China’s three-year population slide; births fell to just 9.54 million in 2024, barely half the 2016 peak.

India: High-frequency data point to resilient momentum. Manufacturing and services purchasing manager indices (PMIs) remain firmly in expansion territory at 58.4 and 60.4, respectively, while bank credit growth has rebounded to 9.6% y/y. Federal capital spending surged 38.7% y/y in May to INR 616bn, with roughly half channelled into roads and rail. A favourable monsoon, quicker kharif sowing, early policy rate cuts and an expected cash reserve ratio (CRR) reduction are all keeping liquidity plentiful, leaving FY 2026 GDP growth on track for 6.0–6.5%.

Malaysia: Through the first five months of 2025 the fiscal deficit narrowed by 27% y/y as stronger revenues (+5.3%) coincided with a 3.6% drop in expenditure. Nearly all the gap was financed domestically and outside the banking system, reducing rollover risk and signalling progress toward the government’s medium-term consolidation targets.

Sri Lanka: Fiscal debt projections have improved markedly: public debt is now expected to fall to 95% of GDP by 2030—two years ahead of the IMF’s baseline—thanks to faster-than-anticipated growth, easing inflation and a new fiscal rule that caps primary spending at 13% of GDP. These factors have stabilised the currency and lifted output above the 3.1% potential growth rate assumed in the 2023 debt sustainability analysis.

Vietnam: Donald Trump said the US reached an agreement with Vietnam that includes a 20% tariff on Vietnamese imports and a 40% duty on goods deemed mere transshipments, pending precise product definitions and an exemption list. UBS estimates that, given existing Section 232 carve-outs, the weighted-average import tariff would settle near 16% if 95% of exports faced a 20% rate and the remaining 5% were hit with a 43% surcharge, posing a significant risk to Vietnam’s export-led growth model.

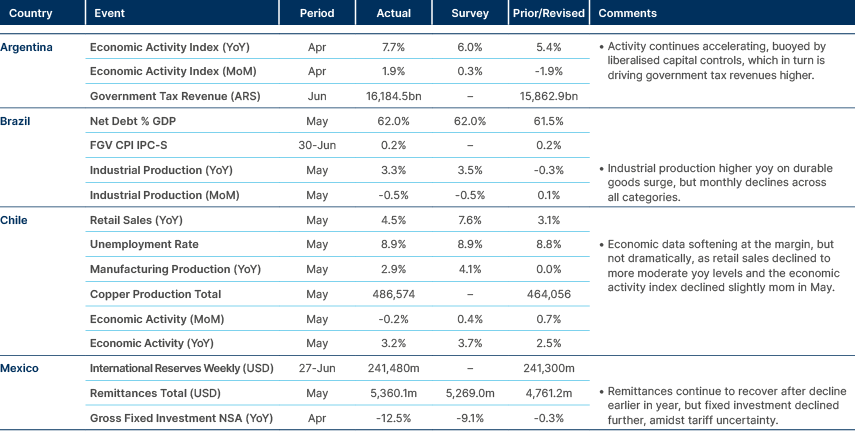

Latin America

Argentinian economic activity accelerates; Chile marginally softer.

Argentina: Finance Minister Luis Caputo brushed off worries about both the exchange rate and the current account gap, arguing that the peso’s strength mirrors Argentina’s structural overhaul and telling sceptics to “buy dollars” if they truly believe the rate is overvalued. Caputo projects a modest current account deficit of 1.5% to 2.0% of GDP, calling it the normal outcome of private-sector investment in an under-capitalised economy that he says can grow 6% after public debt was trimmed by USD 50bn. FX reserve accumulation will shift to the Treasury—responsible for hard-currency debt—using proceeds from privatisations, asset sales, concessions and bulk dollar purchases from provinces and companies; USD-subscribed local bond sales are likely to continue but were absent from the latest auction.

Brazil: Finance Minister Fernando Haddad warned that a further BRL 15bn budget freeze will be needed for 2025, in addition to revenue expected from its tax on financial transactions (IOF), to keep the 2025 fiscal target within reach. He said Brasília had weighed scrapping BRL 40bn in tax incentives but scaled the cut back after consultations with Congress. Haddad added that taking the IOF repeal case to the Supreme Court was the president’s “duty”, not a political manoeuvre, because the executive views the repeal as unconstitutional.

Chile: Communist Party contender Jeannette Jara moved into first place in the post-primary polls, drawing 26–34% support in three surveys from Cadem, Criteria and other trusted firms after the 29 June primaries unified the left’s ticket. Even so, the polls still imply an uphill fight for Jara: the three right-wing hopefuls together outpoll her by a wide margin, and Cadem and Criteria runoff tests currently indicate she would lose a head-to-head second round.

Colombia: At the International Conference on Financing for Development, President Gustavo Petro called for dismantling the International Monetary Fund (IMF), accusing its leadership of ignoring urgent debt relief and climate investment needs. The IMF suspended Colombia’s USD 9.8bn flexible credit line in April after repeated fiscal target misses, prompting Moody’s and S&P to downgrade the country’s credit ratings.

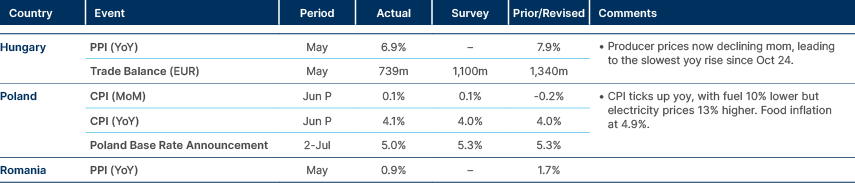

Central and Eastern Europe

Poland cuts rates again.

Poland: Poland delivered a surprise rate cut, after a one month pause. The central bank commented that they now expect inflation to ease to within the target range within the coming months. The currency fell on the news. Central bank Governor Adam Glapinski said rates may be trimmed further in September, but emphasised that this should not be interpreted as the beginning of a true easing cycle.

Central Asia, Middle East, and Africa

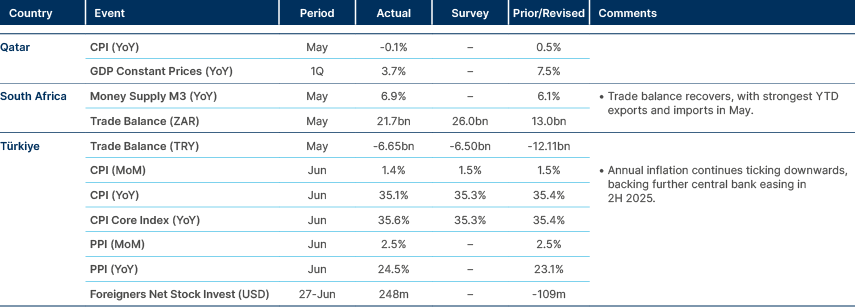

Turkey annual inflation back on downward trajectory.

Egypt: The IMF will fold Egypt’s fifth and sixth programme reviews into a single assessment in September, giving Cairo extra time to meet the reform milestones tied to its USD 8bn Extended Fund Facility (EFF). Analysts believe the merged review could push the next loan tranche back by roughly six months, although IMF staff say it is still too early to gauge how much money will be released once the combined review is cleared. The last review, completed in March, unlocked USD 1.2bn under the EFF, and a separate decision granted USD 1.3 bn through the Resilience and Sustainability Facility. IMF spokesperson Julie Kozack said Egypt has made “notable improvements” in inflation and FX reserves, but must deepen reforms, shrink the state’s economic footprint and improve the business climate. Priorities include advancing the state ownership policy and the asset diversification programme in sectors earmarked for withdrawal.

Nigeria: The naira strengthened after the IMF’s Article IV report endorsed the central bank’s tight monetary stance. That policy, combined with recent reforms—scrapping fuel subsidies, ending deficit financing by the central bank and liberalising the FX market—is helping to anchor inflation and improve Nigeria’s macro-economic outlook.

Saudi Arabia: Aramco is expected to raise the official selling price of Arab Light crude to Asia by about USD 2 a barrel, reflecting Strait of Hormuz risk premiums and robust summer fuel demand. Meanwhile, OPEC+ has slated a fourth consecutive production increase for August, adding 411k barrels per day (b/d)—roughly half from Saudi Arabia—after which the kingdom is set to pump 9.5 million b/d in July.

Senegal: Preliminary data show central government debt climbed to 121% of GDP in 2024 from a revised 111% in 2023 (previously reported at 99.7%). The IMF praised the new administration for confronting earlier mis-stated debt and deficit figures and is assisting officials while an audit determines the true public debt burden.

Türkiye: Türkiye’s trade deficit widened 39% y/y to USD 8.2bn in June. Higher energy prices linked to Middle East geopolitical risk account for part of the gap, but consumer goods imports also surged 32.5% y/y and now make up 18% of total imports. Exports rose 8% on the year, with 46% still destined for the European Union.

United Arab Emirates: Dubai has rolled out a new first-time-buyer scheme that lets both UAE nationals and long-term expatriates purchase off-plan homes of up to AED 5m with mortgages priced below prevailing market rates. Five partner banks provide streamlined, milestone-linked financing, while 13 major developers offer early access and small price concessions on their launches. Buyers must be at least 18 and own no other freehold property. The initiative broadens the pool of qualified purchasers, boosts absorption in the mid-income segment and improves developers’ cash flow by replacing lengthy post-handover payment plans with paced mortgage disbursements. Banks gain fresh, collateral-backed retail lending, and Dubai moves closer to its goal of lifting real estate’s share of GDP.

Developed Markets

US jobs data resilient, but possibly distorted by deportations.

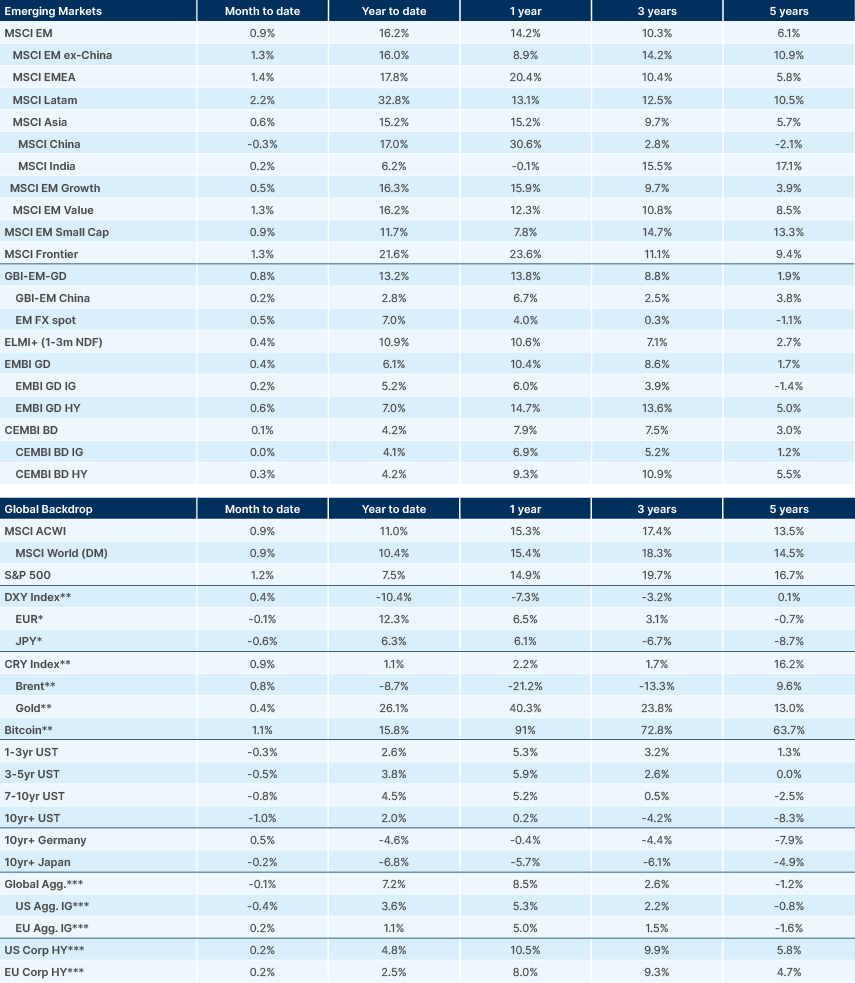

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.ashmoregroup.com/en-gb/insights/inconvenient-truth-behind-us-exceptionalism

2. See – https://www.ashmoregroup.com/en-gb/insights/germanys-historic-fiscal-shift-impact-emerging-markets