Easing market volatility, ‘goldilocks’ US data and a landslide victory for Takaichi in Japan

- Sanae Takaichi’s gamble paid off as the LDP won a supermajority in Japan’s Lower House.

- US macro data continues to point to a ‘Goldilocks’ setup.

- The volatility spike in risk assets last week has settled with stocks, metals and crypto recovering.

- The conservative Bhumjaithai Party were the biggest winners in Thailand’s General Election and are likely to be able to form a cohesive government with coalition partners.

- Argentina’s Luis Caputo projects inflation falling to 16% by end 2026.

- In Colombia, frontrunner Iván Cepeda was barred from participating in the primaries to decide the left-wing coalition candidate.

- Bank of Mexico paused its rate cutting cycle, signalling caution.

- South Africa’s Democratic Alliance leader John Steenhuisen plans to step down by April.

- Zambia’s FX reserves rose 83% in 2025, buoyed by higher gold prices.

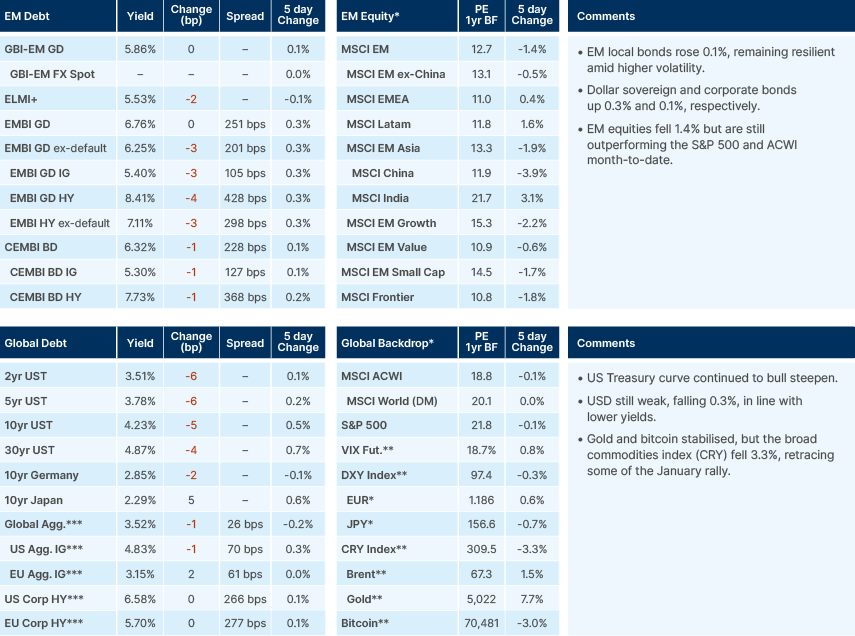

Last week performance and comments

Global Macro

Sanae Takaichi’s gamble paid off. The Liberal Democratic Party (LDP) party won a decisive victory in the Lower House snap election over the weekend, winning 316 out of 465 seats. Together with its coalition partner, the Japan Innovation Party, the LDP now holds 76% of the Lower House. This is the LPD’s highest ever majority, by far. It easily clears the supermajority (67%) required to override any vetoes from the Upper House, clearing the path for Takaichi and the LDP to implement reforms without much need to compromise with opposition parties.

The initial market reaction is likely to be a continuation of the ‘Takaichi trade’: equities higher and government bond yields higher. The reaction function in recent months of higher Japanese bond yields has been a weaker Yen. This is unusual, with the USDJPY normally trading relatively tight to the spread between US and Japanese bond yields. The breakdown of this correlation has largely been down to the fact that the feedback loop between Japanese bond yields and the currency has been dominated by rising inflation expectations, with the currency leading the weakness and yields following as markets have priced in looser fiscal policy. For the JPY to appreciate, in our view, concerns over inflationary fiscal expansion must ease. It was notable, then, that since the LDP’s landslide victory, the Yen has strengthened. This likely reflects foreign inflows into Japanese equities – but also Takaichi’s recommitment to fiscal discipline. With a supermajority, Takaichi will have the mandate to increase spending in her preferred areas, such as military and infrastructure, while cutting spending in areas which would have been difficult had she won with a weaker mandate. The response of the bond market to her preferred policies will be an important yardstick; Japan’s very high debt burden means any meaningful rise in bond yields from here would likely make any significant unfunded spending increases untenable for the budget.

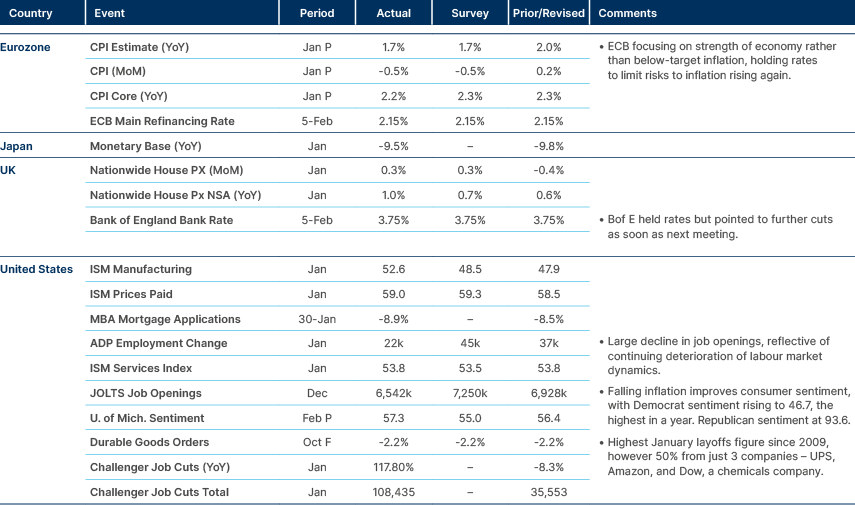

US macro data last week continued to point towards a ‘Goldilocks’ macro setup this year. The ISM manufacturing index rose by 4.7 points to 52.6, with production rising by 5.2 points to 55.9, and new orders rising by 9.7 to 57.1. The New Orders/Inventory ratio, historically a strong recession indicator, jumped to 1.2, the highest level since July 2021. Evidence is mounting that we are on the cusp of a recovery in US industry, a sector which has been in a rolling recession since 2022. This recovery will be underpinned by further rate cuts, and data last week increased our conviction that we will see multiple more in 2026. Not only did ‘Challengers’ layoffs hit the highest levels since 2021, but ‘Truflation’, a high frequency inflation indicator, fell to 0.9%, with housing inflation falling fastest.

The direction of US economic data should be supportive for risk assets. Indeed, risk sentiment stabilised on Friday after large non-linear sell offs in precious metals and crypto had begun to spillover to equity markets last week, which were also being impacted by a fresh sell off in US tech. US equities are less Mag 7-led day-to-day, but Mag 7 capex remains the pressure point. Q4 2025 earnings were very solid on cloud, yet Microsoft, Amazon, Google and Meta all guided capex above expectations, implying more debt issuance and reigniting concerns around future profits. Mag 7 valuations look much less stretched in P/E terms after consolidation in the last year. However, prices are at record highs versus free cash flow given the higher capex, which highlights the high risk / high reward game the US hyperscalers are currently playing. In the meantime, the ‘picks and shovels’ companies directly benefitting from the capex will continue to enjoy very high profits, in our view.

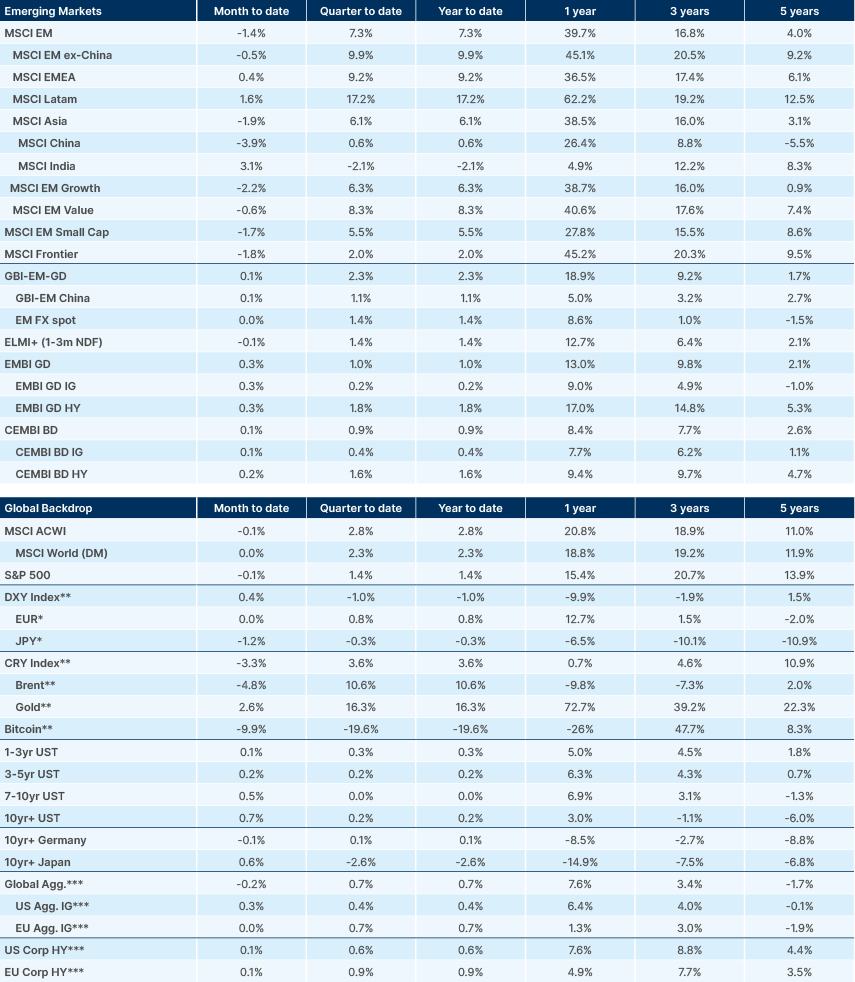

With bitcoin and metals now stabilising, the spike in volatility over the last two weeks looks like deleveraging and a repricing of ‘debasement hedge’ trades after Trump’s nomination of Kevin Warsh for the next Fed Chair – as we pointed out last week. There is no confirmation from rates or FX vol of anything more sinister. Credit and funding conditions look stable, and the VIX index is now declining again. On balance, the moves we have seen look like an intensification of a trend which has been in place since November 2025; rotation away from crowded trades and towards broader leadership, including international equities. Emerging market (EM) equities have held up very well in this environment and remain well ahead year-to-date versus the US and Europe, up 7.3%.

Geopolitics

The US and India have announced an interim trade deal in principle. The headline is that the US says it will apply an 18% tariff to certain imports from India, rather than higher levels previously discussed. India has said it will cut tariffs on some US goods, but this is likely to be selective by product, not “zero tariffs across the board”. The two sides also talked about India buying more US goods over the next five years (figures around USD 500bn have been cited), which should be read as a target rather than a binding contract. Trump has also linked the announcement to India reducing purchases of Russian crude, but that does not look like a clear, enforceable commitment yet, and the practical impact will depend on the detailed terms that will follow.

Commodities

A sharp correction in precious metals, alongside weakness in equities and crypto, has triggered broad deleveraging across commodities and pushed positioning more defensive. The moves were disorderly in the most crowded parts of the complex, where thin liquidity amplified forced selling and stop-outs, particularly in precious metals and some industrial metals. While the Bloomberg Commodity Index (BCOM) fell 5.3% on the week, it remains up around 10% year-to-date, with Brent spot prices holding their level just below USD 70 per barrel.

Emerging Markets

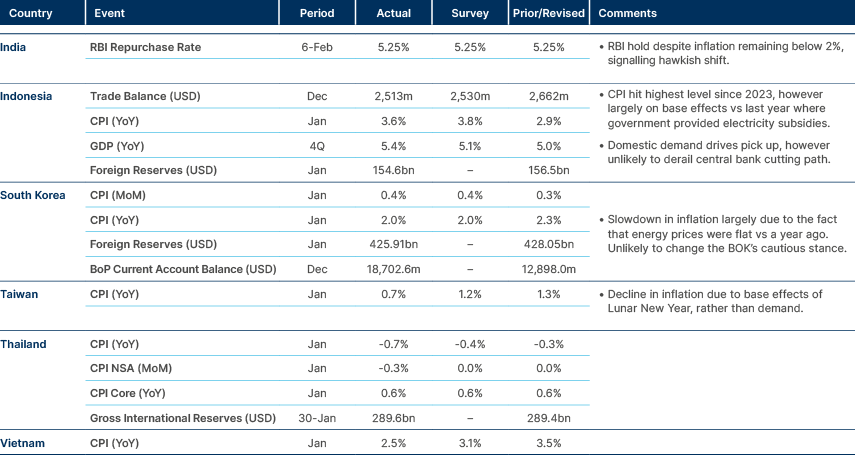

Asia

India held rates steady.

Kazakhstan: Trade ties with South Asia are set to deepen after Kazakhstan and Pakistan signed a cooperation roadmap targeting an increase in bilateral trade turnover to USD 1bn by 2027, from USD 105.6m in 2025. While ambitious given the low base, the agreement signals intent to diversify trade partners and deepen regional connectivity.

Philippines: President Ferdinand Marcos’ net satisfaction rating improved to -3 in November from -5 in September, with an average rating of +27. While still well below the +62 average recorded by former president Rodrigo Duterte, the data suggest some easing of political pressure after earlier deterioration.

South Korea: President Lee Jae Myung proposed raising capital gains tax rates by 20pp for owners of two homes and by 30pp for owners of three homes from May, signalling renewed efforts to cool property-related wealth accumulation. Separately, South Korea and Indonesia agreed to extend their KRW 10.7trn bilateral currency swap line to 2031 and will launch a cross-border QR payment system in April, strengthening financial cooperation and FX liquidity backstops.

Thailand: Thailand’s general election over the weekend produced a result tilted toward the conservative establishment, with the Bhumjaithai Party emerging as the largest bloc in parliament. Bhumjaithai and allied establishment parties are set to control close to 200 of the 500 seats, materially reducing the risk of a fragmented or reformist-led coalition and improving the prospects for a relatively swift government formation. In parallel, around 60% of voters backed a referendum to begin drafting a new constitution, signalling demand for institutional reform, though this is likely to be a gradual, medium-term process rather than an immediate policy catalyst.

Markets reacted positively to the outcome. The SET index rallied by more than 3% and the Baht strengthened by around 1% against the Dollar as investors priced lower political risk and reduced odds of abrupt policy shifts. Near-term sentiment is supportive for domestic assets, but the medium-term market outlook will still hinge on whether the incoming government can address weak growth momentum and elevated household debt while preserving fiscal discipline.

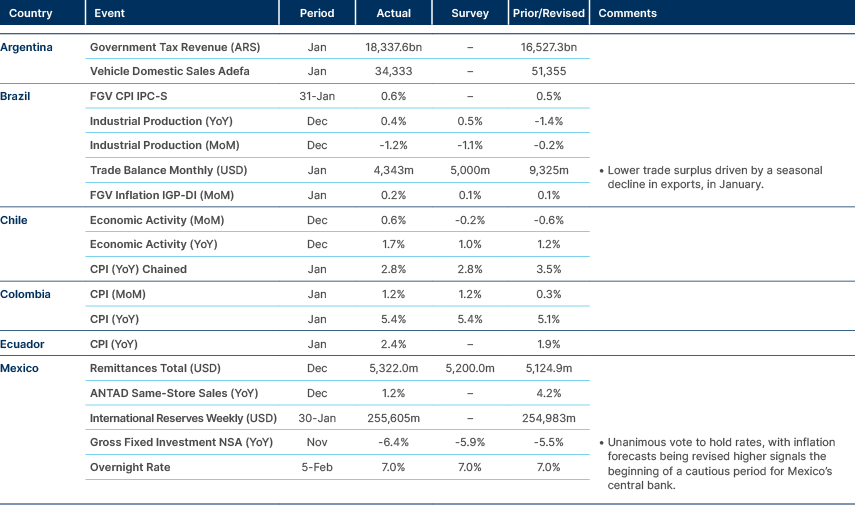

Latin America

Mexico paused their rate cutting cycle.

Argentina: Disinflation expectations improved further, with Economy Minister Luis Caputo projecting inflation around 16% by end 2026 and estimating January consumer price index (CPI) inflation at 2.5% mom. External financing constraints remain visible: the government purchased USD 808m in Special Drawing Rights (SDR)s from the US Treasury to meet a USD 878m International Monetary Fund (IMF) payment, as central bank reserves held only USD 68m in SDRs, underscoring ongoing reserve fragility despite improved macro optics.

Brazil: The US invited Brazil to join a critical minerals trade group. Brasília is expected to seek full removal of remaining US tariffs – currently affecting around 20% of exports at rates up to 40% – while pushing for safeguards to protect domestic value-added and existing China-linked contracts, highlighting the balancing act between industrial policy and geopolitical alignment.

Chile: Fiscal execution remained broadly in line with targets. The central government posted a deficit of 2.8% of GDP in 2025, with a 12-month rolling deficit of 2.5% as of November. Revenues reached 93.5% of budget and rose 3.5% yoy in real terms, while spending execution was high at 99.5%, leaving limited scope for near-term adjustment.

Colombia: Fiscal pressures intensified materially. Current spending reached 21.1% of GDP over Jan-Nov against revenues of 15.2%, producing a cumulative deficit of 5.9% of GDP. Interest costs of 2.7% of GDP imply a primary deficit of 3.3%, a 1.4% deterioration from 2024, with late-year slippage pointing to a full-year deficit near 6.7% of GDP, close to the 7.1% medium-term framework. Separately, President Gustavo Petro’s move to end diesel subsidies (excluding freight) was enabled by a stronger Peso and lower oil prices that lifted the FEPC balance to COP 0.4trn in Q4 2025. The National Electoral Council (NEC)’s decision to bar Iván Cepeda from participating in the unified left primary removes what had looked like the most straightforward ‘single-candidate’ path for the coalition. With Cepeda unable to run, the left is more likely to enter the consultation in a fragmented configuration, raising the probability of a messier candidate selection process, more intra-bloc bargaining, and a weaker mechanism for consolidating votes early in the cycle. That should be modestly supportive for the opposition at the margin, even if the near-term polling picture has not yet moved. The immediate effect is less about a step change in vote intention and more about lower coordination and higher execution risk for the left as the primary approaches.

Ecuador: Security policy moved back to the centre of the investment narrative after a USD 180m programme was announced covering helicopters, radar, drones, border control and prison infrastructure, including a new 15,000-inmate facility planned within 15-18 months. Country risk has compressed to around 446 basis points (bps), an eight-year low, though rising trade tensions with Colombia present a downside risk to growth and sentiment.

El Salvador: A reciprocal trade agreement with the US improved the near-term external narrative, with tariff relief for selected exports, including textiles, alongside commitments to address non-tariff barriers and standards. The impact is incremental rather than transformational but supports maquila exports and confidence at the margin.

Mexico: Fiscal consolidation advanced sharply in 2025. The budget deficit narrowed to MXN 1.4trn (3.9% of GDP), while the primary balance swung from a deficit of roughly -1.4% of GDP in 2024 to a surplus of around +0.6%. Revenues rose 5.8%, helped by a 22.3% jump in oil income, while spending fell 10.4% despite a 42.2% surge in financial costs. The composition matters: capital spending dropped 17.1% and current outlays fell 11.8%, which improves the near-term arithmetic but raises the medium-term durability question given large structural commitments in welfare and pensions. In that sense, the consolidation looks real, but part of it is coming from categories that are easier to cut cyclically than politically. Politically, Adán López resigned as Morena’s Senate leader and was replaced by Ignacio Mier, an AMLO ally closer to President Claudia Sheinbaum.

Banxico has paused its easing cycle by holding the policy rate at 7.0%, signalling a preference to reassess disinflation progress before delivering further cuts. The tone is still consistent with a gradual easing bias, but conditional: the bar to resume cuts is clearer evidence that recent inflation firmness does not broaden or persist. For markets, this keeps the near-term policy path anchored to incoming inflation and activity prints, supports MXN carry at the margin, and reduces the risk of an overly aggressive easing profile being priced prematurely.

Panama: Legal uncertainty increased after the Supreme Court voided a ports concession extension. The ruling does not directly affect Panama’s ‘Baa3’ (negative) rating, but potential international arbitration represents a contingent fiscal risk. President José Raúl Mulino rejected Chinese criticism of the decision, suggesting further political and legal friction around canal-related operations.

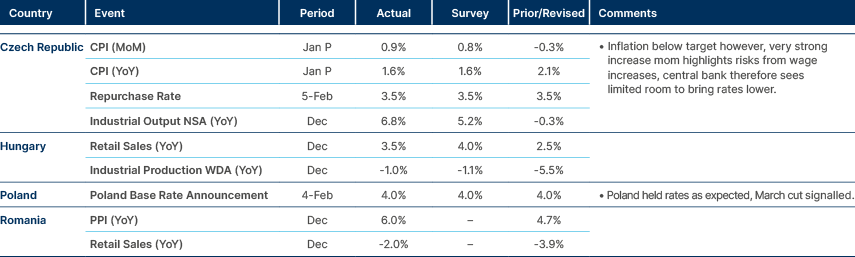

Central and Eastern Europe

Czech held rates, with inflation risk rising, Poland also held.

Czech Republic: The 2026 state deficit is set to rise to CZK 310bn (3.5% of GDP), with general government and structural deficits widening to 2.2%, breaching the 1.75% limit. Gross financing needs will reach 8.2% of GDP, with net issuance of CZK 250bn. The expiry of the windfall tax (CZK 26.7bn) remains unresolved, and public debt is projected to rise to 46.2% of GDP.

Poland: The IMF expects growth to hold at 3.5% in 2026, but flagged significant fiscal imbalances. The deficit is estimated at 7.0% of GDP in 2025, easing only to 6.5% in 2026, with debt near 59% of GDP. The IMF recommended a cumulative fiscal adjustment of around 4% of GDP, highlighting medium-term sustainability risks.

Romania: FX reserves rose 3.9% mom to EUR 80bn, driven mainly by a 16.6% increase in gold valuations and a 1.6% rise in FX reserves, with inflows of EUR 4.8bn exceeding outflows of EUR 3.8bn. Reserves remain near 20% of GDP, though a EUR 1.3bn external debt repayment in February could temporarily reduce buffers. Separately, real estate transactions fell 20.2% yoy in January following the August 2025 VAT hike, mortgages dropped 28.3% yoy, and the current account deficit widened 2% yoy to EUR 2.5bn in November, leaving the 12-month gap at 7.9% of GDP.

Türkiye: Türkiye signed a Saudi-backed USD 2bn deal to build 2,000MW of solar capacity with 50% localisation and 25-year offtake agreements. President Recep Erdoğan also appointed Fatma Özkul and Gazi Ishak Kara as Deputy Governors at the central bank, a move closely watched for implications for policy continuity.

Central Asia, Middle East & Africa

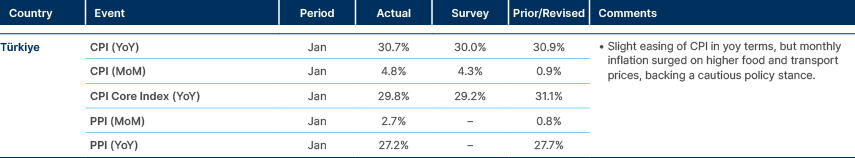

Turkish inflation surged on mom terms.

Egypt: The government is considering cutting tariffs by 10-15% on around 150 industrial inputs, lowering effective rates to 2-5%, while potentially raising tariffs on imported finished goods to as high as 60%, signalling a tilt toward import substitution. Foreign holdings of local bonds were estimated at USD 5.0bn at end-September 2025. Suez Canal traffic fell 3.6% mom in January, with estimated revenue losses of USD 5.2bn in 2025 (around 1.5% of GDP). The central bank’s gold reserves, valued at USD 18bn, appear fully available under IMF net international reserve definitions.

Gabon: Public debt is projected to rise to 82.6% of GDP from 76% in 2025, with the fiscal deficit expected to widen to 4.8% of GDP in 2026 before narrowing to 3.2% in 2027. Authorities are engaging petroleum unions to avert strikes, while China’s ZMEV proposed a vehicle assembly plant starting in 2027, with local assembly rising from 30% initially to 90% by 2036.

Morocco: Projects for a USD 1bn liquefied natural gas terminal and a national gas pipeline have been put on hold, while port infrastructure spending continues, including Nador West Med, scheduled to open in H2 2026, and a separate USD 1bn Atlantic port project.

Nigeria: Security risks have stepped up after coordinated attacks in Kwara State killed more than 160 people, reinforcing the view that insecurity is not contained to the traditional flashpoints and can spill into areas seen as relatively peripheral. The government’s confirmation of a limited US troop deployment focused on intelligence and training support is a tacit admission that domestic capacity gaps remain material, and that external enablers are needed to improve situational awareness and operational effectiveness. The near-term implication is higher security and fiscal strain, with a persistent tail risk of confidence shocks if violence continues to broaden geographically.

South Africa: Democratic Alliance leader John Steenhuisen announced plans to step down ahead of the April 2026 Party Congress, with Cape Town Mayor Geordin Hill-Lewis emerging as a potential successor. Separately, a national disaster was declared due to drought and water shortages across the Eastern, Western and Northern Cape, highlighting chronic infrastructure and municipal capacity problems.

Zambia: External buffers strengthened sharply in 2025. Gross international reserves rose 83.3% to USD 5.5bn by December 2025, supported by gold holdings of 3,051kg (USD 396m). GDP growth is estimated at 5.2% in 2025 and 5.8% in 2026, while inflation eased to 11% and is expected to return to the 6-8% target range by end-2027. The IMF approved a USD 190m ECF disbursement, lifting total support to USD 1.7bn, as the fiscal deficit narrows from 4.6% of GDP in 2025 to 2.8% in 2026. Copper output rose 8% y/y to 890,346 tonnes in 2025, still below the 1m-tonne target.

Developed Markets

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.