- Emerging market (EM) asset outperformance shows no sign of slowing down

- US labour market data continues to soften, still in a ‘fragile equilibrium’

- Fed Chair Powell said the US Justice Department had issued a subpoena related to his June Senate testimony on the renovation of Fed office buildings.

- Donald Trump directed Fannie Mae and Freddie Mac to buy USD 200bn of mortgage-backed securities in secondary markets, leading to fall in 30-yr USTs.

- Iran protests intensified and a US response is expected this week. Oil prices rose.

- The White House took steps to shield Venezuelan oil revenues held in U.S. Treasury accounts from any legal claims.

- Argentina secured a USD 3bn repo with international banks to pay USD 4bn in amortisation and coupons to bondholders.

- Presidents Trump and Petro held a conciliatory call after months of escalating rhetoric.

- Japan’s PM Takaichi reportedly plans a snap election in February.

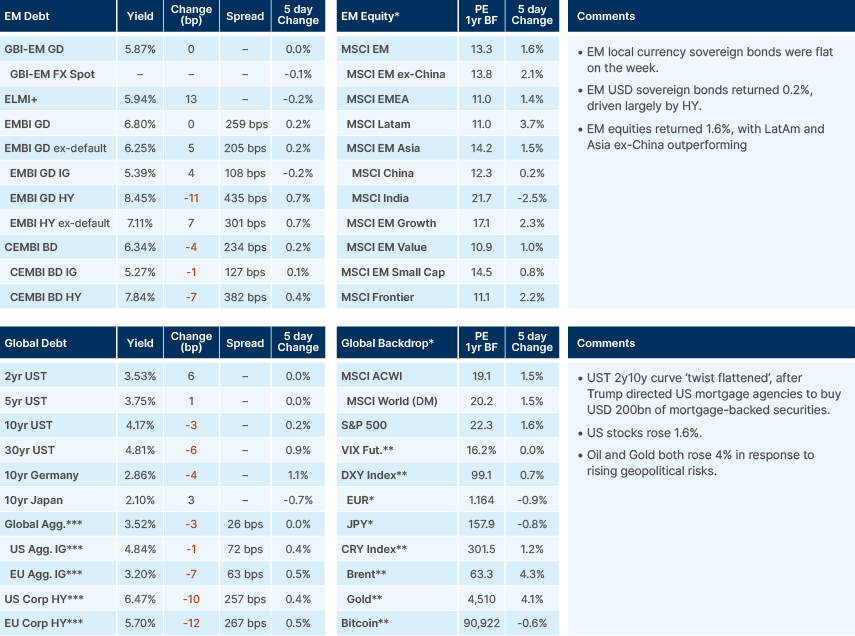

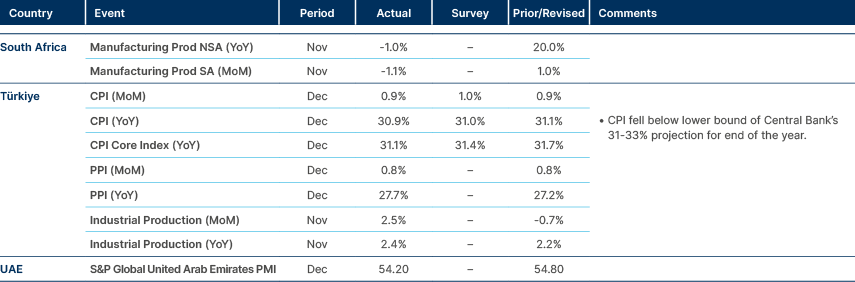

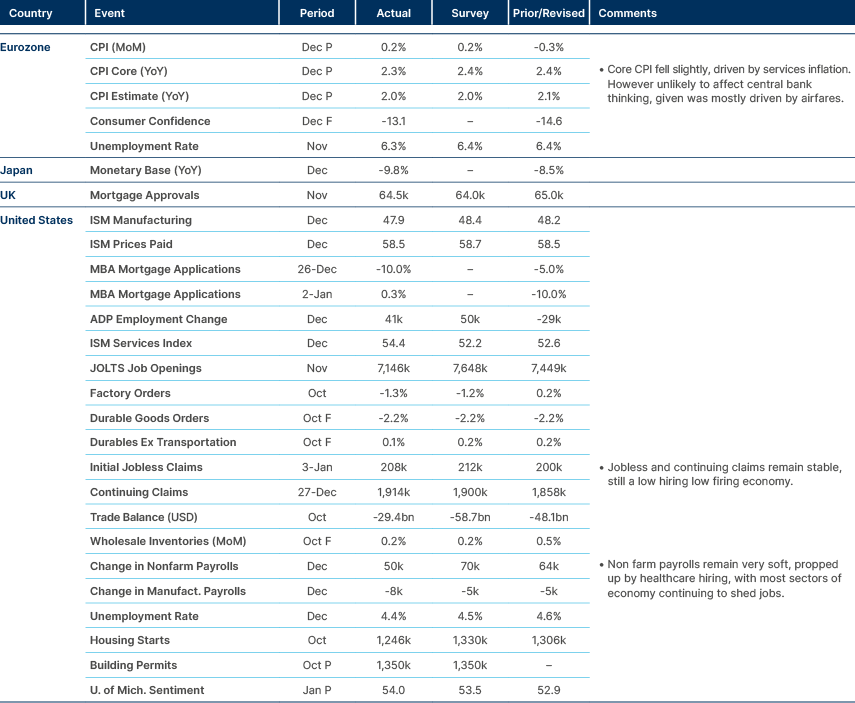

Last week performance and comments

Global Macro

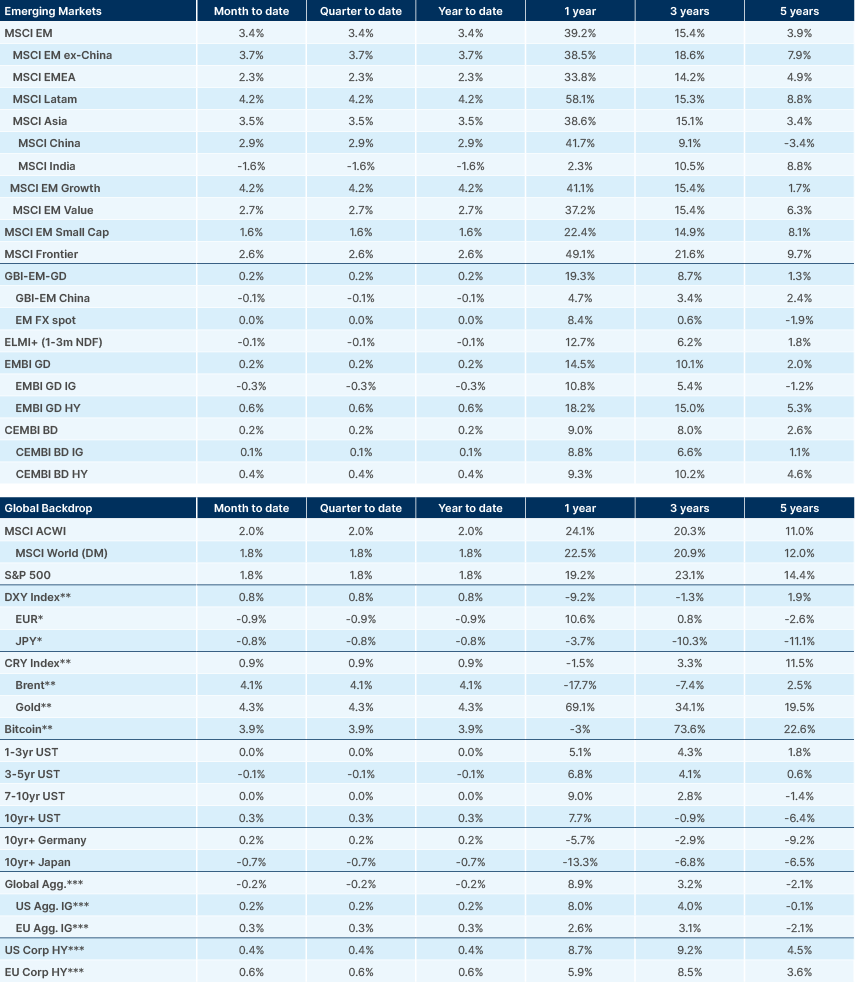

Emerging market (EM) assets have picked up where they left off in 2025, continuing to outperform developed market (DM) counterparts in bond and equity markets. EM equities seem to be stealing the show, however, with MSCI Asia and MSCI Latam continuing to outperform, up 3.5% and 4.2% YTD, respectively, against a 1.8% increase for the MSCI DM. The US ‘Magnificent Seven’ continue to underperform both domestically and internationally, with the Bloomberg equal weighted index of the seven companies down 1% since the start of November. Meanwhile, US small caps (Russell 2000) are 2% higher, EM stocks are 6% higher and European stocks are also 6% higher over the same period.

US nonfarm payroll (NFP) data published on Friday was slightly weaker than expected, with a 50k headline increase versus consensus estimates of 70k. However, with further downside revisions to previous months’ readings, the three-month moving average NFP number – closely followed for trend analysis – fell to -22k and has been negative for the last three months. Most sectors in the US economy continue to shed jobs, particularly cyclical sectors such as manufacturing, trade and transport. Healthcare hiring continues to be robust and is the only sector of the economy consistently driving payroll gains. This trend is structural rather than cyclical, driven by an ageing US demographic which is being accelerated currently by affluent ‘baby boomers’ entering pension age.

Despite the weak data, the unemployment rate fell from 4.6% to 4.4%, which markets interpreted as marginally hawkish. Two-year US Treasury (UST) yields rose six percentage points on the day. For the past year, the US labour market has been both a supply and demand story. Labour demand has been very weak, but the labour force has also stagnated, driven by a steep decline in net migration, as well as a decline in the labour force participation rate. Certain Federal Reserve (Fed) members now estimate that the breakeven rate of monthly job creation, in other words, the rate at which the unemployment rate is stable, is less than 50,000 today. In past notes we have referred to this as a ‘fragile equilibrium’, which remains the case today. Two-year UST yields rising also reflects expectations that US consumer price index (CPI) data published tomorrow could surprise to the upside. It is expected to rise, given data was distorted in the last reading by a government shutdown.

Fed Chair Jerome Powell said on Sunday that the US Justice Department had issued a subpoena related to his June Senate testimony on the renovation of office buildings, requiring the Fed to provide documents and potentially further testimony. Powell characterised the move as part of broader political pressure on the central bank. US President Donald Trump denied any involvement. Powell argued the action reflected dissatisfaction with monetary policy decisions rather than the substance of his testimony, reiterating that interest rates are set based on the Fed’s assessment of what best serves the public interest. Markets have so far reacted calmly, treating the episode largely as political noise. However, a prolonged dispute or escalation into formal legal proceedings could raise political risk premia, complicate the Fed leadership transition in 2026 and increase volatility at the margin, in our view.

While the short-end of the UST curve sold off last week, the long-end of the curve rallied in a ‘twist’, with the 30Y falling 6 basis points (bps). This was mostly driven by Trump’s announcement he would direct Freddie Mac and Fannie Mae – the US agencies tasked with providing liquidity for mortgage-backed securities (MBS) – to purchase USD 200bn of MBS bonds in secondary markets, in a bid to bring down mortgage rates. This would represent 2.5% of the total market and is expected by analysts to bring down mortgage rates by a meaningful 25bps. Mortgage rates in the US have fallen from 8% in 2023 to 6.2% today but remain very elevated versus their 10-year average.

Housing affordability remains poor in the US and is a very important political issue, with Trump now targeting it in his bid to regain popularity ahead of the midterms later in the year. While not direct quantitative easing, this interventionist policy to bring down long-end rates has been signalled by Trump and Treasury Secretary Scott Bessent since the administration began. Trump also announced another policy to cap credit card rates at 10% for a year, however US banking stocks are yet to react given this would have to be approved by Congress, which is uncertain.

Geopolitics

Unrest in Iran

Iranian demonstrations that began over economic hardship have rapidly broadened into a more general challenge to the Islamic Republic in the last two weeks. Human rights organisations report casualty figures exceeding 500 dead and more than 10,000 arrests in less than two weeks of unrest, although precise counts remain difficult due to an extensive internet and telecommunications blackout imposed by Iranian authorities. The government has framed demonstrators as “rioters” and alleged foreign influence, while security forces have used live ammunition and mass arrests in efforts to suppress the unrest. Independent reporting, including eyewitness accounts and footage, suggests widespread use of lethal force in major cities such as Tehran and Rasht, and overwhelmed health facilities struggling with the influx of casualties, although specific details vary across sources.

The US, led by President Trump, has issued strong rhetoric in support of Iranian protesters and indicated that military options remain under consideration if the crackdown continues. Trump announced that Iran has expressed a willingness to negotiate, even amid threats of US retaliation for violence against civilians. However, Tehran has largely dismissed external criticism and blamed the US and Israel for instigating unrest. Should the situation escalate further, particularly if US military action is contemplated, the risk of direct confrontation between Iranian forces and US or allied assets in the Middle East could rise sharply, with likely implications for regional security and global energy markets. The protests represent the most serious domestic challenge to the Iranian state in years, occurring against a backdrop of structural economic weakness and external pressure from sanctions and regional conflicts.

Venezuela: Oil Policy and U.S. Strategic Interests

The Trump administration issued an executive order on Friday under the International Emergency Economic Powers Act to shield Venezuelan funds derived from oil sale in the US or used for diluent imports from the US – to be held by the US Government in Treasury accounts or designated US bank accounts -- from creditors. The order affirms that such funds are property of the Venezuelan Government, with the U.S. acting “in a custodial and governmental capacity”.

In our view, this does not materially damage the prospects of any future restructuring of Venezuelan bonds. Rather, the measure is a pragmatic and necessary step towards stabilising and growing the country’s oil revenue base under the US-controlled framework laid out by the Trump administration. Trump met with senior oil industry executives last week to discuss potential investment in Venezuelan production, with mixed reception. While some publicly expressed scepticism, others indicated interest. We expect producers already established in the country and smaller new players to increase investment first.

Treasury Secretary Bessent told Reuters on Saturday that sanctions could be eased as early as this week to enable oil sales and confirmed plans to meet with the IMF and World Bank to explore reengagement with Venezuela. Discussions are expected to include the possible release of US$5bn in Special Drawing Rights frozen since the pandemic due to the dispute over recognition of the Venezuelan government. Separately, US Energy Secretary Wright expressed in a televised interview on Sunday his support for the completion of the Citgo sale to Elliott. He dismissed suggestions that the U.S. might seek control of the asset or preserve its Venezuelan ownership, stressing instead that the sale is “part of bringing redress to creditors in the United States for the Venezuelan government”; and that “it’s a fantastic thing” to have Citgo ownership transferred to American owners and American entrepreneurs legally through an auction process.

Greenland

The strategic competition over Greenland has emerged as a major flashpoint between the US and its European NATO allies, testing the cohesion of the alliance. Trump has reiterated his public intent to secure formal control over Greenland, an autonomous territory of Denmark, citing its strategic position in the Arctic and concern about rising Russian and Chinese military interest in the region.

This posture, including suggestions the US may act unilaterally if necessary, has alarmed European partners and Danish leadership, who contend that any effort to annex Greenland would undermine NATO’s foundational principles and could fracture the alliance. Danish Prime Minister Mette Frederiksen has warned a US takeover of Greenland would effectively “mark the end of NATO,” underscoring the deep diplomatic rift generated by these assertions. European governments including the UK, Germany, France and Belgium, have publicly reaffirmed that Greenland’s future must be determined by Greenlanders and Denmark within international law and have rejected US assertions that an annexation would secure Arctic security.

In response to the broader strategic competition, and to provide reassurance to Nordic allies, Germany is preparing to propose a new NATO mission, informally dubbed “Arctic Sentry,” modelled on NATO’s existing Baltic Sentry operation, to monitor and protect key infrastructure in Arctic waters including Greenland. Discussions are reportedly underway in Berlin and London about possible contributions to such an effort, and US senators are also planning visits to Denmark to engage on security issues. These developments reflect an emerging consensus among NATO members on the need for enhanced collective presence in the High North to defuse tensions and uphold alliance commitments, while rejecting unilateral attempts to alter sovereign borders. The diplomatic pushback and operational planning underscore both the strategic importance of the Arctic and the potential costs — political and institutional — of unilateral action by a NATO member.

Commodities

Brent crude prices have risen sharply over the past two days, climbing from around USD 60 per barrel to USD 63 marking the largest two-day gain since October, as unrest in Iran and rising tensions between Tehran and Washington have increased geopolitical risk in the oil market. Iran is currently exporting around 2 million barrels per day, and positioning data indicate a sharp shift towards bullish oil calls, with skew now at its highest level since July 2025. While the risk of a US military response has moved higher, Trump is unlikely to tolerate a sustained spike in oil prices given the domestic inflationary implications, in our view. Previous episodes, including last summer’s US strikes on Iran and fears of a closure of the Strait of Hormuz, ultimately failed to disrupt physical supply. For now, the upside in prices appears driven more by technical factors, with the market having been heavily oversold on expectations of global oversupply, leaving room for a corrective rebound as those positions unwind. In parallel, OPEC+ has reaffirmed its decision to keep production steady through Q1 2026, maintaining flexibility around voluntary cuts and signalling a continued preference for defending prices rather than pursuing market share, particularly against a backdrop of seasonal demand weakness and rising non-OPEC supply.

Emerging Markets

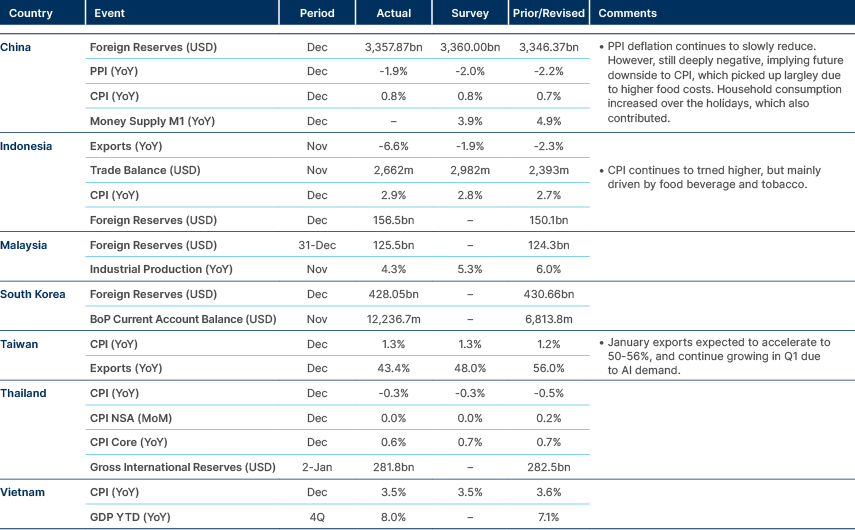

Asia

India: Positive growth and exceptionally low inflation have given the Reserve Bank of India (RBI) ample policy space but little urgency to ease further. With inflation likely past its trough and growth running above trend, the central bank is expected to hold rates in February, prioritising transmission assessment and flexibility over additional near-term stimulus.

South Korea: The government set a 2% growth target for 2026, double the estimated pace in 2025, led by stronger exports and a rebound in construction. Semiconductor demand remains a key tailwind, reinforced by Samsung Electronics’ record Q4 operating profit, highlighting the sector’s central role in supporting growth, exports and the current account.

Philippines: President Ferdinand Marcos Jr signed the 2026 budget while vetoing a significant portion of unprogrammed appropriations, aiming to limit discretionary spending risks. Education and healthcare received the largest allocations, while the government lowered its 2026 growth target to 5–6%, reflecting a more cautious macro outlook after a weaker 2025.

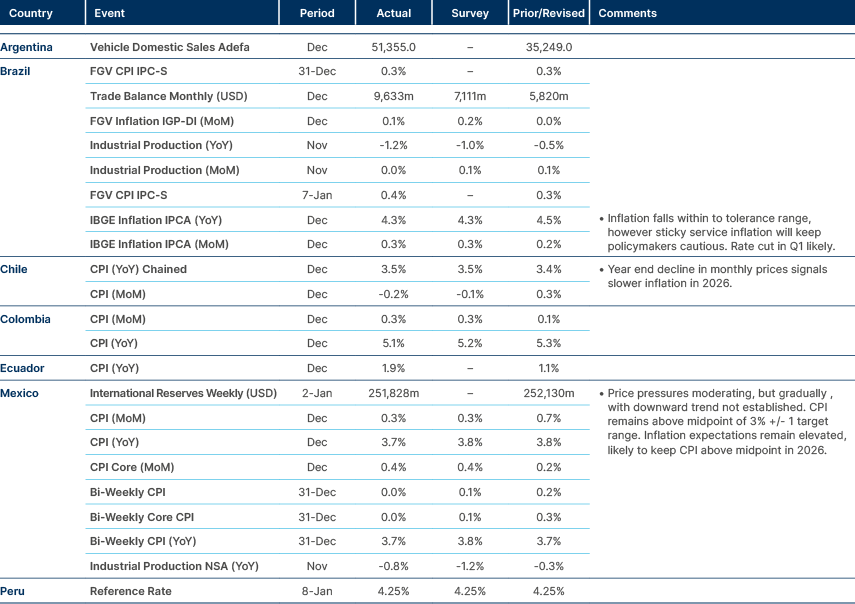

Latin America

Argentina: The central bank secured a USD 3.0bn repo with international banks using USD 5.0bn in sovereign bonds as collateral, to pay USD 4bn in amortisation and coupons to bondholders. Analysts raised the country’s 2026 GDP growth forecast to 3.5% following the ruling party’s strong midterm election performance, though expectations remain well below the government’s budget assumptions. Inflation forecasts were revised up slightly to 20.1% after the adoption of a more flexible FX regime.

Brazil: President Lula vetoed legislation that would have reduced sentences linked to the January 2023 riots, a move widely expected and likely to be challenged by Congress once it reconvenes. The central bank’s monetary policy committee (Copom), is expected to remain conservative despite inflation returning within its target band, citing de-anchored expectations, fiscal uncertainty and a still-tight labour market. The central bank is likely to delay the start of easing until clearer disinflation dynamics emerge later in 2026.

Colombia: After months of escalating rhetoric, President Gustavo Petro held a conciliatory first call with Donald Trump, marking a sharp de-escalation in bilateral tensions. The exchange reduced immediate tail risks around sanctions or confrontation, though Petro faces potential backlash from his left-wing base if relations with Washington shift toward a more transactional footing.

Mexico: Central bank minutes showed a broadly dovish board with limited concern over lingering core inflation pressures, suggesting easing could resume earlier than markets expect. While one member warned of upside risks from taxes and trade uncertainty, the majority argued inflation expectations remain anchored, keeping rate cuts firmly on the table in coming months.

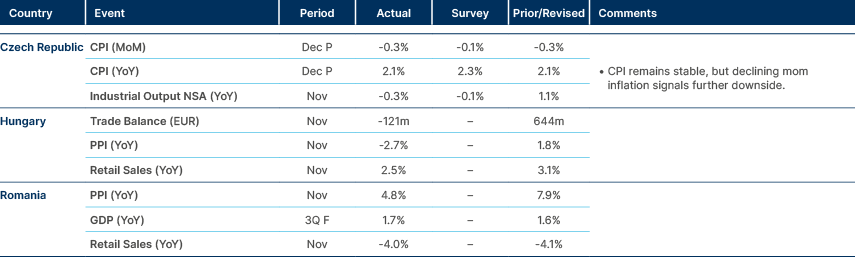

Central Eastern Europe

Middle East & Africa

Egypt: Qatar and Egypt signed an agreement under which QatarEnergy will supply 24 liquified natural gas (LNG) cargoes during the 2026 summer season, helping Egypt meet peak power demand. The deal underscores Egypt’s growing gas supply constraints following declining domestic production and limited new discoveries, reinforcing reliance on imports despite ambitions to remain a regional gas hub.

Nigeria: The central bank expects inflation to ease to 12.9% in 2026, supported by lower food prices and fuel costs, while warning that excessive fiscal spending could reverse disinflation gains. GDP growth is projected to accelerate to 4.5%, driven by structural reforms, stronger oil sector performance and expanding domestic refining. Public debt is expected to rise modestly but remain sustainable, while external reserves are forecast to strengthen to above USD 51bn.

Saudi Arabia: Saudi Aramco cut official selling prices for Asian buyers for a third consecutive month, pushing premiums to their lowest level since early 2021. The move reflects ample global supply and softer demand growth and comes alongside similar price reductions for Europe and the US, signalling sustained pressure on crude pricing despite OPEC+ discipline. Separately, Saudi authorities advanced legislation to grant foreign investors full access to the domestic equity market, removing remaining restrictions on ownership and participation. The reform is aimed at deepening market liquidity, broadening the investor base and supporting capital inflows as part of the Vision 2030 agenda, while increasing the market’s sensitivity to positive global risk conditions.

Developed Markets

Japan: Japanese Prime Minister Sanae Takaichi is reportedly considering dissolving the House of Representatives at the start of the ordinary parliamentary session on 23 January, sources told Kyodo News. We believe, the move would pave the way for a snap general election, potentially with official campaigning beginning in late January or early February and voting in mid-February. The timing reflects Takaichi’s strong personal standing, with recent opinion polls showing approval ratings above 70%. Markets responded positively with equity futures rising and the Yen weakening, as investors priced in a higher likelihood of electoral gains for the ruling bloc and a more active fiscal stance. However, some analysts caution that strong approval ratings for the Prime Minister do not necessarily translate into broad support for the Liberal Democratic Party, and even a lower house majority would still require cooperation from the Upper House. As a result, the scope and durability of any post-election fiscal expansion remain uncertain, with the risk that political constraints limit policy follow-through despite market optimism.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.