- Asset prices were choppy in November, but EM local currency bonds kept up their hot streak.

- Budget confirms UK consolidation path; German infrastructure investment accelerates.

- Positive call between Trump and Xi Jinping signals warmer relationship.

- US and Ukrainian negotiators reported productive talks on a peace framework.

- India’s Q3 GDP growth accelerated to 8.2% yoy from 7.8% in Q2, well above expectations.

- South Korean exports reached a record November high, rising 8.4% yoy to USD 61bn.

- José Antonio Kast solidified a commanding lead in polls ahead of the Chilean presidential runoff.

- Fitch upgraded Zambia’s sovereign rating to ‘B’ with a stable outlook.

- Moody’s affirmed Qatar’s ‘Aa2’ sovereign rating with a stable outlook.

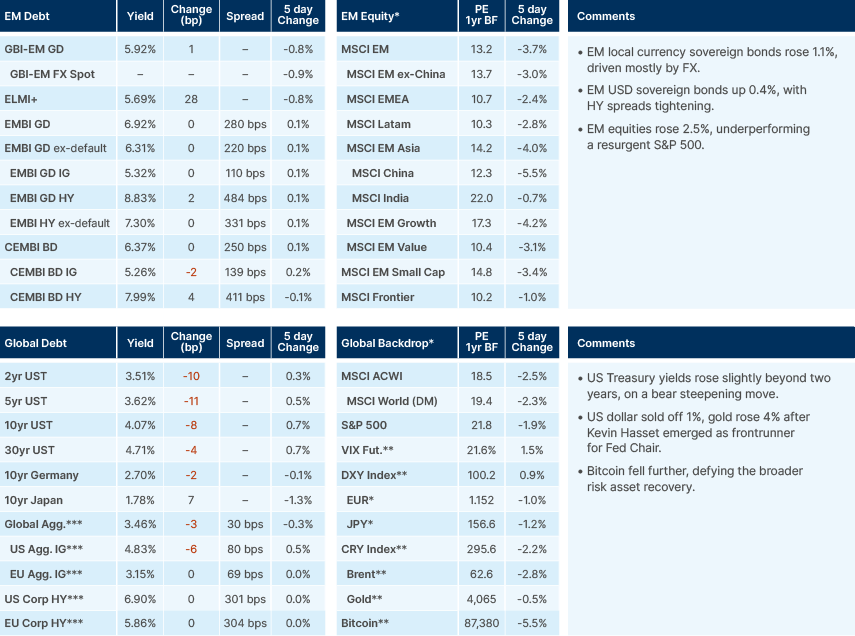

Last week performance and comments

Global Macro

November was a choppy month for asset prices. The narrative was centred on the debate over artificial intelligence (AI) valuations and the feasibility of large capital expenditure plans amidst uncertain returns on capital. Against this backdrop, tighter liquidity, doubts over December rate cuts from the US Federal Reserve (Fed), as well as the UK Budget dominated headlines. The MSCI ACWI ended up flat with developed markets (DM) up 0.3% and emerging markets (EM) down 2.4%. Within EM, Latin America outperformed again, up 6.1%, while Asia unperformed, down 2.8%, and India rose 0.9%.

In fixed income, US Treasuries performed well, with 10-year US Treasury yields down 7 basis points (bps) to 4.01%, leading to 1.0% returns in November and 9% year-to-date (YTD) for the 7-10-year index. However, large issuance in the investment grade (IG) tech market kept credit spreads under pressure. US IG rose 0.6%, EM corporate IG 0.3%, but sovereign IG was flat. EM sovereign high yield (HY) and EM local currency bonds outperformed again in November, rising 0.8% and 1.3%, respectively, and with very solid YTD performance of 15.5% and 17.5%.

Notably, this means that EM local currency bonds have had only one negative calendar month in 2025 to date and only a small 0.8% dip in July. This has been the steadiest run for the asset class in 25 years. The index had two negative months in 2017 and the bullish period of 2002-2008 had much choppier monthly performance.

The UK Budget went largely as anticipated, with the Labour government increasing spending on welfare while implementing various revenue raising measures. The UK is currently looking set for a 1% GDP fiscal consolidation next year, as previously expected. However, much of the new fiscal savings are backloaded, coming in 2028/2029. The additional headroom on the fiscal deficit against the independent Office for Budget Responsibility (OBR) regulator allowed for less issuance of gilts, particularly long-term bonds, which drove yields lower. No measures to directly boost growth were announced. However, bringing UK bond yields lower is supportive. The main concern remains political stability. Over the weekend pressure on the Labour administration from its own backbenchers as well as opposition, remained intense.

As the UK moves towards fiscal consolidation, Germany’s fiscal expansion is accelerating. Spending increased by EUR 12bn in October versus September, driven by a faster rollout of the off-budget infrastructure and climate fund. A continuation of this rollout is likely to boost growth meaningfully in 2026. However, this will likely act as a counterweight to the drag on growth from a growing current account deficit with China, which is becoming an increasingly fierce competitor for Germany’s industrial heartland, particularly the auto sector. Goldman Sachs expects the overall hit to German GDP from China’s intensifying competition to reach 0.9% spread over the next four years.

Geopolitics

US-China

The telephone call between Chinese and US leaders dominated Asia’s geopolitical headlines in the last week. Both sides struck an upbeat tone, with US President Donald Trump describing US–China relations as ‘extremely strong” after state visits were agreed. The official rhetoric and positive news flow add to signs Washington and Beijing may be shifting from their confrontational stance. Key trends to watch include China’s potential relaxation of curbs on rare earth exports and its soybean purchases, as well as US limits on tech exports targeting China. Meanwhile, Trump appears to be balancing ties with both China and Japan, where tensions have recently flared.

Russia-Ukraine

US and Ukrainian negotiators said they had productive discussions about a framework for a peace deal, but there was no final breakthrough. Trump continues to push for a truce with Russia, although he withdrew his 27 November deadline for Kyiv to accept the US peace proposal after strong pushback from Ukraine and European governments. US envoys will now conduct shuttle diplomacy between Moscow and Kyiv, with Trump saying he will meet with leaders Zelenskyy and Putin only “when a final deal is ready.” Russian officials are expected to reject any revised draft that excludes their core demands, including Ukraine’s withdrawal from all of Donetsk, strict limits on Ukrainian force size, and a binding veto over NATO membership. Kyiv maintains that no territorial discussions can occur before a ceasefire along current front lines—a position backed by key EU states.

“There’s more work to be done,” US Secretary of State Marco Rubio told reporters after meeting for at least four hours with Ukrainian officials led by National Security and Defence Council Secretary Rustem Umerov. “This is delicate. It’s complicated.” The meeting, which took place in Florida with US special envoy Steve Witkoff and Trump’s son-in-law Jared Kushner also in attendance, was likely the last chance for Ukraine’s negotiators to sway Witkoff before he leads a US delegation for talks in Russia this week. Rubio said the aim of the negotiations wasn’t just about ending the fighting but also about helping Ukraine “enter an age of true prosperity”.

Umerov said the US “was very super supportive.” Trump told reporters “I think Russia would like to see it end. I know Ukraine would like to see it end. Ukraine’s got some difficult little problems.” Trump also said he spoke with Rubio and Witkoff following the talks in Florida. Ukraine has “a corruption situation going on, which is not helpful” Trump said. “But I think there’s a good chance we can make a deal”. Witkoff leaves Monday for Moscow, according to a US official. “We’ve also been in touch to varying degrees with the Russian side, but we have a pretty good understanding of their views as well”, Rubio said.

Venezuela

In a Saturday morning social media post, Trump announced he had ordered the closure of Venezuelan airspace1: “To all Airlines, Pilots, Drug Dealers, and Human Traffickers, please consider THE AIRSPACE ABOVE AND SURROUNDING VENEZUELA TO BE CLOSED IN ITS ENTIRETY.” The US Federal Aviation Administration recently issued a security notice warning airlines and pilots to avoid Venezuelan airspace, citing “a worsening security situation” increased military activity, and potential global positioning satellite (GPS) interference as risks to flights.

Emerging Markets

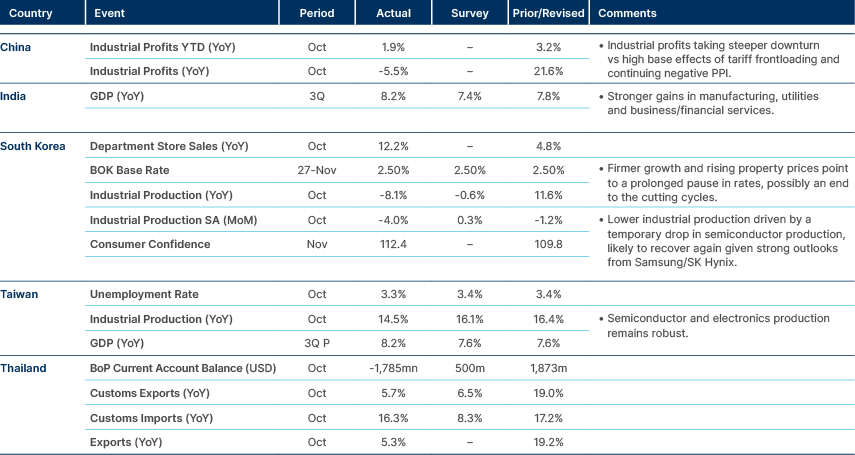

Asia

Korean exports remained very strong in November. Taiwan GDP moved to upside.

China: Two of the country’s largest private property data providers—China Real Estate Information Corp. and China Index Academy—unexpectedly skipped the release of their November nationwide home-sales figures, creating fresh uncertainty around the health of the real estate sector. The non-publication came days after China Vanke, long viewed as one of the sector’s most stable firms, requested a delay in repaying a local bond for the first time. The lack of data transparency, combined with Vanke’s restructuring signals, heightened concerns that property sector stress is broadening again despite recent policy support.

India: Q3 GDP growth accelerated to 8.2% yoy from 7.8% in Q2, well above expectations. Sequential growth was steady at 1.8% qoq (seasonally adjusted), supported by a modest pickup in private consumption even as investment, government spending, and net exports softened. Nearly half of headline growth came from the ‘discrepancy’ line, underlining some volatility beneath the surface. Nominal GDP growth slowed to 8.7% yoy as the GDP deflator fell to a multi-year low of 0.5%—a pattern likely to push real GDP artificially higher in Q4, potentially toward ~7.5%. Full-year forecasts were revised up to 7.7% for 2025 and 7.5% for FY26. Despite the poor transparency on the available data, it is likely that a rebound in production ahead of an expected boost in consumption from consumption tax cuts and better liquidity provision have supported economic activity. Indeed, sales of motorcycles and mopeds have been supported, a positive sign for local consumption over the next quarters.

In other news, the International Monetary Fund (IMF) is expected to shift India’s FX regime classification toward a ‘crawling peg,’ reflecting sustained and large-scale intervention. The INR touched new lows before the Reserve Bank of India stepped in. September’s intervention reached USD 7.9bn—the largest monthly sale of FY25—pulling reserves back below USD 700bn. Markets now expect the IMF review to highlight reduced FX flexibility and the policy challenges ahead of the 2025 Budget.

Indonesia: Headline consumer price index (CPI) inflation rose 2.7% yoy in November with core inflation at 2.4% yoy, broadly matching expectations. The October trade surplus narrowed to USD 2.4bn (vs USD 3.7bn expected), with exports falling 2.3% yoy against consensus forecasts of a 3.4% rise.

Sovereign wealth fund Danantara, established nine months ago, is preparing its first global bond issuance for 2026 to anchor an international funding curve. Dollar issuance will dominate, though a potential CNY tranche is being explored to tap Chinese institutional demand. The fund will obtain full sovereign level credit ratings and expand beyond its IDR 50trn seed capital from ‘patriot bonds’ as major project commitments grow.

South Korea: Exports reached a record high for any November, rising 8.4% yoy to USD 61bn, driven by a continued surge in semiconductor shipments—up 38.6% yoy to a record monthly peak of USD 17.3bn. Auto exports also grew 13.7% yoy to USD 6.4bn. Shipments to the US rose strongly in chips and autos (39% and 11%, respectively), though this was offset by a 24% plunge in steel exports, leaving total exports to the US marginally lower at -0.2% yoy. Shipments to China increased 6.9% yoy, a notable improvement. Imports rose 1.2% yoy to USD 51.3bn, producing a trade surplus of USD 9.7bn—well above consensus and significantly higher than October’s USD 6bn surplus.

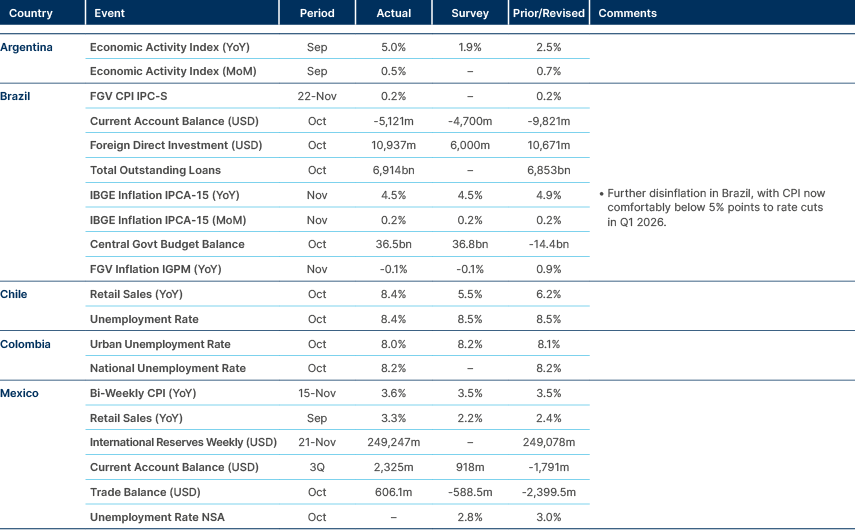

Latin America

Brazil’s CPI is at the top of the inflation target band. Strong retail sales in Chile and Mexico.

Argentina: The central bank marginally loosened liquidity conditions, cutting the reserve requirement on demand deposits from 53.5% to 50% and reducing the daily compliance threshold to 75%. Despite the adjustment, policy remains exceptionally tight compared with July’s 20% reserve ratio, underscoring continued priority on Peso stability after recent episodes of overnight rate volatility. Markets view the change as a short-term stabiliser rather than the start of an easing cycle, as authorities await clarity on external support negotiations with Washington and multilateral lenders. The move aims to provide temporary liquidity relief while avoiding any renewed FX pressure.

Brazil: Petrobras announced a 2% reduction in its five-year investment plan, lowering projected capex to USD 109bn as the company seeks to protect cash flow amid softer global oil prices. Roughly USD 91bn is earmarked for projects already under implementation, although USD 10bn of that still requires budget confirmation pending a financing review. The remaining capex allocation covers projects at earlier stages of analysis with lower execution certainty. Management framed the adjustment as prudential rather than strategic, signalling continued discipline as revenue assumptions weaken.

Chile: José Antonio Kast solidified his commanding lead ahead of the presidential runoff, with most polls pointing toward a 60/40 margin and several showing him already above 50% before undecideds are allocated. The race is widely viewed as Kast’s to lose given momentum and weak consolidation on the left. The Senate also approved the 2026 Budget with only minor amendments, maintaining broadly stable expenditure-to-GDP and a projected 1.5% deficit. A mixed legislative committee will finalise the text, but the Senate’s version is expected to prevail.

Colombia: Invamer released a poll from November showing Ivan Cepeda from Pacto Historico (the incumbent’s coalition) leading with 31.9%, followed by Abelardo de la Espriella (right) with 18.2% of votes and centrist Sergio Fajardo with 8.5%.2 Cepeda is also leading all the runoff scenarios, according to the poll, as the race fragmentation and polarisation between far-left and far-right main challenger increases the risk of an unpopular incumbent party to remain in power.

The Finance Ministry has prepared a decree to shift pension annuity indexation from productivity to inflation, reducing the system’s exposure to the large minimum wage increase planned for 2026. The draft also changes government contributions from lump-sum payments to annual transfers and lowers eligibility from three to two minimum wages. Insurers warn the revisions could force higher reserve buffers, while analysts argue the changes could raise long-term fiscal risks by placing more responsibility on the state. The decree has not yet been published but has circulated widely among market participants.

Ecuador: Fitch upgraded the sovereign’s foreign currency rating to ‘B-‘ from ‘CCC+’ and assigned an RR3 recovery rating, triggering a relief rally across the curve. The RR3 recovery rating indicates a 50%-70% recovery rate in the event of a future default, limiting the potential downside in the event of an unforeseen credit deterioration. Fitch cited improved policy execution but warned that the fiscal outlook still rests on optimistic assumptions, including subdued oil price forecasts, rising debt service, and an interest-to-revenue ratio approaching 10% by 2026. Officials argue that successful delivery of the fiscal plan could help reopen market access next year, though investors remain cautious given sizeable 2025 funding needs and lingering political risk.

Peru: Former president Dina Boluarte filed a motion to annul her impeachment, claiming procedural violations and requesting the process be rolled back to the stage before Congress admitted the case in October. With presidential immunity now removed, multiple corruption and misconduct investigations have accelerated, adding to political uncertainty as the country approaches the 2026 general election. Markets remain wary of institutional instability and the risk of further congressional confrontations.

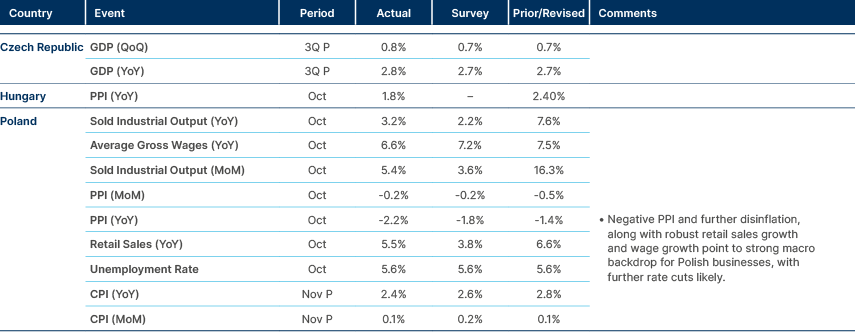

Central Eastern Europe

Wages softened further in Poland below long-term average since June.

Hungary: Social partners agreed to an 11% rise in the minimum wage and a 7% increase for skilled workers from January, a faster adjustment than most had expected. The government will approve the deal without offsetting measures such as social contribution cuts, despite lobbying from employers that warn smaller firms face meaningful margin pressure. Officials presented the increase as part of Hungary’s long-term wage-convergence plan and argued that inflation will remain on track. Analysts are more cautious, noting that higher labour costs could slow disinflation and complicate the National Bank of Hungary’s room for further rate cuts.

Middle East & North Africa

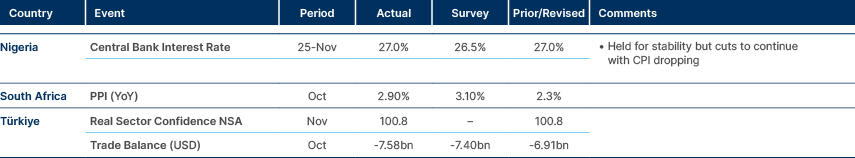

Nigeria’s central bank kept a hawkish tone.

South Africa: Trump announced that South Africa will not be invited to the 2026 G20 Summit in Miami and threatened to cut remaining US funding. Pretoria called the statements “regrettable” and factually incorrect, stressing that G20 membership is fixed and cannot be revoked by a host country. The episode underscores rising geopolitical tension around South Africa’s BRICS+ alignment and its neutral stance on Russia, adding another layer of uncertainty to an already delicate fiscal and political backdrop.

Zambia: Fitch upgraded Zambia’s sovereign rating to ‘B’ with a stable outlook following completion of roughly 94% of its external debt restructuring. External debt service is projected to fall below 2% of GDP by 2027, while debt/GDP is expected to decline from around 100% today to 93% in 2025 and 85% in 2026. Growth is forecast to accelerate toward 6% by 2027 as mining investment restarts and copper-export volumes recover. The upgrade reinforces improving credit dynamics but leaves implementation risks around mining governance and fiscal consolidation.

Qatar: Moody’s affirmed Qatar’s ‘Aa2’ sovereign rating with a stable outlook, citing exceptionally strong sovereign wealth buffers—about USD 400bn, equivalent to 184% of GDP—which anchor debt below 45% of GDP. Liquefied natural gas (LNG) expansion remains the backbone of the medium-term story, with capacity on track to rise more than 80% by 2031. Moody’s expects fiscal balances to shift back into surplus from 2027 as new LNG trains come online, supporting continued resilience despite softer hydrocarbon prices.

Developed Markets

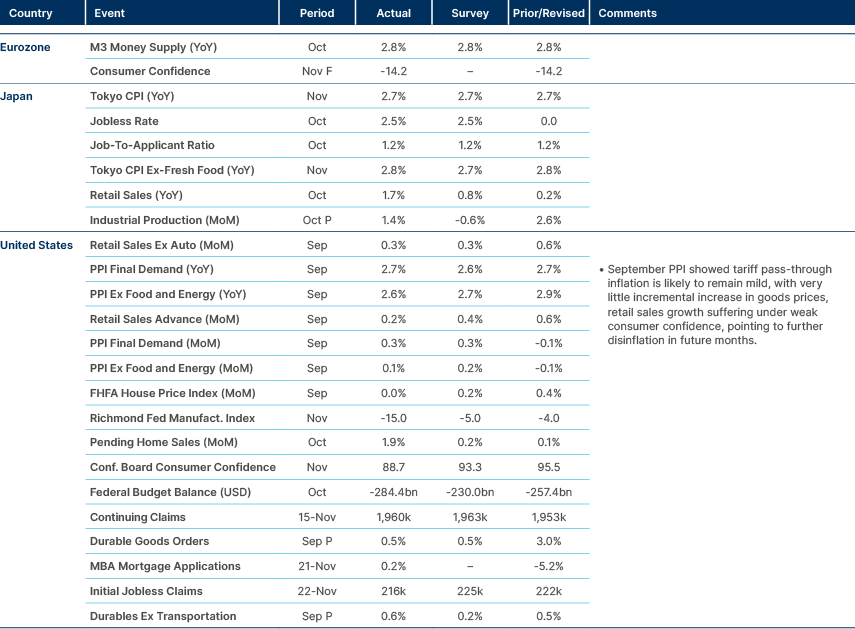

Delayed US September labour market data published last week.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See https://www.politico.com/news/2025/11/29/trump-venezuelan-airspace-military-00670743

2. See https://elpais.com/america-colombia/2025-12-01/ivan-cepeda-se-consolida-como-lider-de-las-encuestas-electorales-para-la-carrera-presidencial-en-colombia.html (in Spanish).