- US stocks now in a technical correction, Bessent unphased.

- ECB officials say uncertainty now higher than during Covid.

- US and Ukraine agreed terms for a 30-day ceasefire proposal, discussion with Russia expected this week.

- Massive anti-authoritarian protests in Eastern Europe.

- Chinese consumption stimulus plans continue to develop.

- Mexico retaliation against US steel and aluminium tariffs delayed until 2 April.

- Moody's revised Romania outlook to negative from stable.

- IMF approved the fourth review of Egypt’s EFF programme.

- S&P upgraded Saudi Arabia’s credit rating to A+ from A.

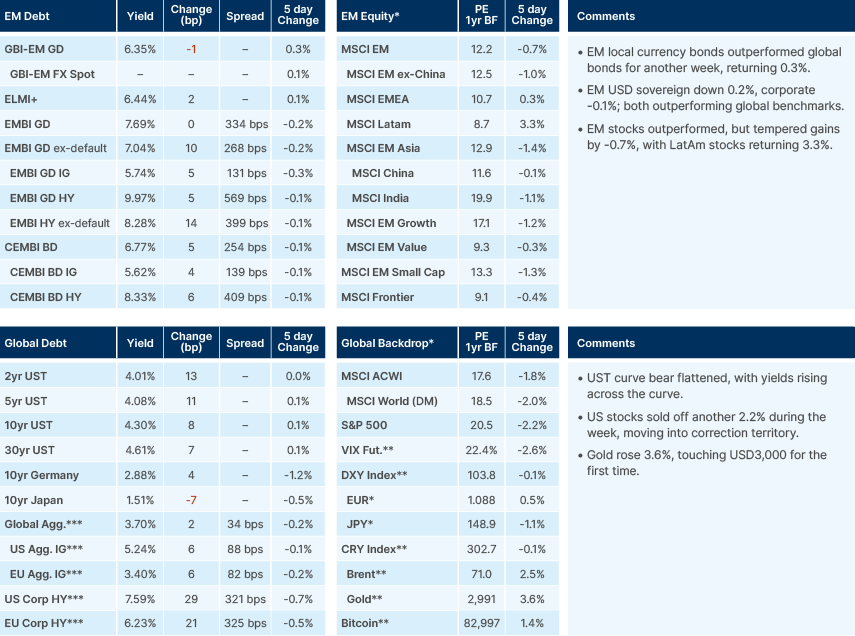

Last week performance and comments

Global Macro

After a 2% recovery on Friday, the S&P 500 was still down 2.2% last week, having slipped into technical correction (over 10% below recent highs). Gold passed USD 3,000 for the first time in the same week, illustrative of investors’ increasing nerves over stocks and bonds. However, US Treasury Secretary Scott Bessent was unphased. “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal. What’s not healthy is straight up” he told NBC News. "You get these euphoric markets. That's how you get a financial crisis. I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.” Bessent added the US needed to be weaned off “massive government spending.”

In our view, the main driver behind the recent market sell-off was the mismatch between overly optimistic valuations and underpriced negative risks in the US economy. Markets entered 2025 with excessive optimism, evident through elevated S&P valuations, historically high exposure of global investors to US equities, and substantial short positions on volatility by hedge funds. Such positioning left the market vulnerable to uncertainty and headline risks stemming from tariffs, immigration, government policy (DOGE) and geopolitics.

Despite this repricing of negative risks, we believe the DOGE initiative, while likely to slow US economic growth at the margin, will not be disruptive enough to trigger a recession. DOGE is powerful symbolically and is making notable cuts to the government payroll and other areas, however the substantial spending cuts will come through Congress, not through Elon Musk. Additionally, the most aggressive US tariff proposals are unlikely to materialise fully, with the strength of the Mexican peso (MXN) serving as an indicator that markets share this view and are looking through tariff-related noise. Geopolitical anxiety, particularly following the US withdrawal from its traditional stabilising role in Europe, also is contributing significantly to market concerns. However, Europe's policy response—particularly Germany's historic fiscal expansion following internal political shifts—is likely to drive stronger European growth. This increased European spending may ultimately help establish a more balanced and sustainable global equilibrium in the long term. China is also pushing through incremental fiscal stimulus with the leadership signalling more significant measures over the next months. The notable divergence between US and European/Chinese policy (fiscal restraint in the former and expansion in the latter) against a backdrop of very divergent asset prices and positioning (overextended in the US vs. light in Europe/China/EM) justified the price action and suggests more legs to come.

In short, while markets remain sensitive to short-term policy noise and geopolitical uncertainty, coincident economic indicators suggest underlying resilience. DOGE’s economic impact should remain moderate, extreme tariff scenarios (25+% tariffs on a broad range of goods from key trade partners) remain unlikely in our view, and still a negotiation mechanism. Europe's newfound fiscal initiatives could eventually offset some geopolitical concerns by fostering a healthier global balance of power.

Last week the US senate passed stopgap funding, preventing a government shutdown. The vote was 54-46 in favour as two Democrats joined all but one Republican for the measure. Senate Minority Leader Chuck Schumer said a shutdown would be worse than passing the six-month GOP bill, giving Donald Trump, Musk and DOGE more power to make government cuts freely.

Trump imposed a 25% tariff on global steel and aluminium imports, with no exemptions. This prompted retaliatory measures, with Canada announcing a 25% tariff on USD29.7bn worth of exports, with Finance Minister Dominic LeBlanc calling tariffs “completely unjustified, unfair and unreasonable.”

ECB

The European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said US crypto support was sowing the seed for a future financial shock. “Financial crises often originate in the United States and spread to the rest of the world. By encouraging crypto-assets and non-bank finance, the American administration is sowing the seeds of future upheavals.” Villeroy added that there was no risk of a banking crisis in the EU bloc. Separately, Villeroy said that the euro should take on a more important role internationally and that Europe needs to “build a powerful savings and investment union, capable of attracting international investors to our currency.”

ECB Vice-resident Luis Guindos said uncertainty is now higher than during Covid, given US policy. On the economy: “Wages have increased, inflation is declining, interest rates are coming down and financing conditions are better,” Guindos said. “But still, the reality is that consumption is not picking up…the possibility of a trade war or wider geopolitical conflict has an impact on consumer confidence.”

Geopolitics

The US and Ukraine agreed to a 30-day ceasefire proposal, aiming to de-escalate ongoing conflicts, with discussions involving Russia anticipated. Russia is yet to agree. Donald Trump says he and Vladimir Putin will discuss "land" and "power plants" when they hold Ukraine peace talks on Tuesday. "We're already talking about that, dividing up certain assets," he says, and on the chances of ending the war, Trump says: "Maybe we can, maybe we can't. But I think we have a very good chance."

Oil prices rose USD2 per barrel after the US conducted airstrikes against Yemen's Houthi rebels in response to attacks on shipping routes.

Massive protests in Budapest and Belgrade yesterday. In Budapest, tens of thousands rallied against Prime Minister Viktor Orbán's 15-year rule, supporting the opposition Tisza Party led by Péter Magyar, who advocates for Hungary's integration into a strong Europe and challenges Orbán's stance against EU membership for Ukraine. Belgrade witnessed one of its largest ever anti-corruption rallies, with over 100k participants demanding accountability following a deadly train station canopy collapse in Novi Sad, attributed to government negligence and corruption. A common theme in both protests is public dissent against perceived corruption and authoritarianism, with demonstrators advocating for greater transparency, democratic reforms, and alignment with European standards.

Emerging Markets

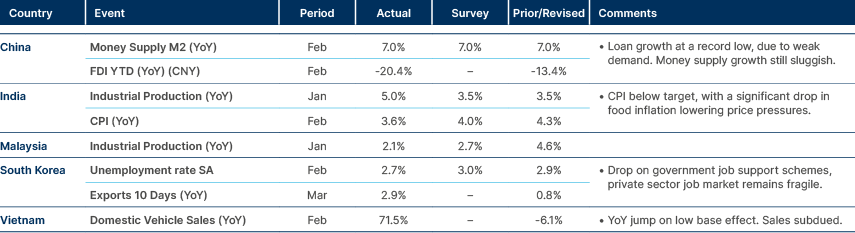

Asia

India’s CPI declined as industrial production rose.

China: Mixed start to 2025: Retail sales suggested a modest boost in consumer spending and industrial production was above consensus. However, the unemployment rate climbed to a two-year high at 5.4%, and the property sector struggles on, with real estate investment down 9.8% in the first two months.

The Chinese government unveiled a plan to "vigorously boost" domestic consumption, focusing on raising incomes, stabilising the housing and stock markets, and improving medical and pension services. This initiative aims to counteract weak consumer confidence and deflationary pressures in the economy. Additionally, ANZ revised its 2025 GDP growth forecast for China upward to 4.8% from 4.3%, citing positive momentum in the official economic data from the first two months of the year.

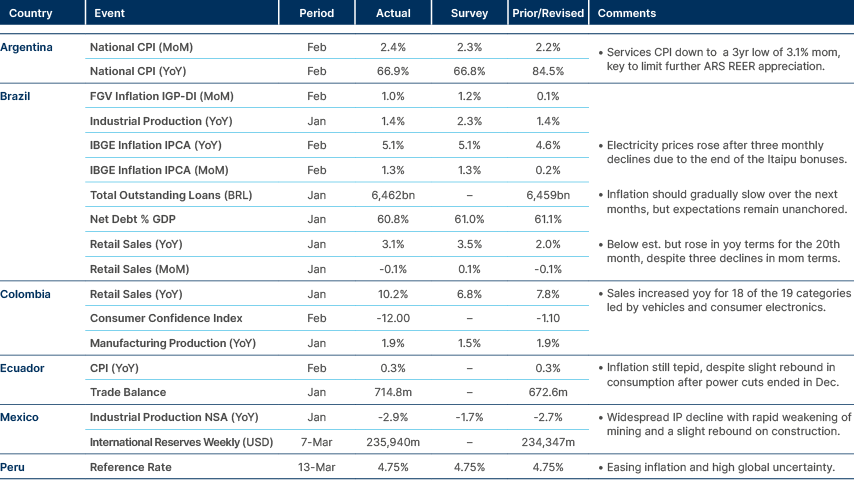

Latin America

Inflation still declining in Argentina.

Argentina: Ex-President Mauricio Macri restated his support of the government after large anti-austerity protests, particularly as pensioners’ payments have not matched inflation. The demonstration led by football ultras turned into a chaotic clash with the police. Macri said he suffered a similar orchestrated attack at the end of 2017 that failed to put an early end to his government, but still did immense damage. Macri said there is a clear modus operandi in which hired rioters attack the police with sticks and stones and then play victim once there is a proportional response. In other news, Rio Tinto said construction of USD 2.5bn lithium projects begins mid-2025. The first production is expected by 2028.

Brazil: President Lula said his income tax reform would be sent to Congress next Tuesday. The reform would raise the exemption threshold to incomes below BRL 5k. The plan is for lost revenue to be offset by higher tax for those earning above BRL 50k per month. Beyond the need to present credible revenue estimates, the government is also expected to face some challenges in Congress, as lawmakers have already signalled resistance to increasing taxes on higher-income earners.

Chile: Finance Minister Mario Marcel said the upcoming gross domestic product (GDP) reading for February will appear weaker than current market expectations. Analysts surveyed had anticipated a 1.0% year-over-year growth for February. However, Marcel noted that the market is underestimating the negative impact from two specific factors: the leap-year effect (an extra day in February 2024 inflating last year's baseline) and disruptions caused by the February 2025 blackout. February represents the peak of these negative calendar effects, but Marcel clarified that the overall calendar impact will turn positive for the remainder of 2025.

El Salvador: The opposition warned that El Salvador's agreement with the International Monetary Fund (IMF) is at risk due to ongoing Bitcoin purchases by the government. President Nayib Bukele has reaffirmed that the country will continue these Bitcoin acquisitions as part of its strategic reserves. However, IMF Communications Director Julie Kozack stated that the Salvadoran government had previously committed not to accumulate Bitcoins at the broader public sector level. Kozack also mentioned that Salvadoran authorities have confirmed their actions remain aligned with the conditionalities agreed upon in the IMF programme. The IMF is expected to further address this issue during scheduled quarterly reviews.

Mexico: Bank of Mexico Deputy Governor Omar Mejía said the central bank is factoring US tariffs into its monetary policy decisions. He described tariffs as a negotiating tool and questioned whether their impact would be lasting, noting that Mexico's official response is still uncertain. Mejía maintained an optimistic outlook, expecting the Mexican economy to grow in 2025 in line with the central bank’s GDP forecast of 0.6%.

Meanwhile, the Mexican government will delay retaliatory measures against US steel and aluminium tariffs until 2 April, opting instead to negotiate directly with the US administration. Meetings with the US Commerce Secretary are anticipated, although President Claudia Sheinbaum has warned that reciprocity will be applied.

In other news, nominal wages in Mexico rose 7.8% year-over-year in February, continuing a strong upward trend. This sustained growth in wages suggests that the fundamentals driving private consumption remain robust, potentially bolstering economic resilience.

Regarding Mexico’s Supreme Court, all leading candidates for the presidency of the court have ties to the ruling MORENA Party. Justice Yasmín Esquivel currently leads voting intentions with 15%, though her position is weakened by past allegations of thesis plagiarism—an issue that could resurface if she distances herself from the administration. Another loyalist, Lenia Batres, ranks second with 12%. A significant 38% of respondents have indicated either uncertainty or unwillingness to support any candidate.

Panama: Cobre Panama has signalled its willingness to suspend arbitration proceedings against the Panamanian government, directing its legal team to meet with government lawyers to find a mutually beneficial resolution. The company seeks an outcome favourable to workers, communities, suppliers, and the broader public. Previously, President Mulino authorised the removal of mineral material from the Donoso plant, stipulating that revenues from copper sales abroad must return to Panama.

In other news, Fitch Ratings warned that Panama could still lose its investment grade rating, indicating that the recent CSS (Caja de Seguro Social) reforms were insufficient. Senior Director Martínez explained that these reforms do not alleviate pressures on public finances, as they fail to reduce the operational deficit. Martínez noted that ongoing disruptive factors continue to negatively affect Panama’s credit profile and pose risks to its investment grade status.

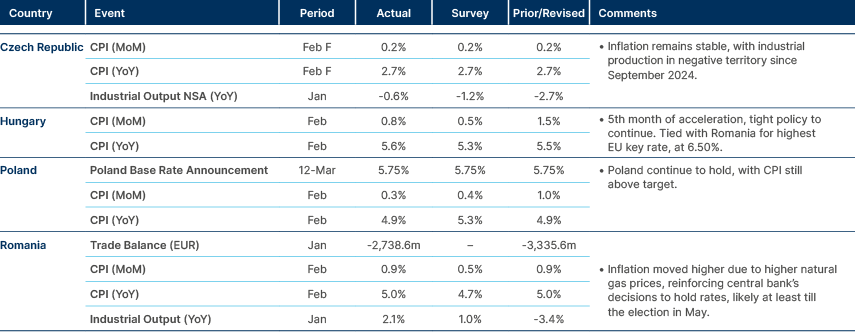

Central and Eastern Europe

Inflation remains elevated across CEE.

Romania: Moody's revised Romania outlook to negative from stable, and affirmed its Baa3 rating. “The decision to change the outlook to negative reflects the risk that in the absence of the adoption of additional fiscal consolidation measures, Romania's fiscal strength will significantly weaken in coming years. In our baseline scenario, we expect Romania's fiscal deficit will remain elevated at 7.7% of GDP in 2025 and only gradually improve thereafter, driving the government debt burden to 68.5% of GDP by 2028, while also significantly weakening the government's debt affordability metrics. In the absence of significant improvements to the fiscal outlook, these risks leaving Romania's overall credit profile materially weaker than Baa3-rated peers.”

Central Asia, Middle East, and Africa

Egypt CPI plunges.

Egypt: The IMF approved the fourth review of Egypt’s Extended Fund Facility (EFF) programme and endorsed a separate USD 1.3bn Resilience and Sustainability Facility (RSF). The approval of the fourth review releases a USD 1.2bn tranche, expected to arrive within days. The IMF acknowledged that Egypt maintained macroeconomic stability but highlighted mixed progress on structural reforms. The IMF also urged Egypt to enhance domestic revenue mobilisation, improve its business environment, accelerate divestments, and boost governance and transparency efforts.

Kenya: The IMF and Kenyan authorities have agreed that the ninth review under Kenya’s current EFF and Extended Credit Facility programmes will not proceed. IMF mission chief Haimanot Teferra confirmed this decision following a recent mission to Nairobi. Instead, the IMF and Kenya plan to discuss a new lending programme. Kenya’s existing IMF programme, launched in April 2021, is scheduled to expire next month. Its implementation has been challenged by violent anti-tax protests last year and disagreements over new borrowing from the United Arab Emirates (UAE).

Morocco: Manufacturing output growth slowed to 5.0% year-over-year in the fourth quarter of 2024. Meanwhile, extractive industries output increased by 9.2%, and electricity production rose by 6% during the same period. On an annual basis, extractive industries grew significantly by 21.0%, manufacturing expanded by 5.4%, and electricity production maintained positive growth.

Saudi Arabia: S&P upgraded Saudi Arabia’s credit rating to A+ from A, assigning a stable outlook. The ratings agency highlighted government measures designed to stimulate investment and consumption, supporting robust non-oil growth over the medium term. While expecting wider fiscal deficits partly due to lower oil revenues, S&P believes the recalibration of some large infrastructure spending will help maintain Saudi Arabia’s strong sovereign balance sheet and external financial position.

South Africa: In an unprecedented move, the US expelled South African Ambassador Ebrahim Rasool after US Secretary of State Marco Rubio labelled him a "race-baiting politician" and declared him “persona non grata”. The decision came after Rasool accused Trump of leveraging supremacist rhetoric for political support. South Africa’s presidency described the expulsion as regrettable but reaffirmed its commitment to maintaining positive relations with the US.

South Africa’s fiscal consolidation remains on track following a compromise budget. The ANC is trying to strike a compromise with its coalition party Democratic Alliance by moderating the proposed VAT increase to a cumulative 1% instead of the initial 2%. Fiscal consolidation continues to target a deficit of 3.3% of GDP, though now delayed by one year, expected to be reached in 2027/28. The budget allocates an additional ZAR 46.7bn toward critical infrastructure projects in the medium term, and funds wage increases and social relief of distress (SRD) grant adjustments. The budget projects achieving a primary surplus of 0.9% of GDP, stabilising public debt at 76.2% of GDP.

United Arab Emirates: GDP expanded by 3.8% year-over-year during the first nine months of 2024. Non-oil sectors continued to drive growth, now representing 75% of total GDP.

Türkiye: President Recep Tayyip Erdoğan urged US President Donald Trump to reconsider the sanctions imposed on Türkiye's defence industry. Erdoğan specifically requested the removal of CAATSA sanctions implemented in 2020 after Türkiye purchased Russia’s S-400 missile defence system. Erdoğan also expressed the expectation for Türkiye to be reinstated into the multinational F-35 fighter jet programme, from which Türkiye was excluded due to US security concerns. Additionally, Erdoğan asked Trump to finalise the sale of F-16 fighter jets to Türkiye and voiced support for Trump's mediation efforts in the Russia-Ukraine conflict.

Separately, the national statistics agency was issued with a court order to release withheld inflation basket data within 15 days. This decision will significantly impact pension adjustments for retirees, civil servants, and workers nationwide. Compliance with the court’s order could expose past discrepancies in inflation calculations, potentially requiring retrospective adjustments to pensions and wages. Non-compliance would further undermine investor and public trust. The order is positive for investors and individuals to regain trust in Türkiye’s key institutions.

Developed Markets

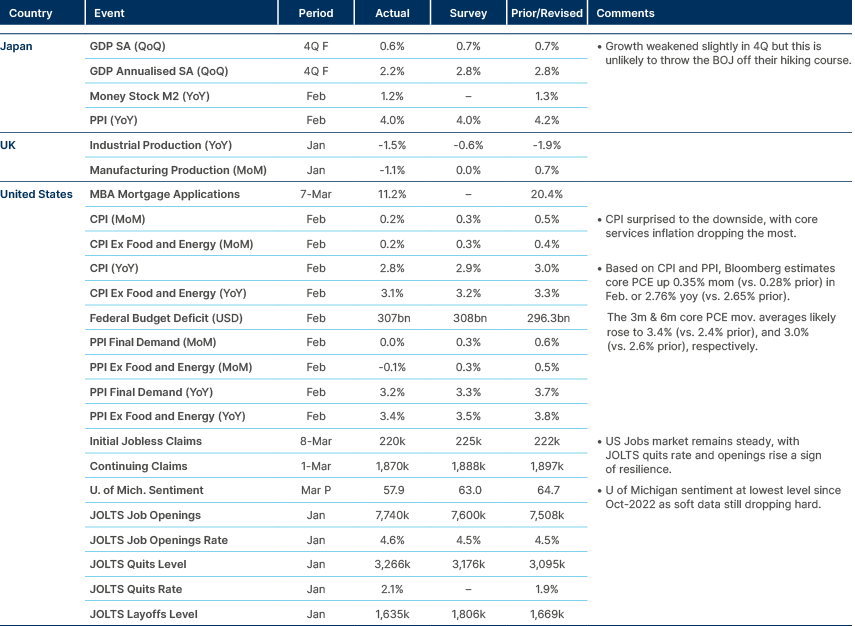

Softer US inflation, but details less encouraging.

France: Fitch affirmed France's sovereign credit rating at AA- with a negative outlook, noting a significant deterioration in the fiscal situation. France's budget deficit increased to 6.0% of GDP in 2024, substantially higher than the original target of 4.4%, and more than double the median for other AA-rated countries. Nearly two-thirds of this deficit increase compared to 2023 was led by government expenditure, despite achieving savings by phasing out pandemic-related spending. As a result, France's expenditure-to-GDP ratio rose to 57.4%, the highest among both AA-rated and eurozone sovereigns. Key factors driving this growth included inflation-indexed social spending, increased local government expenditures, and higher interest payments. Meanwhile, tax revenues rebounded less strongly than anticipated. Fitch notes that France's revised 2025 budget includes only modest fiscal consolidation, projecting a deficit reduction to 5.5% of GDP in 2025, mainly due to lower economic growth forecasts (0.6% instead of the previously expected 0.9%).

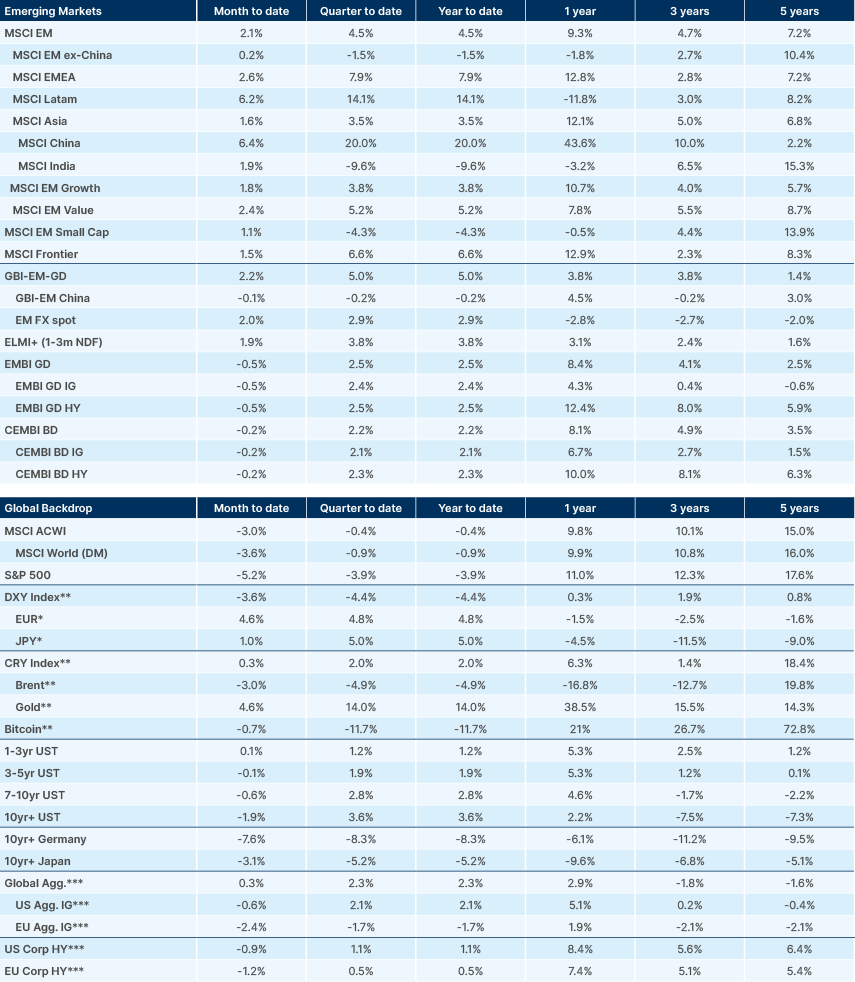

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.