- Weak US payrolls all but assures a September rate cut. The US10Y is flirting with 4.0%.

- US Senate expected to confirm Stephen Miran as a temporary Fed Chair, but he will take a leave of absence from his White House role during his tenure.

- French PM Bayrou expected to be ousted after today’s non-confidence vote.

- Japanese PM Ishiba resigned after two poor election outcomes over the past year.

- China’s WWII parade showcased advanced weapons with global leaders in attendance.

- Argentina’s midterm elections in Buenos Aires a setback for Milei.

- OPEC+ agrees in principle to increase production by 137k b/d in October.

- Pro-Bolsonaro protests drew 40,000 in São Paulo.

- Poland’s central bank cut policy rates by 25bps.

- Nigeria’s on-oil revenue rose 41% yoy to NGN 20.6trn (Jan–Aug).

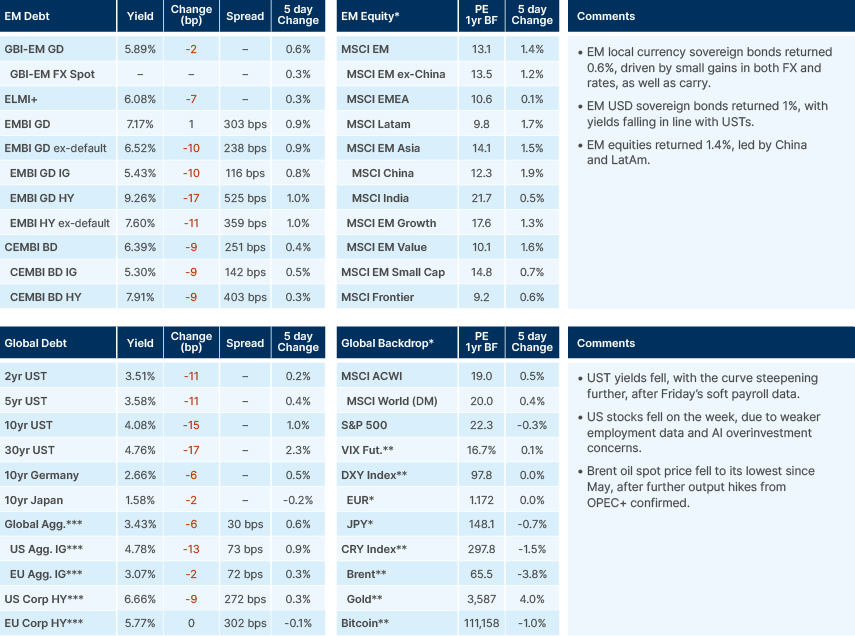

Last week performance and comments

Global Macro

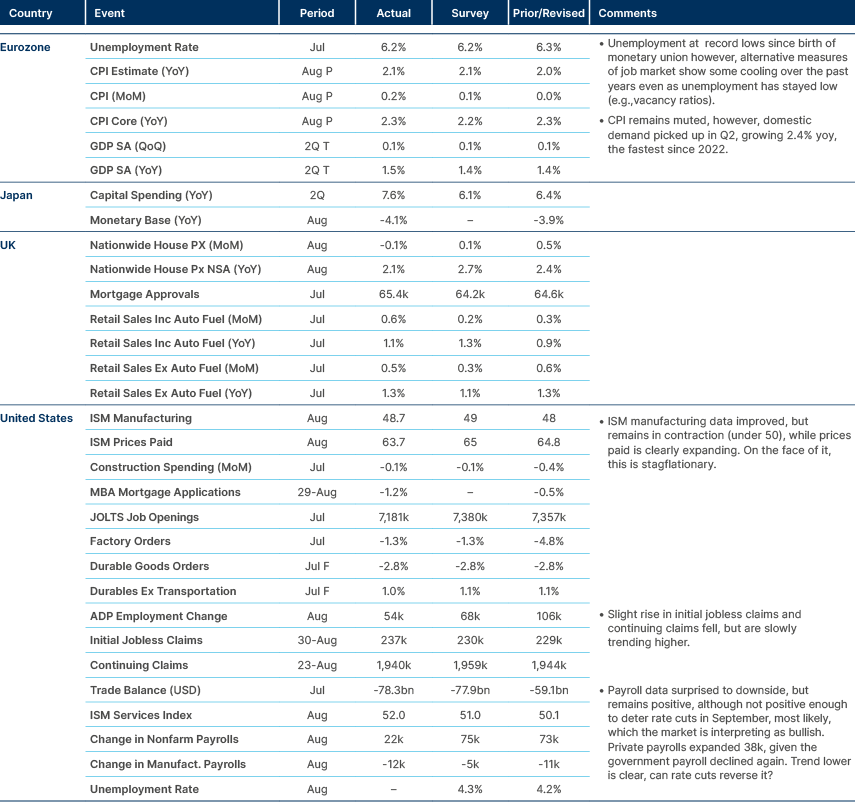

In a somewhat eerie echo of last year, market participants are discussing the possibility of a 50 basis points (bps) ‘insurance’ rate cut by the US Federal Reserve (Fed) in September, after weakening jobs market data stoked fears of an impending recession. This time, US non-farm payrolls look much worse. The US payroll added only 22k jobs in September (vs 240k last September), and revisions have brought previous readings lower, with June’s payroll now at -13k. The weakening jobs market data has led to a drop in US10Y treasury yields to close to 4.05%, at the time of writing. Looking back, US 10Y yields fell too in early September last year, before a bumper 50bp cut reignited animal spirits and led to a rapid move higher over the next two months. A 50bp cut looks unlikely from here, but bond investors will still be asking themselves whether this time will be different.

While non-farm payrolls are getting worse, the unemployment rate remains low, having risen to 4.3% in August. This is just 10bps higher than last August, when it hit 4.20%, a 50bps rise from its previous 12-month low and triggered the ‘Sahm Rule,’ a recession indicator. All this tells a simple story, in our view. US labour demand is weakening, but so is labour supply. Part of this is likely due to the decline in net migration under President Donald Trump, with many migrant employees having left the workforce over the summer. The lack of firings and tepid, but stable wage growth suggests there is not a major demand/supply imbalance in the labour market yet, but both factors are playing a role in determining its current temperature.

This demographic factor, along with a deterioration in data quality this year (evident in the size of revisions), suggests investors should take non-farm payroll numbers with a pinch of salt. Nevertheless, the downward trend in the labour market is relatively clear, and a 25bps cut in September looks all but assured – given the minority of Fed members still expressing hawkish views – unless very hot inflation data this week changes the picture. Markets are now pricing just under three 25bps cuts by December, and three more in 2026, with a terminal rate of 3.00%.

Senate Banking, Housing, and Urban Affairs Committee hearing determined that Stephen Miran may proceed with his nomination to the Fed Board, but only to complete Adriana Kugler’s term ending 31 January 2026, due to his conflict of interest as a de-facto employee of Trump. Therefore, during this period, he will take unpaid leave from his White House role to avoid a conflict of interest. Miran is currently the Chairman of the Council of Economic Advisors, who work with the executive branch. As Senator Jack Reed said: “You are going to be technically an employee of the President, but an independent member of the Fed Board – that’s ridiculous.” The final hurdle is a full Senate vote, which, given the Republican majority and expedited process, is expected to pass without frictions, probably in time for Miran to vote in the Federal Open Market Committee meeting on 16–17 September.

The fate of Governor Lisa Cook’s position on the Fed Board remains unclear. A recent Supreme Court ruling decreed the Fed is exempt from the “unitary-executive doctrine”, whereby the president can dismiss officials at will. Why the Fed was considered exempt was not made obvious. If the Fed’s exception to the unitary executive doctrine is fragile, Cook could still lose her case, eroding central bank independence. Alternatively, a broader interpretation supporting Fed autonomy could safeguard it. A third scenario, where any allegation (such as mortgage fraud) could count as "cause," especially if the Supreme Court defers to the president’s judgment, would effectively allow at-will dismissal from here forward. Wharton’s Peter Conti-Brown, an economic-historian author specialising in Fed independence, warns that if “for-cause” means anything the president deems appropriate, that equates to lawless dismissal powers, undermining institutional credibility. In other words, central bankers could be removed for virtually any reason.1

French Prime Minister François Bayrou is expected to be ousted after today’s no-confidence vote. President Emmanuel Macron has been courting the Socialists (PS) to assemble a workable minority, with PS leader Olivier Faure and compromise figures such as former Cour des comptes head Didier Migaud or ex-PM Bernard Cazeneuve seen as possible options. The key sticking point is fiscal consolidation. Bayrou’s package of EUR 43–44bn in cuts and taxes to target a 4.6% of GDP deficit in 2026 is unlikely to pass, with the outcome closer to 5.0%. The EU requires structural adjustment of 0.5% of GDP per year, while Bayrou’s plan implied c.1.4%. If a successor cannot secure passage of the 2026 finance bill by year-end, France could revert to ‘provisional twelfths’, operating month-to-month on the prior year’s budget and delaying consolidation.

Japanese Prime Minister Shigeru Ishiba resigned ahead of the Liberal Democratic Party (LDP) leadership vote after two poor election outcomes over the past year meant the loss of the party’s majority in congress. His replacement will be chosen in an emergency party vote on 4 October. Both LDP lawmakers and regional party representatives will cast ballots, with the winner requiring at least 50% of the combined votes. Whoever the next prime minister is, some fiscal easing is all but certain, as Ishiba had pledged an autumn fiscal package weighting cash handouts to help cushion consumers from the effects of inflation. Any successor is unlikely to renege on these pledges. Markets are nevertheless pricing looser monetary policy as a result of Ishiba’s departure, which is surprising. Stronger growth and elevated inflation still point to higher policy rates.

Geopolitics

China’s military parade marking the 80th anniversary of World War II highlighted new weapons, including laser systems, robotic ‘wolves’, and nuclear-capable underwater drones. Premier Xi Jinping was joined by Russia’s Vladimir Putin, North Korea’s Kim Jong Un, and Belarus’s Alexander Lukashenko, alongside leaders from Iran, Pakistan, Vietnam, and Zimbabwe. European attendees included Slovakia’s Robert Fico and Serbia’s Aleksandar Vučić, who posed with Putin after the event. Polish President Narol Nawrocki secured assurances from Trump that US troops will not withdraw from Poland, with the possibility of an expanded presence.

Commodities

OPEC+ agreed to raise output by 137k b/d from October, a smaller step than the large monthly increases seen through the summer. Since April the group has been steadily reversing past cuts, fully unwinding a 2.5mn b/d reduction and now beginning to roll back a second 1.65mn b/d tranche, well ahead of schedule. While the reduction in the pace of hikes in October reflects the softening outlook, the decision to still raise production underscores that OPEC+ is willing to prioritise market share and revenue, even at the risk of adding to oversupply.

Emerging Markets

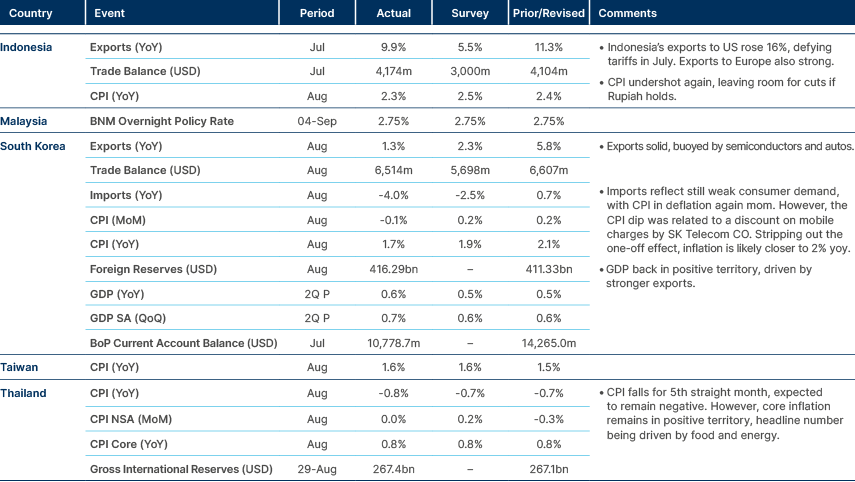

Asia

Soft inflation prints across Asia again.

Kazakhstan: Consumer price index (CPI) inflation accelerated to 12.2% yoy in August, and the National Bank of Kazakhstan warned that September data could prompt a rate hike. Governor Timur Suleimenov dismissed fears of overheating, highlighting a counter-cyclical 2026 budget that will lower spending to 15% of GDP and provide room for rate cuts if fiscal consolidation is credible. Parliament is targeting a deficit-free budget, capping National Fund transfers at KZT 2.77trn annually in 2026–28, while loosening dividend rules for the sovereign wealth fund Samruk-Kazyna.

Pakistan: Flooding in Punjab destroyed roughly 60% of the rice crop, 35% of cotton and 30% of sugarcane. Around 3.8m residents have already been evacuated, with Sindh bracing for a southern surge. The Pakistan Business Forum pressed Prime Minister Shehbaz Sharif for zero-interest farm credit and direct aid, while by-elections were postponed in affected areas. Losses threaten food security and GDP growth, and emergency relief spending could jeopardise fiscal targets ahead of the September International Monetary Fund (IMF) review.

Philippines: Gross foreign exchange (FX) reserves rose to USD 105.9bn in August, covering 7.2 months of imports and 3.4 times short-term external debt, supported by gold revaluation and investment income. The peso has been trading steadily at around 57, however Bangko Sentral ng Pilipinas reiterating that it does not target FX levels even as bets on Fed cuts build. The Monetary Board cut the policy rate 25bps in August to 5.0%. Governor Eli Remolona signalled further easing if demand cools, although food and electricity price risks remain. Inflation is projected at 1.7% in 2025, with July CPI inflation slowing to 0.9% yoy, though El Niño could add pressure to staples. The purchasing managers’ index (PMI) remained in expansionary territory at 50.8, highlighting manufacturing resilience despite global headwinds.

South Korea: The government announced a KRW 284trn relief package to offset the impact of US tariffs, including KRW 270trn in export-credit insurance and KRW 13.6trn in Korea Development Bank loans. Loan caps were raised ten-fold and rates cut by 30bps, targeting SMEs and hard-hit steel and aluminium exporters. The measures were framed as job-protection ahead of the 2026 elections. FX reserves rose 1.2% m/m to USD 416bn, the first yoy gain since October 2024, supported by forex-asset and SDR valuation gains, providing stability for the Won as tariff volatility persists.

Thailand: FX reserves rose USD 5.5bn to USD 267bn, aided by forex inflows and gold revaluation, while the net forward position increased to USD 23bn. Added liquidity steadied the Baht around THB 32, providing a buffer against political uncertainty. The opposition People’s Party offered conditional support to Anutin Charnvirakul’s Bhumjaithai Party for a four-month minority government, demanding quick dissolution and new elections. The likely outcome is legislative gridlock except for urgent budget and flood-relief bills, with early-election dynamics hinging on rural support retention.

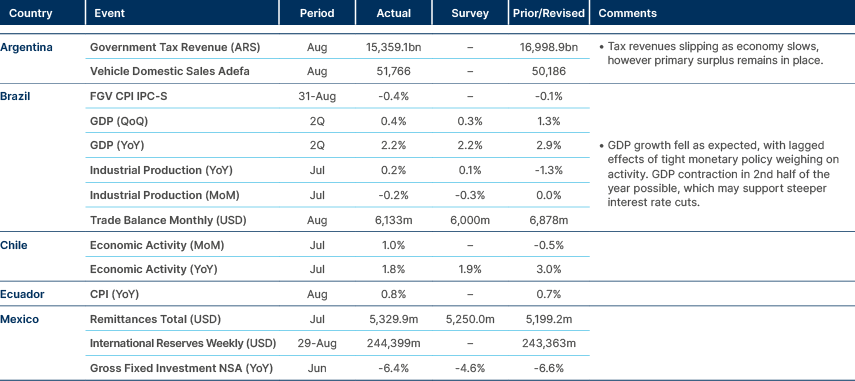

Latin America

Politics trumping the data with Milei’s defeat in Argentina and pro-Bolsonaro protests in Brazil.

Argentina: Midterm elections in Buenos Aires were a setback for the government, with the Peronist opposition securing 47% of the vote versus 34% for President Javier Milei’s La Libertad Avanza, with 91% of ballots counted. Milei acknowledged a clear defeat and pledged a “deep self-critique,” but vowed not to deviate from his fiscal and monetary strategy. Ahead of the vote, consensus 2025 growth forecasts were cut to 4.4% following data revisions, tight monetary policy and market jitters, with inflation breakevens holding near 40%. The Treasury spent USD 1.7bn to defend the Peso below ARS 1,468, highlighting limited reserves and the ‘REER-first’ approach (Real Effective Exchange Rate)BCRA Vice Governor Werning indicated reserve rebuilding will wait until sovereign market access resumes, arguing a strong real exchange rate helps anchor inflation. Congress overrode Milei’s veto to expand disability pensions, the first democratic-era veto reversal, adding 0.5% of GDP to spending and straining surplus targets. The provincial election was seen as a proxy for October midterms, with La Libertad Avanza needing a narrow loss to calm markets and limit downside risk.

Brazil: Q2 GDP slowed to 2.2% yoy as investment fell 2.2% qoq under the weight of higher Selic rates. Household consumption remained supported by wages and transfers but showed signs of softening. Producer prices dropped 1.4% yoy in July, the sixth consecutive monthly decline, reinforcing the Banco Central do Brasil’s decision to hold rates. Political uncertainty grew as União Brasil and the Progressive Party (105 seats) exited Lula’s coalition, narrowing his legislative base and backing São Paulo governor Tarcísio de Freitas for 2026. The right revived efforts to grant amnesty to 8 January rioters and Bolsonaro, with Lula leaning on the Senate and Supreme Court to block. Pro-Bolsonaro protests drew 40,000 in São Paulo, larger than last year, but smaller than mobilisations during his presidency. Governor Tarcísio de Freitas publicly endorsed the amnesty bill, increasing his political exposure as a centrist candidate. Bolsonaro faces a coup trial that could extend his political ban beyond 2030 and strain ties with the US. Banco Central Governor Gabriel Galípolo defended central bank autonomy as a bill allowing Congress to dismiss directors stalled.

Chile: President Gabriel Boric’s approval rating was stable at 32% in August, remaining within a 28–35% range. Concerns over crime, corruption and weak growth have constrained political space for new fiscal or pension reforms.

Colombia: Tax revenues through July reached COP 179trn, around 19% of annual collections, supported by withholding and enforcement actions, though compliance gaps remain. Net public debt rose to 60.7% of GDP. Despite this, sovereign spreads compressed 80bps relative to Brazil, which the Treasury celebrated but analysts questioned as unsustainable. The government presented a new 2026 tax reform aiming to raise 4% of GDP through a higher personal income tax top rate of 41%, a levy on extractive industries, broader VAT coverage, a carbon tax escalator and a temporary wealth-normalisation scheme. Critics warned of inflationary effects, weaker investment and rising pre-election fiscal risks.

Ecuador: A referendum scheduled for 30 November will ask voters to approve the deployment of foreign troops in anti-narcotics operations, with the port of Manta identified as a potential base. US Senator Marco Rubio signalled support, while designating the Los Choneros and Lobos gangs as foreign terrorist organisations to choke financing. The security crisis remains central to President Daniel Noboa’s political strategy, and the referendum outcome could reshape sovereignty and defence policy.

Mexico: Petróleos Mexicanos launched a USD 9.9bn buyback of bonds maturing in 2026–29, financed by recent sovereign pre-capitalisation issuance. Fitch raised its rating from ‘B+’ to ‘BB’, while Moody’s placed the company under review for a possible upgrade. Analysts noted that continued sovereign support or an upgrade could move Pemex closer to ‘BB+’ or higher. President Claudia Sheinbaum is weighing tariffs on non-FTA imports, including from China, echoing US pressure and raising risks for competitiveness and inflation. Banco de México Deputy Governor Heath criticised CPI inflation forecasts as “naïve,” urging caution before rate cuts, though most board members still lean toward easing in September.

Venezuela: The US deployed four navy warships to waters off Venezuela to counter drug cartel activity. Venezuelan armed forces were ordered to reinforce the Colombian border and deploy large vessels in territorial waters.

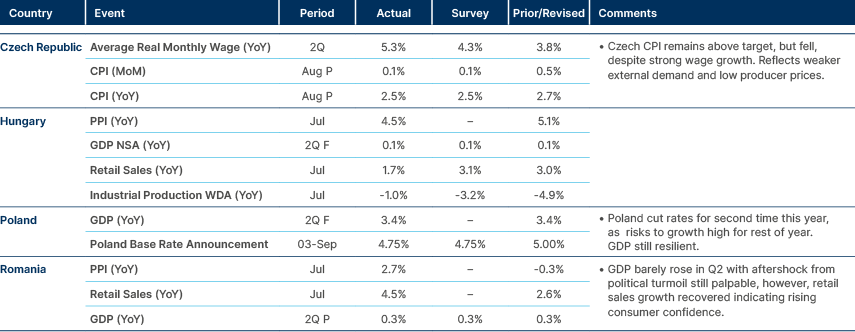

Central and Eastern Europe

Poland cut policy rates.

Poland: The central bank cut policy rates, securing a 25bps reduction in September as inflation slowed to 2.8% in July, below consensus of 3.1% but still just above the 2.5% target. Political tensions grew as President Nawrocki clashed with Prime Minister Donald Tusk over fiscal and investment policy. Nawrocki vowed to veto tax increases despite the widening deficit, raising risks of policy gridlock and undermining consolidation efforts.

Middle East and Africa

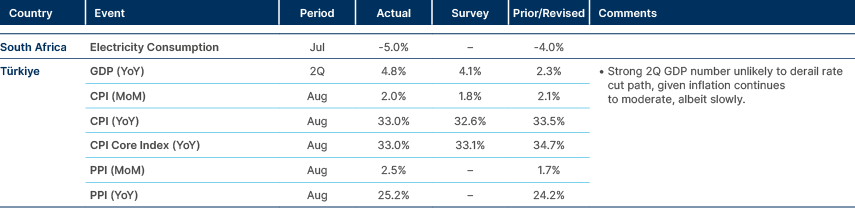

CPI a tad higher in Türkiye.

Türkiye: Consumer inflation ticked higher, keeping pressure on the Central Bank of the Republic of Türkiye even as GDP growth accelerated to 4.8% in Q2 from 2.3% in Q1. The government announced the termination of the costly FX-protected deposit scheme (KKM), with new accounts barred from 23 August. Existing deposits will be allowed to mature, with USD 11bn still outstanding, including a USD 4bn redemption in October. The scheme, introduced in 2021, created a fiscal burden of roughly USD 60bn. The trade deficit narrowed 11% yoy to USD 6.4bn in July, with exports concentrated in manufactured goods and defence products.

Nigeria: Non-oil revenue rose 41% yoy to NGN 20.6trn in January–August, making up 76% of total revenue and supporting claims of diversification. President Bola Tinubu declared the 2025 revenue goal achieved early, presenting it as evidence of fiscal resilience against US tariffs, though analysts highlighted doubts given weak oil output and slow tax reform. Foreign equity flows turned negative in July, with inflows falling 31% m/m and outflows rising 44%, leaving domestic investors accounting for 92% of exchange turnover.

Oman: Plans were finalised for a fourth liquified natural gas (LNG) train at Qalhat, which will increase capacity by 33% to 3.8 metric tonnes per annum by 2029. A final investment decision is expected in early 2026. State company OQEP has aligned Block 61 as feed gas, and interest from Engineering Procurement and Construction (EPC) contractors is strong.

Qatar: The Qatar Investment Authority invested USD 13bn in artificial intelligence (AI) firm Anthropic’s latest funding round at a valuation of USD 183bn. The move is part of Qatar’s strategy to diversify into high-growth technology sectors and expand AI exposure.

South Africa: FX reserves rose USD 1.26bn in August to USD 70.4bn, the highest since 2023. The increase was driven by a EUR 500m World Bank loan and higher gold prices, lifting the liquidity cushion to USD 65.9bn.

Zambia: Former Treasury Chief Fredson Yamba and ex-minister Joseph Malanji were convicted of illicit transfers totalling K 108m linked to luxury aircraft purchases, with sentencing pending. Opposition politician Bowman Lusambo received a second three-year prison term on corruption charges. Critics view the prosecutions as politically motivated, but the cases highlight the government’s anti-corruption campaign, which is closely watched by the IMF and creditors during restructuring.

Developed Markets

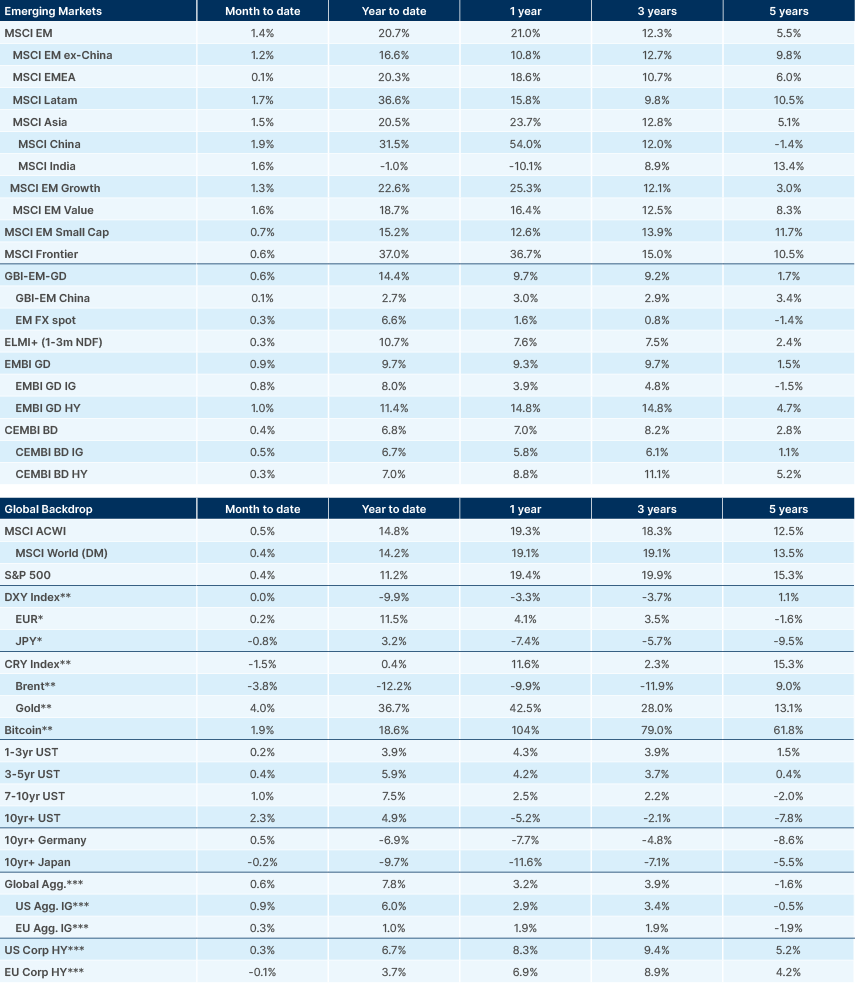

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See - https://www.ft.com/content/50c3c073-3bed-455e-a8d2-ccde8b55792a