- Trump’s softer stance on China tariffs and U-turn on firing Powell led to a re-pricing of policy risk for US assets.

- EM assets continued to deliver strong positive returns across the board.

- The IMF updated its World Economic Outlook forecasts. It cut global 2025 GDP growth by 50bps to 2.8%, but the DM vs EM growth differential widened.

- Kazakhstan indicated it will prioritise national interests over OPEC+ commitments.

- An Indian retaliation to Pakistan is expected after a terrorist attack on civilians in Kashmir last week. Trump condemned Putin’s continued strikes on Ukraine on social media.

- The IMF suspended Colombia’s flexible credit line on fiscal concerns.

- Hungary’s government was accused of unlawfully subsidising pro-government media.

- South Africa’s Finance Minister cancelled the controversial VAT increase.

- ECB Governor Rehn said if inflation develops as expected, the ECB should keep cutting rates.

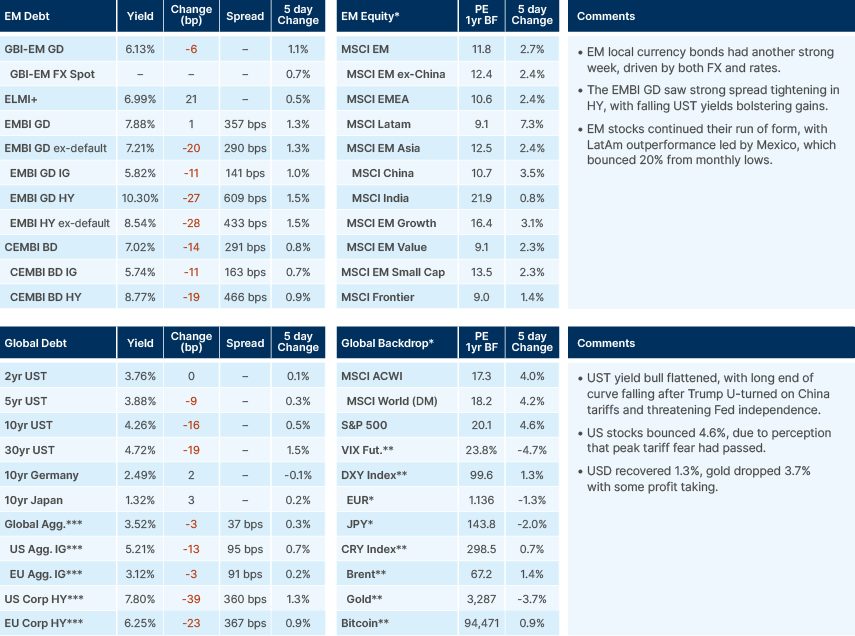

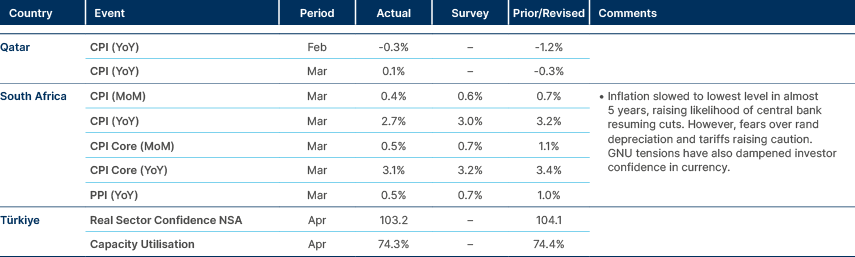

Last week performance and comments

Global Macro

Risk assets performed well last week, after US President Donald Trump U-turned on his wish to fire Federal Reserve (Fed) Chair Jerome Powell, and indicated willingness to lower tariffs on China. The change in stance reportedly came after Bessent explained to the president that the FOMC would be unlikely to change their policy even with Powell gone. The S&P 500 rose 4.6% and is now back to the level it was a year ago. US Treasury (UST) long end yields dropped despite strong economic data as some policy risk was priced out of the market. Systematic flows and technicals suggests the rebound can have a few more legs, as certain assets, including US stocks, had become oversold in the short term. Retail investors' inflows are currently dominating price action.

The fundamentals behind the rebound on US equitiesare questionable at best. The Wall Street Journal reported Trump’s aides were considering the destination for Chinese tariffs to be 60-65%, with 35% on ‘non-strategic’ sectors, and 100% for sectors relevant for national security. Up until 2 April, this was deemed the worst-case scenario and could still have a strong impact on activity and inflation when combined with relatively high baseline tariffs. US Treasury Secretary Scott Bessent affirmed last week that China is the primary target for the tariffs, which seek to instigate a long-term rebalancing of Chinese/US and even global trade dynamics. This won’t come without significant economic friction. Bilateral trade between the US and China is already declining substantially with container ship tonnage from China to the US already dropped some 50%, whilst Chinese energy buyers have now totally suspended imports of liquified natural gas (LNG) from the US.

Regardless of where tariffs eventually end up, prolonged US policy uncertainty – and the administration’s protectionist impulses – have created a paradigm that market participants now accept as a likely environment for a long-term dollar decline due to rebalancing flows away from US assets. We have been pointing to this likelihood since 2024. The real value of the dollar is still nearly two standard deviations above its average since Bretton Woods ended in 1974, so this move has much further to run as we continue to highlight. Jan Haztius, the Chief Economist at Goldman Sachs, noted last week that the two historical periods with similar dollar valuation levels were the mid-1980s and early 2000s, which both saw depreciations of 25-30%. 1

The International Monetary Fund (IMF) updated its World Economic Outlook forecasts. Global gross domestic product (GDP) growth for 2025 was cut by 50bps to 2.8%, and 2026 downgraded 30bps to 3.0%. The US suffered a particularly sharp downgrade of 90bps to 1.8%. Mexico's outlook had a 170bps downgrade, projecting a contraction of 0.3%. Europe hasn’t been affected as severely, but Germany was downgraded by 30bps to zero growth following two annual contractions in 2023 and 2024. The IMF always updates the sell-side forecasts after the Wall Street banks revise theirs, and penned-in lower growth in the US and better growth in emerging markets (EM), particularly EM ex-China, thus widening the expected growth differential between the developed and emerging world.

Commodities

Oil turned lower after Kazakhstan said it will prioritise national interests over output limits agreed with the OPEC+ alliance, a move that risks fuelling further tensions within the cartel. Reuters reported Kazakhstan’s newly-appointed Energy Minister Erlan Akkenzhenov said the country is unable to reduce production at its three largest projects as they are controlled by international oil majors. Brent crude futures lost as much as 1.5%, dipping below USD 67.

Geopolitics

Russia/Ukraine

“I am not happy with the Russian strikes on KYIV,” Trump wrote on his Truth Social platform on Thursday. “Not necessary, and very bad timing. Vladimir, STOP! 5,000 soldiers a week are dying. Let’s get the Peace Deal DONE!” Trump’s comments came after Russia’s deadliest and largest bombardment of the Ukrainian capital in months, which killed at least 12 people and injured more than 90 others.

Emerging Markets

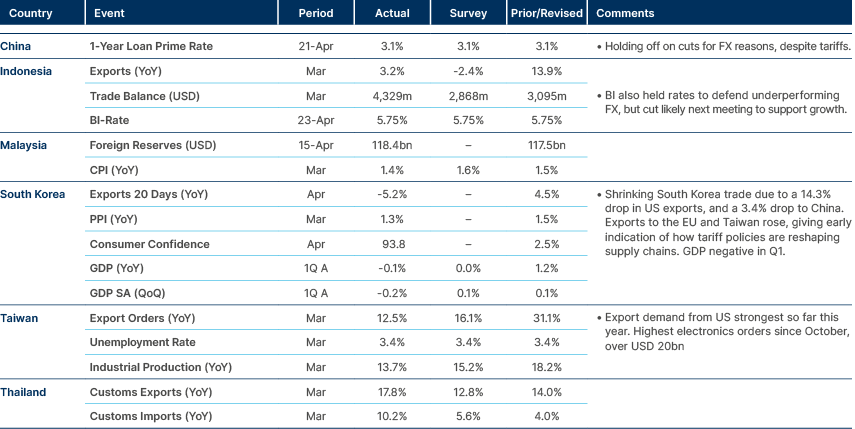

Asia

India/Pakistan: Tensions between India and Pakistan escalated sharply after a terrorist attack in Kashmir killed 27 civilians. Two of three suspects in the massacre are Pakistani nationals, with police identifying them as part of militant group LeT, killed 175 people in Mumbai in 2008. Pakistan denied any link to the attacks and have indicated they will consider any Indian retaliation the first move. However, following a speech from Modi, it appears a retaliation from India is now likely. India have already banned entry of Pakistani nationals and have told all those currently holding visas in the country to leave within 48 hours. Pakistan closed its airspace to India’s airlines; said it would suspend a 1972 peace treaty. A retaliation from India could me a military strike on targets within Pakistan, or a diversion of shared river waters in the Indus basin. Pakistan have indicated that both would be considered ‘an act of war.’ A disruption of water supply to southern Pakistan could have a severe impact on agriculture, as this river is the primary water source for the country’s irrigation system for crops. In the past, these conflicts have de-escalated after India retaliated in kind with strikes. However, India’s geopolitical position and political considerations may bring a more meaningful escalation.

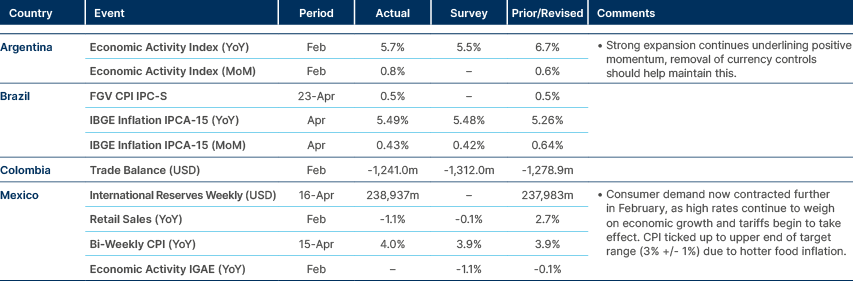

Latin America

Chile: Chile is working to diversify its export markets due to the economic risks posed by the ongoing US-China tariff war. Currently, 37% of Chile's exports go to China and 16% to the US, making it heavily exposed to the trade tensions. President Gabriel Boric visited Brazil with a high-level business delegation to strengthen bilateral investment ties.

Colombia: The IMF suspended Colombia’s USD 8.4bn Flexible Credit Line (FCL) on Saturday, citing a lack of action to control its rising public deficit and debt, which have exceeded expectations. “Colombia’s continued qualification for the FCL is contingent on the completion of both the ongoing Article IV consultation and a subsequent FCL mid-term review,” said IMF Communications Director Julie Kozack.

The suspension raises the risk premium on Colombian assets and increases the likelihood of a sovereign credit rating downgrade. Colombia currently holds an investment-grade local currency rating (BBB- by S&P), and its foreign currency rating stands at BB+ with a negative outlook. Moody’s rates Colombia Baa2 (negative), while Fitch assigns a BB+ (negative) rating. President Gustavo Petro posted a cryptic message on X following the news, translated as, “the vampires are coming, but vampires disappear before the Sun”.

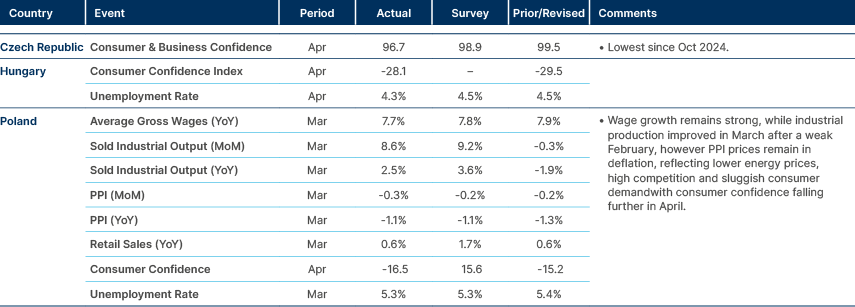

Central and Eastern Europe

Hungary: Viktor Orbán’s government is being accused of handing more than EUR 1bn in unlawful subsidies to pro-government media, adding to concerns that state support is being used to bolster the Hungarian leader’s grip on power.

Two Hungarian media outlets, Magyar Hang (Hungarian Voice) and a second that has requested anonymity, told the FT they would lodge a complaint with the European Commission on Monday. Both claim advertising revenue was channelled to pro-Orbán newspapers, television stations and online platforms between 2015 and 2023 to ensure support for the ruling party and to crowd out critical journalism.

Central Asia, Middle East, and Africa

South Africa: On 24 April, Finance Minister Enoch Godongwana announced the cancellation of the government’s proposed value-added tax (VAT) increase, which the Democratic Alliance (DA) had strongly opposed, and which was set to take effect on 1 May. This leaves a ZAR 75bn budget shortfall over three years, demanding spending cuts to keep fiscal stability

The reversal was the result of political and public pressure and is possibly linked to a reconfigured Government of National Unity (GNU). Last week, a poll showed the DA ahead of the African National Congress (ANC) for the first time. This increases odds of the DA remaining in the GNU, which helps investor confidence. ActionSA also stated it would not join the GNU until the VAT hike is removed, indicating the decision to cancel the increase could be part of broader coalition negotiations. The ZAR has strengthened further in recent days, recovering most of its losses over the course of the month.

Türkiye: Forty seven individuals were detained last week, including senior municipal officials, as part of the ongoing corruption investigation on jailed Istanbul Mayor Ekrem Imamoglu. Those detained includes Imamoglu’s aide and brother-in-law Kadriye Kasapoglu and city hall officials.

Opposition figures suggested that the arrests are linked to resistance against the controversial Canal Istanbul project, a massive infrastructure initiative proposed by President Recep Tayyip Erdoğan in 2011. The canal aims to connect the Black Sea to the Sea of Marmara, alleviating traffic in the Bosphorus Strait. Environmentalists and urban planners have raised concerns about potential ecological damage, including risks to water resources and seismic stability. The project has also faced criticism for its financial viability and potential to bypass international maritime agreements.

Despite opposition, construction on the Canal Istanbul project has progressed, with new zoning plans and infrastructure developments underway. The government projects significant economic benefits from the canal, including increased shipping revenues and real estate development.

Developed Markets

European Union: European Central Bank (ECB) Governor Ollie Rehn said that if inflation develops as expected, the ECB should continue cutting interest rates. He noted that tariffs have a mixed effect on inflation. Governing Council member Simkus said the ECB should look past the temporary impact of tariffs and focus on medium-term growth. Chief Economist Philip Lane added that although trade tensions are weighing on the eurozone, a recession is unlikely. He emphasised the economy is still growing, just at a slightly slower pace.

Germany: Germany revised is growth forecast down to 0% this year, with its manufacturing sector expected to suffer from Trump’s trade wars. The German economy has been in recession for the last two years, with GDP 0.2% lower last year and 0.3% lower in 2023.

Germany’s reform of the ‘debt brake’ will unleash further debt-funded infrastructure, and defence spending, as well as tax subsidies for investment and deregulation. However, the effects will not be felt probably until 2026, with Trump’s tariffs a bigger issue in the near term.

United States: The US 10-year yield declined 16bps last week, in a bull flattening move, despite somewhat stronger-than-expected data following dovish Fedspeak.

Fed Governor Christopher Waller said he would “expect more rate cuts, and sooner, once I start seeing some serious deterioration in the labour market.” but caveated this was unlikely to materialise until after the 90-day pause expires in July. Cleveland Fed CEO Beth Hammack said “if we have clear and convincing data by June, then I think you’ll see the Committee move if we know the right way to move at that point.”

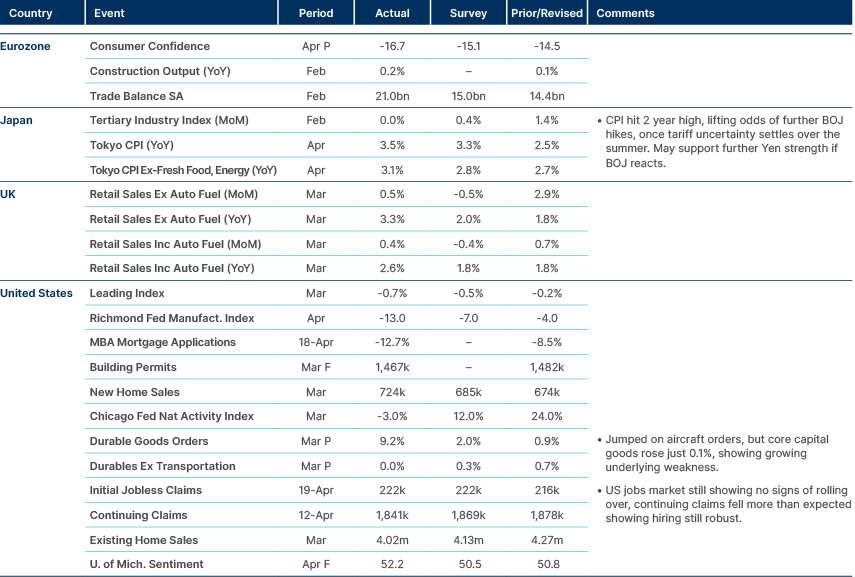

Durable goods orders surged 9.2% month-on-month in March (consensus: 2.0%), supported by the volatile aircraft segment, but importantly core capital goods orders rose just 0.1% (cons: 0.1%). The solid expansion in manufacturing output in the first quarter, boosted in part by front-loading ahead of tariff concerns, is likely to slow soon.

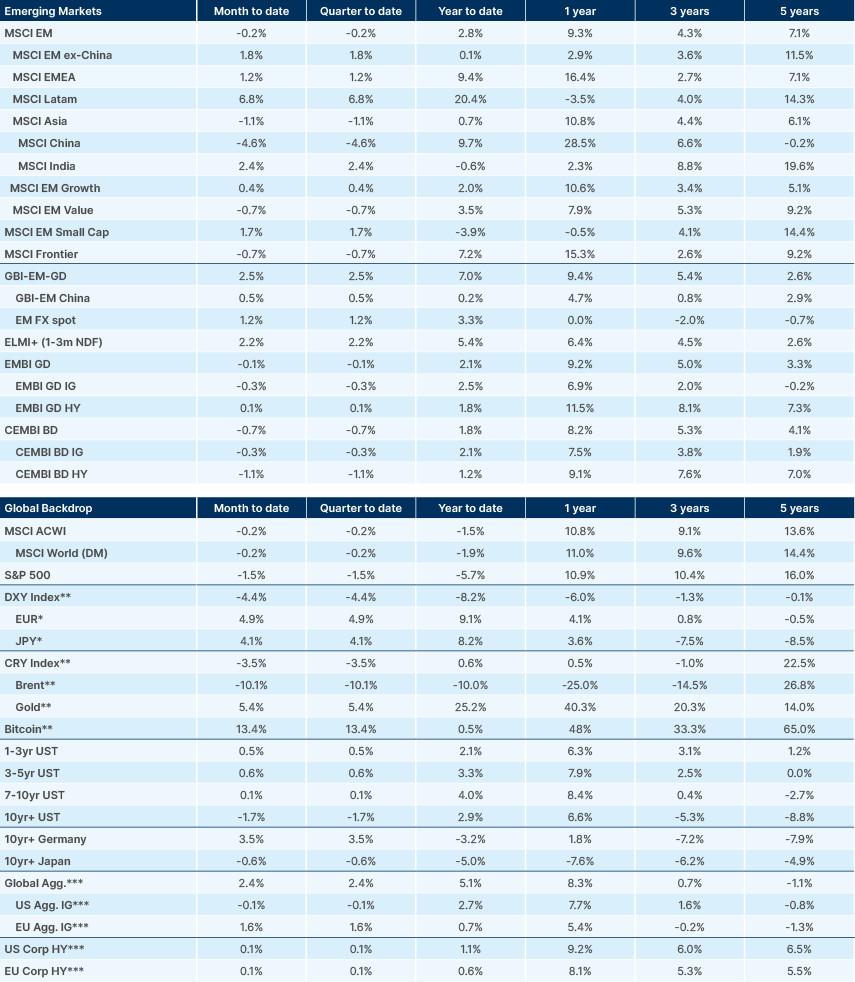

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.ft.com/content/976e2798-f9db-46c6-9582-fe237c572f28