- Uncertain over US reciprocal tariff due on 2 April remains, but recent news was more benign

- Investors rotation from the US in early stages after Germany approved a historical policy shift

- Türkiye intervened on TRY and tightened liquidity after political shock

- Argentina posted another budget surplus and Brazil hiked rates by 100bps

- Colombia replaced its finance minister as Petro struggles to pass his proposed legislation

- Kuwait is preparing to allow its banks to sell mortgages for the first time.

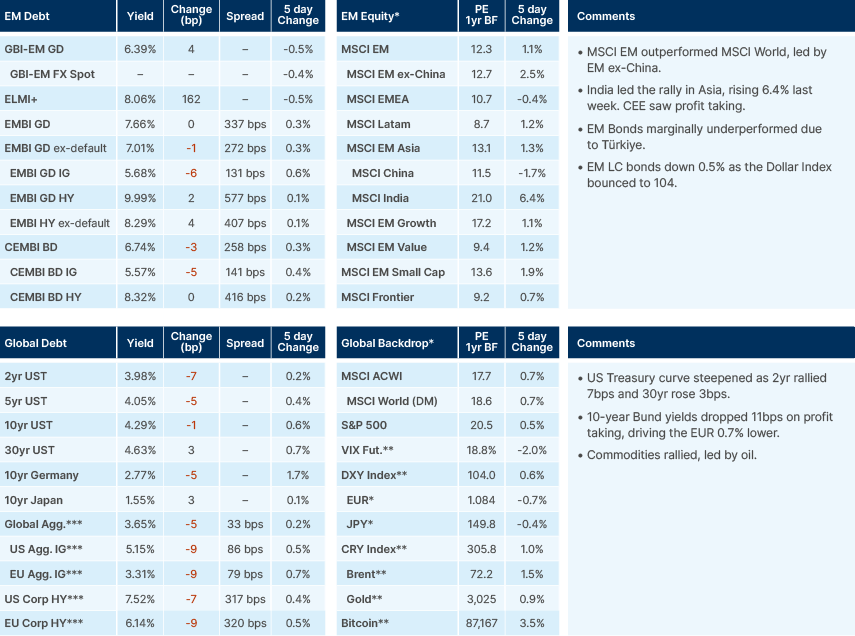

Last week performance and comments

Global Macro

Tariffs

A recent Wall Street Journal article suggests a more targeted approach by the US administration regarding tariffs, which has slightly reduced market concerns related to tariff risks. The countries identified as particularly vulnerable to reciprocal tariffs include Australia, Brazil, Canada, China, the European Union (EU), India, Japan, South Korea, Mexico, Russia, and Vietnam.

A Deutsche Bank survey of global fund managers showed 62% of respondents anticipate the Trump administration will adopt a softer stance on tariffs than initially pledged. Overall, we still believe moderate tariffs will stick, but that the threat of more aggressive tariffs will remain. This may keep investors jittery as the US tries to extract concessions towards trade rebalancing, reciprocity, and national security concerns.

The same survey showed the perceived risk of a US recession within the next year is estimated at 43%. This is close to the back-tested even odds of the likelihood of a recession following a 10% market correction. We believe the odds of a recession have increased given the rising uncertainty of economy policies, but think there is not enough disruption to drive an economic recession yet.

Another global fund manager survey, by Bank of America, highlighted the second-largest drop in global growth expectations on record, the largest-ever reduction in US equity positions, and the most substantial increase in cash holdings since March 2020. However, investor actions contrast with those sentiments, as evidenced by last week’s substantial inflows into global and US equities, marking the largest weekly inflows of 2025. Private clients at Bank of America also recorded significant stock purchases over the past two weeks. Despite recent global fund managers’ rebalancing, overall asset allocations to US equities remain substantial, suggesting investors remain sensitive to negative developments.

The Federal Open Market Committee (FOMC) struck a balanced tone at its latest meeting, and Federal Reserve (Fed) Chairman Jerome Powell’s remarks were taken as marginally “dovish”. For the Fed, a one-off price increase because of a tax hike (tariffs) is less of an important consideration than its implications for the full employment side of the mandate. The Fed would struggle to be symmetrical in its approach, in our view, as aggressive tariffs would have an impact on growth that would be commensurate with higher inflation. If aggressive tariffs are a bargaining mechanism, the additional monetary policy volatility from a hike would threaten a deeper recession, which would violate the Fed’s dual mandate.

Bank of Japan (BOJ) Governor Kazuo Ueda defended the central bank's quantitative easing policies in parliament, underscoring its commitment to achieving stable and sustainable inflation. These developments occur amid international scrutiny, with US President Donald Trump criticising Japan and China for currency devaluation practices, suggesting potential tariff implementations as a countermeasure.1

Deutsche Bank economists noted continued uncertainty over the scale and timing of Germany’s fiscal expansion. Growth forecasts indicate real gross domestic product (GDP) growth of 1.5% in 2026 and 2.0% in 2027, despite a downward revision of 2025 estimates by 20 basis points (bps) to 0.3%. Deutsche Bank anticipates the current growth driven by deficit spending will diminish post-2027, unless significant productivity-enhancing investments and structural reforms are enacted. For investors too concentrated in US assets, the fact that the US has negative growth drivers (fiscal tightening) while European growth accelerates over the next few years is likely to be the most important consideration. The effectiveness of Germany's economic reforms may become a key concern towards the second half of 2027.

In geopolitics, tensions escalated following renewed Israeli military operations in Gaza after a ceasefire collapse. The US government reaffirmed its support for Israel, highlighting efforts toward hostage release and securing freedom of navigation in the Red Sea. Additionally, diplomatic engagement between Trump and Russian President Vladimir Putin led to a 30-day limited ceasefire agreement in Ukraine, halting attacks on energy infrastructure, with discussions ongoing about a more extensive ceasefire arrangement.

In commodities, Brent crude oil prices rose 2.1% to USD 72.3 per barrel, reaching their highest level since late February, influenced by new US sanctions on a Chinese refinery accused of purchasing Iranian oil. This development indicates potentially stricter enforcement of US sanctions against Iran.

Emerging Markets

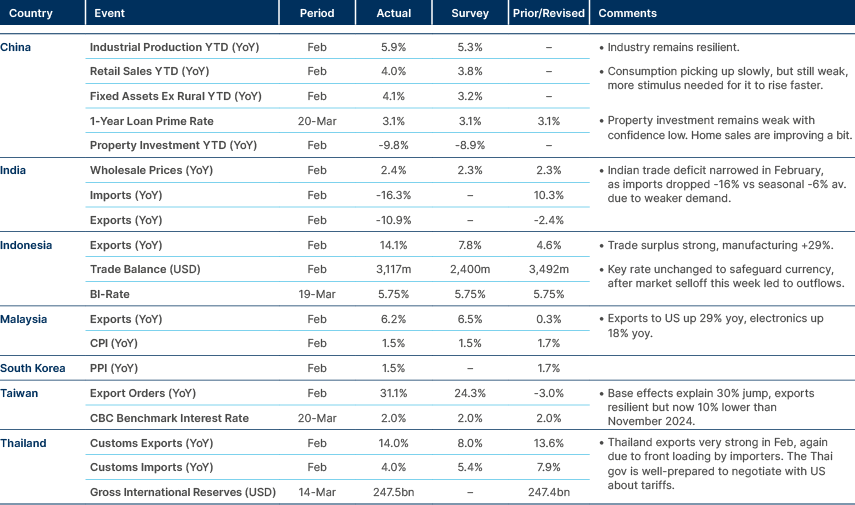

Asia

Indian trade deficit narrowed as liquidity remains tight despite solid equity bounce.

Korea: The first 20-day exports in March rose 4.5% yoy, broadly in line with the Jan-Feb data. Tech exports are expected to offer some buffer in the near term, particularly from memory chips. but non-tech exports are likely to remain weaker.

Taiwan: The defence budget will soon exceed 3% of GDP, up from 2.5% currently. Taiwan buys most of its cutting-edge weaponry from the US.

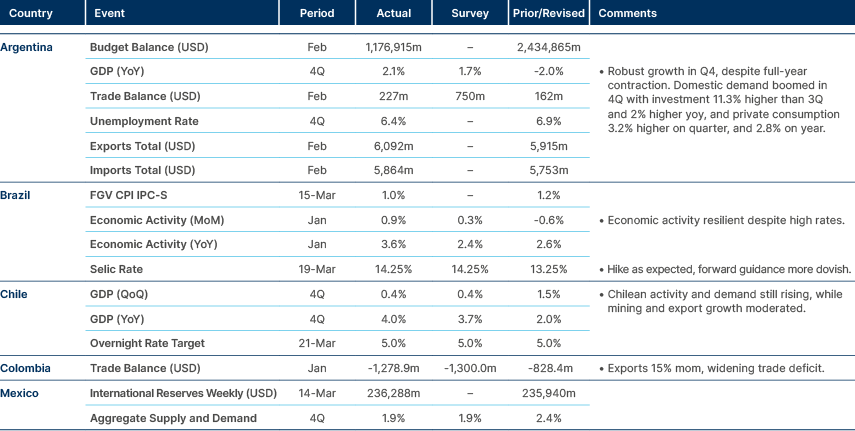

Latin America

Better than expected economic data in Argentina, Brazil, and Chile.

Argentina: Former President Cristina Fernández de Kirchner was banned from entering the US. The announcement provides her with political ammunition to rally supporters and counterattack domestically. However, increased polarisation may also benefit President Javier Milei, as it reduces Kirchner's capacity to reclaim influence, especially given the current economic recovery and rising purchasing power.

The country achieved another nominal surplus in February and maintained a primary surplus of 0.4% of GDP year-to-date. Despite this positive headline figure, spending growth of 16.5% has significantly outpaced revenue increases of 4.6% in real terms, driven mainly by higher provincial transfers, capital investment, and expanded social programmes. While future revenues face challenges from the elimination on purchases of foreign exchange (PAIS) tax and lower export duties, anticipated strength in VAT, income taxes, and social security contributions amid economic growth should enable the government to maintain a balanced budget this year.

Brazil: In March 2025, Brazil's central bank raised the Selic rate by 100bps to 14.25%, aligning with market expectations. Policymakers signalled a potential slowdown in future hikes, with markets anticipating a 50bps increase in May, suggesting the tightening cycle may be nearing its end. Last week, the government proposed exempting individuals earning up to BRL 5,000 per month (c. USD 881) from income tax, fulfilling a longstanding promise. The BRL remained stable following the announcement, as markets had largely anticipated the reform since its proposal in late 2024. The plan also requires congressional approval, and its full implementation as well as policies to compensate for lower taxes remain uncertain.

Colombia: After just three months in office, Finance Minister Diego Guevera submitted his resignation after his proposal to freeze COP 12bn in the national budget was turned down. This proposal came as strong spending pressure from the budgetary backlog left over from 2024 has continued into 2025, with the tax collection outlook for the year looking less favourable than reflected in the 2025 financial plan.

In a related development, President Gustavo Petro's proposed labour reform was recently rejected by a Senate committee, prompting him to announce plans for a national referendum on the matter. This referendum, intended to be held in April or May 2025, would allow voters to decide on the labour and healthcare reforms stalled in Congress. For the referendum's outcome to be binding, it requires the approval of Congress beforehand and must achieve participation from at least one-third of registered voters. The next general elections in Colombia are scheduled for May 2026, with any new administration taking office in August 2026.

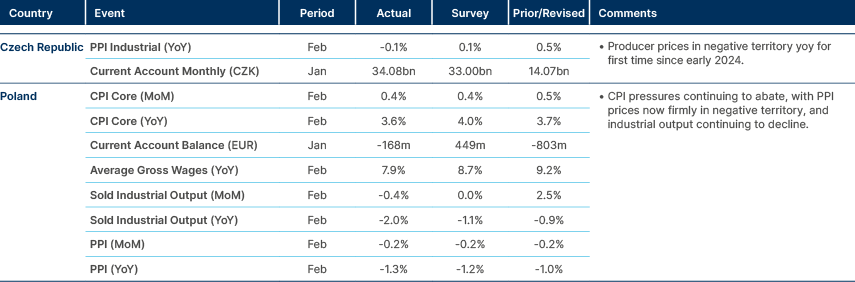

Central and Eastern Europe

Inflation softens in Czech and Poland

Central Asia, Middle East, and Africa

Inflation declining in Nigeria and South Africa.

Kuwait: The country is preparing to allow banks to sell mortgages for the first time. This change in regulation can unlock a market with a potential size of USD 65bn and could significantly improve Kuwaiti banks’ profitability. Until now, mortgages were not permitted due to concerns over the political consequences of foreclosures on homes. Instead, the government has a public housing scheme for married couples which offers highly-subsidised housing with a low interest loan. However, the system has become inefficient, with a backlog of around 100k requests which could have taken around a decade to fill.

Türkiye: In March 2025, Turkish authorities detained Istanbul Mayor Ekrem İmamoğlu at his residence, following the annulment of his university diploma, a move that potentially disqualifies him from contesting the 2028 presidential election. İmamoğlu, a prominent opposition figure, has been considered a leading challenger to President Recep Tayyip Erdoğan. In a voice message, İmamoğlu condemned the police action as politically motivated.

The detention sparked significant unrest across Turkey, with nearly a million demonstrators rallying in Istanbul and other cities to express support for İmamoğlu. These protests, reminiscent of the 2013 Gezi Park demonstrations, were largely peaceful, but underscore growing public frustration amid economic strains and perceived democratic erosion.

Financial markets reacted negatively to the political turmoil. The Turkish lira depreciated over 10% before stabilising, following interventions and assurances from Finance Minister Mehmet Şimşek that economic policies remain unchanged. The Central Bank of Turkey (CBT) responded by raising the overnight lending rate from 44% to 46%, while maintaining the one-week repo rate at 42.5% and the overnight borrowing rate at 41%. Additionally, the CBT suspended one-week repo auctions, effectively increasing the average cost of funding to 46%, and resumed Turkish lira-settled forward foreign exchange (FX) transactions to preserve reserves during heightened currency volatility.

Over the weekend, authorities implemented further measures to stabilise financial markets, including broadening the short-selling ban to encompass all listed companies and easing share buyback regulations. These steps aim to mitigate market volatility and reinforce investor confidence.

On Sunday, a court formally arrested İmamoğlu on corruption charges, though a request to detain him on terrorism-related charges was denied. The Istanbul municipality is set to hold internal elections to appoint a new mayor, with the opposition Republican People's Party (CHP) holding the majority. However, the Interior Ministry retains the authority to appoint a trustee to the mayoral position, depending on the progression of legal proceedings.

The CBT's net reserves are estimated at approximately USD 45bn, following a USD 12bn decline on Wednesday. Despite significant outflows and a reduction in foreign positions by c. 50%, the CBT's interventions have maintained a positive net reserve position of c. USD 20bn, which is significantly above the net USD -66bn at the bottom one year ago. However, the risk of dollarisation from companies and individuals in Türkiye persists, emphasising why authorities are doing all they can to maintain TRY stability and elevated deposit rates.

Beyond the clear negative impact on the rule of law and democratic values, in the short term, these developments are likely to have a negative impact on economic growth. If the Turkish lira remains stable, the resulting slowdown may contribute to faster disinflation, aiding in the stabilisation of the economy amid ongoing political challenges.

Developed Markets

European and EM data continues to surprise to upside relative to US data

Japan: In March 2025, Japan's Finance Minister Katsunobu Katō emphasised that the nation has not yet overcome deflation, despite rising consumer prices and notable wage increases. He highlighted the necessity of a comprehensive assessment of underlying price trends before declaring an end to deflation. This cautious stance reflects concerns that current inflation may be driven by external factors, such as a weak yen and elevated commodity costs, rather than a sustainable cycle of domestic demand and wage growth.2

On other news, the Government Pension Investment Fund (GPIF) announced a briefing on its new mid-term plan scheduled for 31 March. Nikkei reported the GPIF is likely to maintain its current asset allocation strategy, reflecting a steady approach amid ongoing economic uncertainties.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.reuters.com/markets/currencies/trump-says-japan-china-cannot-keep-reducing-value-their-currencies-2025-03-03/?utm_source=chatgpt.com

2. https://www.ft.com/content/7a6f5482-4fef-4557-bd11-e25b180aa6ac