Negative non-farm payroll revisions rattle risk, halt USD recovery

- Trump’s signal of willingness to meddle with the Fed and Bureau of Labour Statistics echoes Türkiye’s and Argentina’s mistakes before their reforms a few years ago.

- Tariff deadline of 2 August expired. Various ‘deals’ have been announced, but the main takeaway is US willingness to expand its list of exempt products.

- Mexican President Sheinbaum and Trump announced a 90-day delay in implementing higher tariffs, providing some more breathing room for the Mexican economy.

- OPEC+ agreed to raise oil production by another 547k barrels in September.

- S&P affirmed Indonesia’s sovereign rating at ‘BBB’ with a stable outlook.

- Argentina’s central bank raised reserve requirements on money market and short-term deposits from 20% to 40%.

- Moody’s upgraded the Dominican Republic’s rating to ‘Ba2’.

- South Africa’s central bank shifted its effective inflation target from the mid-point to the lower bound of its 3–6% range.

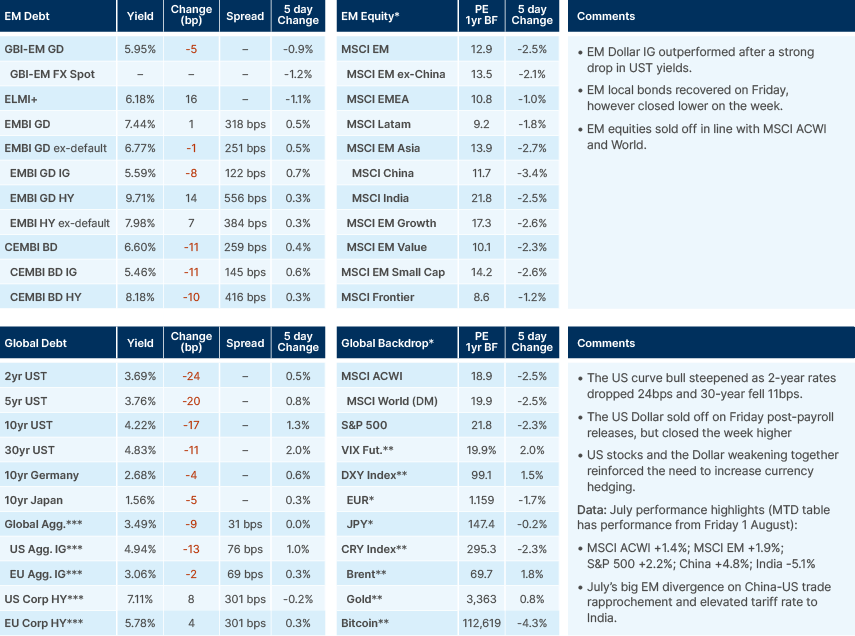

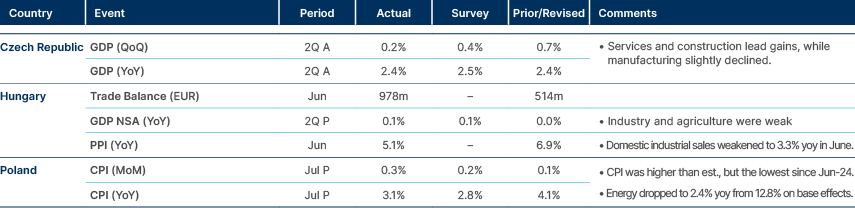

Last week performance and comments

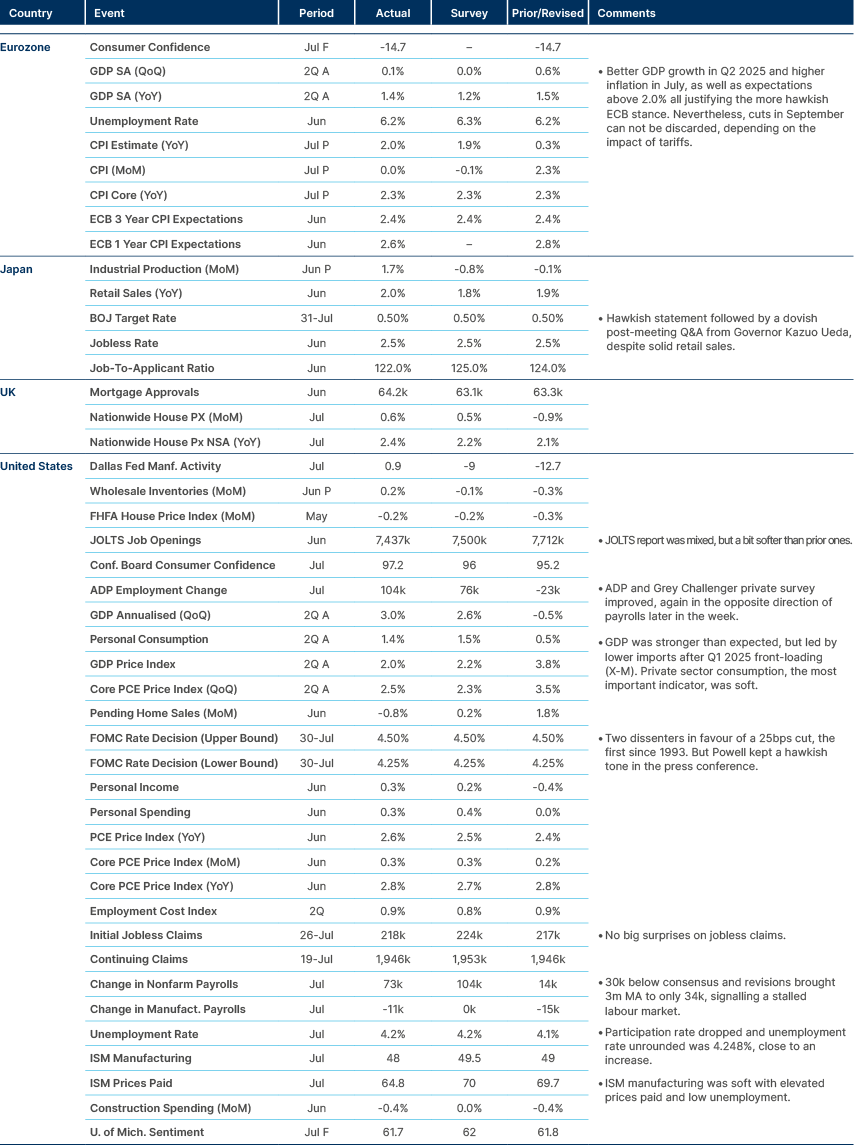

Global Macro

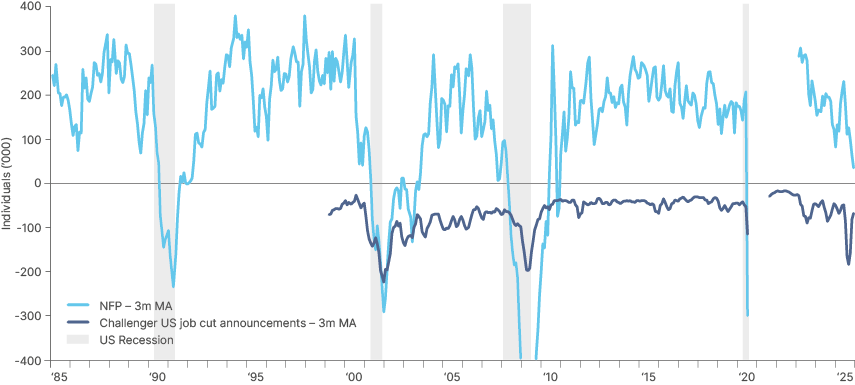

Never a dull moment. The yields on US Treasuries (USTs) plunged last Friday after non-farm payrolls had the largest two-month revision (-258k) since 1968, outside of recessions. The revision showed payrolls increasing by only 34k per month over the last three months. The data corroborated US Federal Reserve (Fed) Governor Christopher Waller’s dovish views and suggests he and fellow Governor Michelle Bowman were right to dissent Chair Jerome Powell’s vote and favour a 25bps cut in July – the first double dissent since 1993. Interest rate futures now price 80% odds of a 25bps cut in the September Federal Open Market Committee (FOMC) meeting, with some chance of a 50bps cut.

Fig. 1 shows that further softness in the labour market would justify a repeat of last year’s 50bps cut in September. But the politicisation of interest rate decisions, and the noise introduced by tariffs, are not helpful.

Fig. 1: 3-month moving average of non-farm payroll and private sector layoffs by Challenger Jobs Data

After the negative data surprise, Donald Trump fired the CEO of the Bureau of Labour Statistics (BLS) Erika McEntarfer, claiming the startling numbers review was politically motivated. Non-farm payroll revisions have been larger than average this year, and are driven, in part, by late filings of submissions by survey respondents, which expands the data set and can cause significant shifts in data. Summer months are also generally volatile when it comes to employment data with hiring and firing often disrupted due to holidays.

Last week, Governor Adriana Kugler announced an early retirement from her position, effective 7th August, ahead of the original date of 31 January 2026. This means Trump will nominate a Fed Governor and a new BLS Commissioner this week. The Governor is very likely to become the next Fed Chair, unless Trump decides to promote Waller. Waller was one of the first to turn hawkish post-pandemic and correctly predicted the soft slide of the labour market tightness in line with the Beveridge curve.1 The other front runner with market credibility is former-Governor Kevin Warsh. Both advocate for shrinking the Fed balance sheet to allow the central bank to cut rates more aggressively, as discussed in our latest Emerging View.2

The US tariff train continues to barrel onwards but is now less talk and more action. Last week, Trump announced his (kind of) ‘final’ tariffs for several countries. The main negative surprises were Switzerland and India, which were slapped with 39% and 25% tariffs, respectively. These two countries had been early in negotiating and were expected to get a “good deal”. Also last week, Trump confirmed the 50% tariff rate for Brazil, but his Executive Order had an extensive exclusion list, which means more than half of Brazilian exports, were left out, bringing effective tariffs to close to 20% level, much lower than feared. Certain key exports like beef and coffee remain subject to the 50% tariff.

Tariffs increased for Canada, while Mexico and China were given a 90-day extension for negotiations. Tariffs on Mexico and Canada are only non-United States-Mexico-Canda Agreement (USMCA) compliant items, which we expect to be less than 20% of imported goods. China’s 90-day reprieve is another surprising concession= from the US, after not bowing to pressure and tightening supply of critical rare earths in retaliation.

Overall, the Yale Budget Lab estimates effective tariffs settling in the 17.5% ballpark, but it considers only 50% of Canadian and Mexican exports becoming USMCA-compliant. Our estimates bring effective tariff rates closer to 15%. We suspect other countries will get their own exemption lists, as the impact of tariffs on goods that are hard to replace becomes apparent and politically contentious.

Geopolitics

Malaysian Prime Minister Anwar Ibrahim said Trump will attend the East Asia Summit in Malaysia on 26-28 October. This is just before the APAC summit on the 31 October, opening a gap for a potential visit to China.

The Wall Street Journal reported some progress in a US-led peace deal between Armenia and Azerbaijan. The deal sidelines Iran and Russia, the main mediators to the conflict over Nagorno-Karabakh, which started in the late 1980s.

Commodities

Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman agreed to lift oil production by 547k barrels per day from September for the second consecutive month. Oil prices fell below USD70, as OPEC continues to shift its priority from price stabilisation towards market share capture. The group's rationale for supply hikes continues to cite a "healthy global economy" and "low inventory levels.”.

Copper prices rose as Chilean mining giant Codelco grappled with the aftermath of a deadly accident at El Teniente, one of the world’s biggest underground mines. Codelco’s biggest mine produced 356k tons of copper last year, equivalent to one month of Chinese imports of refined copper.

Emerging Markets

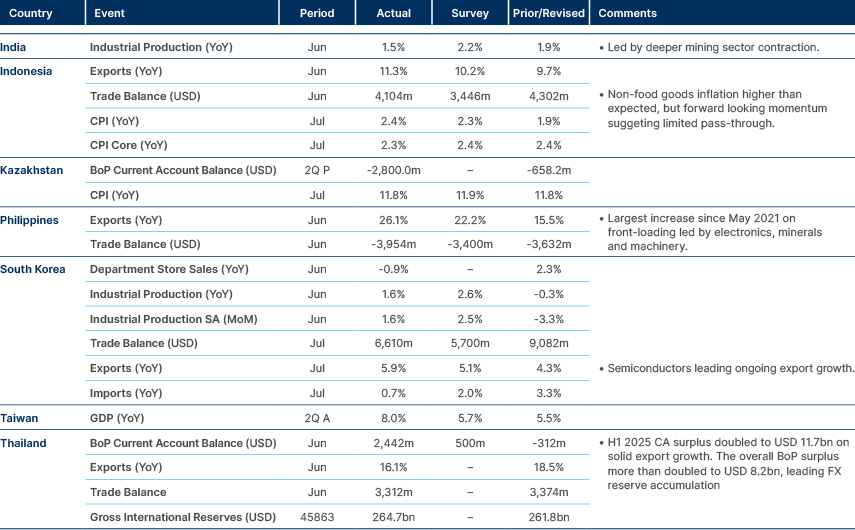

Asia

Korean and Taiwan exports remained buoyant. Indo CPI increased marginally.

India: A social media post from Trump criticising India’s trade protectionism accompanied newly-imposed US tariffs and had a market impact comparable to the measures themselves. At the same time, the US strengthened ties with Pakistan, adding to investor concerns. Indian equity valuations remain relatively rich, and the recent correction is viewed as healthy. Despite this, private sector investment and trade expansion are likely to continue, supported by India’s long-term structural growth story.

Indonesia: S&P affirmed Indonesia’s sovereign rating at ‘BBB’ with a stable outlook. Finance Minister Sri Mulyani Indrawati indicated that additional fiscal stimulus is being prepared for late 2025. Bank Indonesia expects core consumer price index (CPI) inflation to remain below 2.5%, creating room for further rate cuts. The central bank believes the recent trade agreement will support market sentiment. Foreign direct investment (FDI) totalled IDR 202.2trn in Q2 2025, underpinning positive growth expectations.

Pakistan: The US reduced tariffs on Pakistani exports from 29% to 19%, although overall US trade exposure remains limited at 10% of exports and 1.5% of GDP. As part of the broader engagement, the US pledged to assist Pakistan in developing its oil reserves, though doubts remain over the commercial viability of such projects. The tariff reduction provides modest support, but broader economic benefits are likely to be constrained.

South Korea: The government announced tax hikes to recover public revenue lost over the past two years. Measures include an increase in the corporate tax rate from 24% to 25%, a rise in the stock transaction tax from 0.15% to 2%, and a lower threshold for capital gains tax on stock holdings, cut from KRW 5bn to KRW 1bn. President Lee Jae-myung’s approval rating rose to 63.3%, up from 61.5% the previous week, with his push for stricter workplace safety laws receiving strong public support.

Vietnam: JP Morgan estimated Vietnam’s effective tariff rate at 17.5%, with potential upside depending on future US enforcement of anti-transshipment rules. The Foreign Direct Investment (FDI) outlook remains closely tied to US trade policy. Despite tariff risks, FDI inflows from China have remained strong, suggesting Chinese manufacturers remain committed to accelerating supply chain diversification into Vietnam to take advantage of existing tariff differentials.

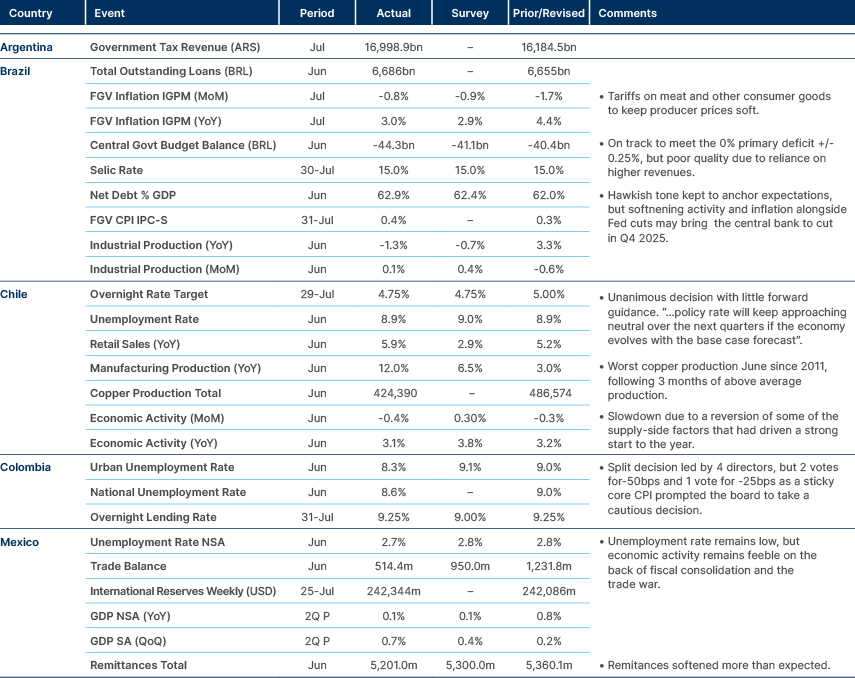

Latin America

Activity remains soft in Mexico. Colombia kept rates unchanged.

Argentina: The central bank (BCRA) raised reserve requirements on money market and short-term deposits from 20% to 40% to tighten liquidity. It continued selling USD futures to support the FX rate and intervened in the private overnight repo market to push rates higher. The International Monetary Fund (IMF) board approved the first review of the Extended Fund Facility, unlocking a USD 2bn disbursement and praising fiscal policy efforts. The IMF also commended corrective measures, including bond issuance and block purchases, after missed FX accumulation targets, while calling for greater transparency on monetary operations. President Javier Milei’s approval rating rose slightly to 45.1%, with disapproval at 47.8%, but he remains more popular than other key political figures, including Kirchner, Kicilof, and Macri.

Brazil: The US confirmed a 50% tariff on imports from Brazil starting 7 August, but released an exemption list covering 649 products, representing 51% of Brazil’s exports to the US. Only about one-third of exports will face the top rate, with key exclusions including aircraft and orange juice. The estimated effective tariff rate is 28.5%. Finance Minister Fernando Haddad ruled out retaliation and stated the government would focus on a contingency plan to protect jobs and the economy, possibly using extraordinary credits to keep spending outside the primary result. Supreme Court Justice Alexandre de Moraes confirmed that the trial of former President Jair Bolsonaro for an alleged coup attempt will proceed despite foreign pressure. STF justices backed de Moraes following US sanctions against him under the Magnitsky Act. Bolsonaro may be arrested later this year, potentially worsening US-Brazil relations. Investigations into Eduardo Bolsonaro’s US activities are advancing, with asset freezes fuelling claims of political persecution from Bolsonaro’s allies.

Chile: The US clarified that the 50% tariff on semi-finished and copper-intensive derivative products does not apply to Chile’s refined copper (cathodes). Only around USD 1bn of Chilean copper exports will be affected by tariffs. In H1 2025, Chile exported USD 26bn of copper, of which USD 4bn went to the US.

Dominican Republic: Moody’s upgraded the Dominican Republic’s rating to ‘Ba2’ with a stable outlook, citing strong growth, rising income levels and improved institutions. However, the stable outlook reflects a relatively weak fiscal position and high external debt. Moody’s forecasts a 3.2% fiscal deficit in 2025, above the official 2.9% estimate. The central bank held its policy rate at 5.75%, citing tight international financial conditions and global uncertainty. Headline CPI and core inflation remained close to target at 3.6% yoy and 4.2% yoy, respectively.

Ecuador: President Daniel Noboa announced a tentative 14 December date for a referendum on allowing foreign military bases, following June’s National Assembly approval of the constitutional reform. Noboa seeks logistical, technological and intelligence support, rather than foreign troops on Ecuadorian soil.

Mexico: President Claudia Sheinbaum and Donald Trump announced a 90-day delay in implementing higher tariffs. Trump stated Mexico agreed to end its non-tariff trade barriers. The government issued USD 12bn in 5-year bonds to strengthen Mexico’s state-owned petroleum an oil company, PEMEX’s balance sheet, providing crucial liquidity as the state-owned oil firm faces large liabilities with creditors and suppliers.

Panama: The 2026 budget was submitted to Congress, proposing USD 34.9bn in spending, including USD 11.2bn for public investment—up from the USD 30.7bn contingent budget. The fiscal deficit is projected to decline to 3.5% of GDP in 2026, after 4.0% in 2025 and 7.4% in 2024. GDP growth is forecast at 4.0% in 2026. Authorities stated the budget focuses on strategic investment, public savings and administrative efficiency without compromising essential services. However, the revenue forecasts are optimistic, and around 40% of the planned spending increase is allocated to capex, which has historically been under-executed.

Central Eastern Europe

Softer GDP in Czech; inflation declined in Poland.

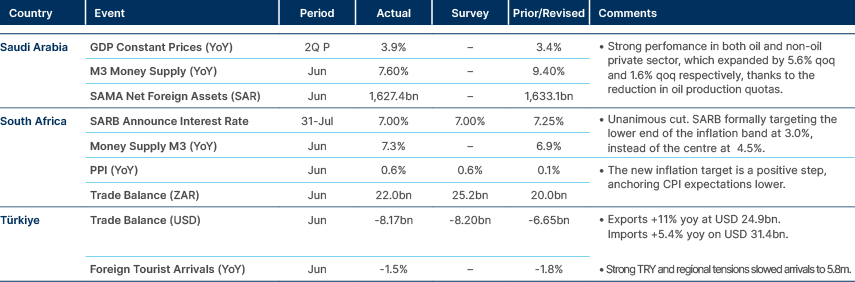

Central Asia, Middle East, and Africa

South Africa Reserve Bank aiming at 3.0% inflation target.

Egypt: The current account deficit narrowed to USD 2.3bn in Q1 2025, from USD 5.0bn in Q4 2024. The non-hydrocarbon deficit improved to USD 3.8bn, though the hydrocarbon balance worsened to a USD 3.6bn deficit due to lower gas production. Despite weak Suez Canal revenues (USD 0.8bn), the services surplus rose to USD 3.4bn, supported by strong tourism inflows. Large positive errors and omissions (USD 2.2bn) and stable net FDI (USD 3.6bn) led to a positive overall balance, excluding real estate and hospitality flows, for the first time since capital controls were eased. Net portfolio inflows totalled USD 5.3bn, including USD 2bn from Eurobond and local bond inflows. As a result, bank net foreign assets rose significantly, reaching approximately USD 10bn in Q1.

Ghana: The Bank of Ghana cut its policy rate by 300bps to 25%, citing improving macro conditions, strong external buffers and anchored inflation expectations. Inflation is projected to decline through Q3 2025 and return to the 6–10% target range by year-end. JP Morgan expects further 300bps cuts in September and November, bringing the policy rate to 19% by year end.

Kazakhstan: The National Bank of Kazakhstan intervened in the FX market after the Tenge hit new lows, citing extremely low liquidity, which is typical for this time of year. Tensions over Russian oil exports increased following threats from President Trump of secondary sanctions on buyers of Russian oil, raising concerns for Kazakh oil transit. New Russian requirements for Financial Stability Board (FSB) approval of oil loadings caused temporary disruptions, and there are rumours of possible retaliatory restrictions on Kazakh exports. Most Kazakh oil is exported through the Caspian Pipeline Consortium (CPC) pipeline via Russian ports, with US and other Western companies heavily involved in production. Although Russia has previously disrupted CPC flows, a full ban has never occurred, and Kazakh authorities maintain friendly ties with Moscow.

Saudi Arabia: The fiscal deficit widened to SAR 93.2bn (USD 24.9bn) in H1 2025, up from SAR 27.7bn in H1 2024. Oil revenues fell 24% yoy to SAR 302bn due to lower prices. Government spending declined 2% yoy to SAR 658bn, driven by cuts in capex and subsidies, while wages and debt servicing costs rose 3% and 17% yoy, respectively.

South Africa: The South African Reserve Bank shifted its effective inflation target from the mid-point to the lower bound of its 3–6% range, now aiming for 3.0% inflation. Forecasts for 2026 and 2027 were revised down to 3.3% and 3.0%, respectively. GDP growth was revised down by 0.2ppt to 1.3% in 2026, but up 0.2ppt to 2.0% for 2027. The implied rate path suggests a 25bps cut by end-2025 and a total of 100bps in easing by end-2026.

Ukraine: The current account deficit reached USD 3.1bn in June, slightly narrower than USD 3.4bn in May. Secondary income transfers improved to USD 2bn, up from USD 0.7bn, but the trade deficit widened to USD 4.4bn from USD 3.6bn. The cumulative current account deficit for H1 2025 reached USD 14.9bn, compared to USD 10.4bn in the same period of 2024.

Developed Markets

Weak US NFP the highlight, but other labour market data was not so soft.

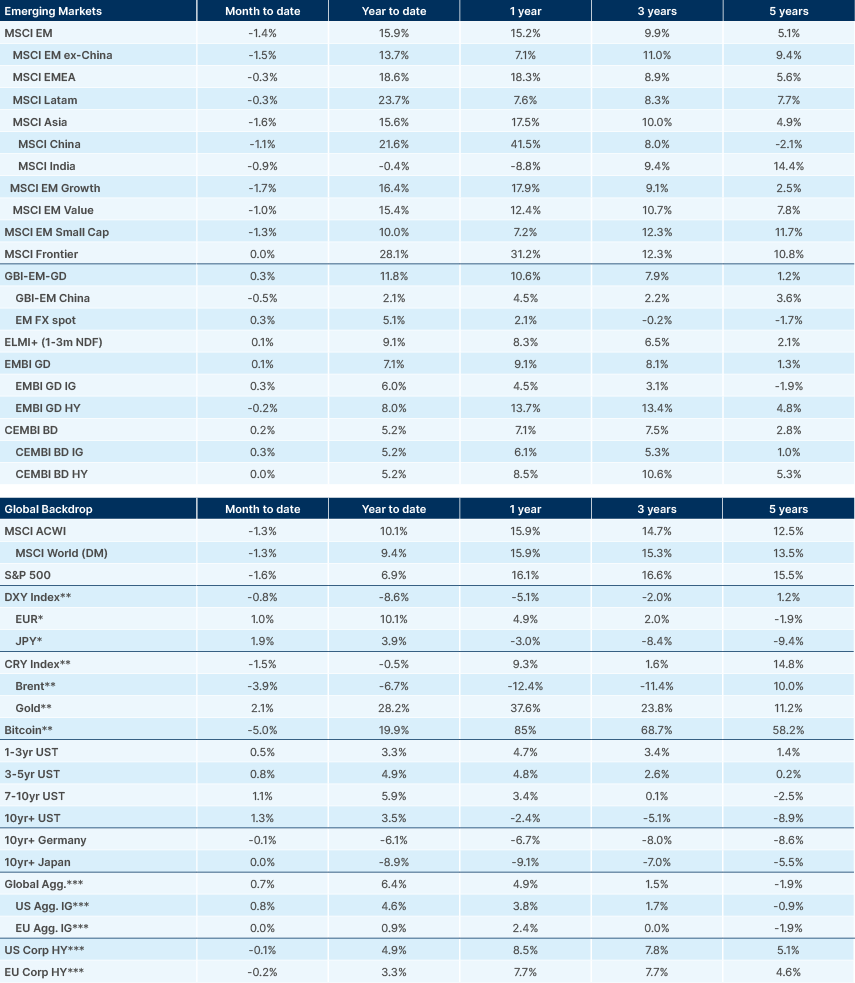

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. https://www.bls.gov/charts/job-openings-and-labor-turnover/job-openings-unemployment-beveridge-curve.htm

2. See https://www.ashmoregroup.com/insights/diversified-asset-allocation-and-us-fiscal-dominance