Greenland, tariffs, and yet another case for EU capital repatriation

- Trump threatened to impose a 10% tariff “on any and all goods” from 8 European nations on 1 February, increasing to 25% on 1 June if they don’t negotiate the sale of Greenland.

- China’s record trade surplus in December took its 2025 surplus to USD 1.2trn

- Chinese onshore banks sold a net USD 100bn of FX on behalf of clients over the month, pointing towards a shift in market sentiment towards Dollar depreciation

- US consumer price index (CPI) inflation surprised to the downside last week

- Argentina’s inflation came above expected, but at its lowest year-end level since 2017

- Brazil Finance Minister said rising debt is due to high interest rates rather than fiscal slippage

- The Deputy Governor of the Czech central bank is hawkish, despite falling headline CPI.

- The UAE central bank’s foreign assets increased 23% yoy to USD 275bn in November

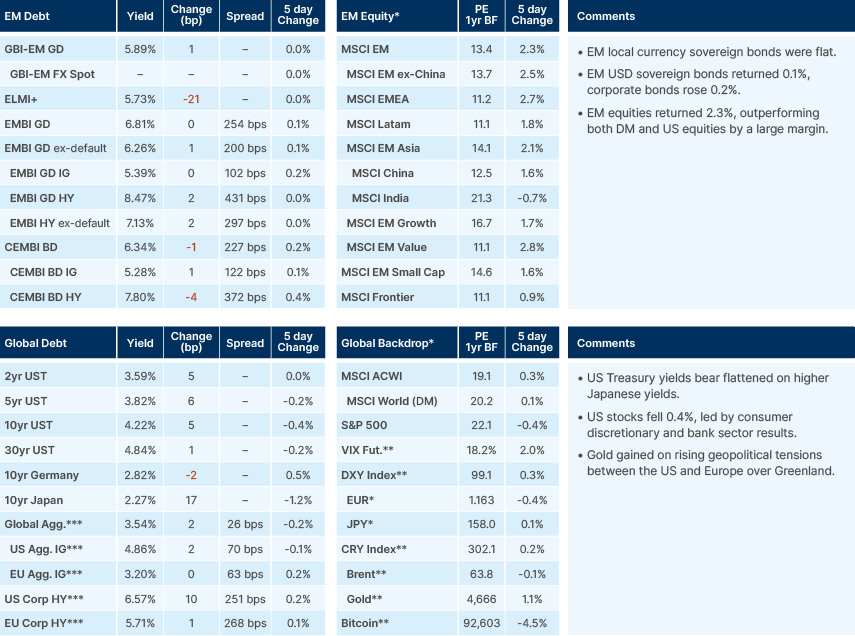

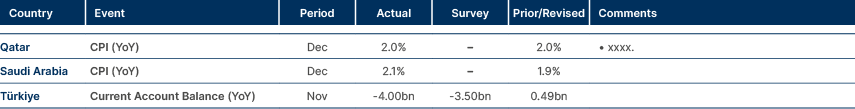

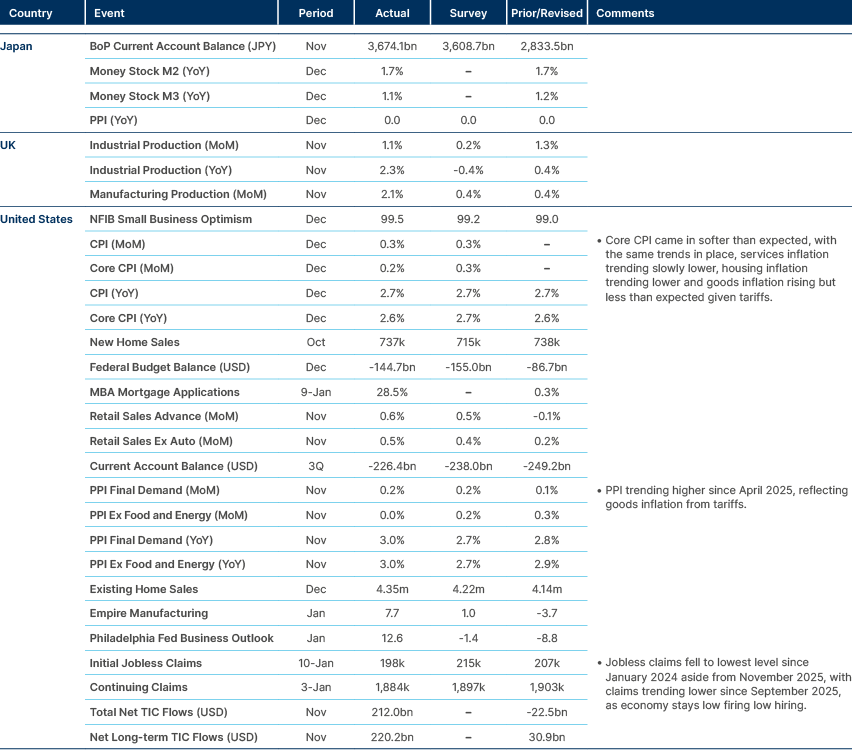

Last week performance and comments

Geopolitics

The big event last week was Trump’s insistence on taking over Greenland, threatening to impose a 10% tariff “on any and all goods sent” to US from Denmark, Norway, Sweden, France, Germany, UK, Netherlands, and Finland, increasing to 25% on 1 June “until such time as a deal is reached for the complete and total purchase of Greenland”. Later, Trump sent a letter to the Norwegian Prime Minister where he mentioned his Nobel prize snub as a factor. US Treasury Secretary Scott Bessent ratified the President’s view, saying Greenland is strategic and must be in control of the US for national security reasons.

Economists estimate the European economy would be hit by 0.1%-0.2% on a 10% tariff and close to 0.5% of GDP on a 25% tariff. European leaders have threatened to escalate using the anti-coercion law, which allows countries to retaliate against unfair economic coercion by third party countries via goods tariffs and other instruments affecting the services sector of the offender. The measure would likely take time (some two to three months) to take effect because EU Member States must negotiate and agree on complex legal interpretations and political ramifications. Nevertheless, this escalation could have a significant impact on asset prices as Europe is the largest investor in the US and one of the largest markets for US companies, particularly in the services sector.

We believe it would be hard for Trump to meaningfully hike tariffs before the mid-term elections given its negative impact on inflation. He has also been sensitive of large negative moves in US equities, which is likely to happen if the EU retaliation becomes effective. Therefore, while Trump would love to be a president that annexed considerable land to the US, we believe the tariff threat is likely to play out similarly to the “Liberation Day” tariffs, with Trump backtracking on its threat. A ruling by the Supreme Court against using IEEPA powers for tariffs would also render the tariff threat meaningless.

The real impact is likely to happen via asset allocation. Europeans have the largest amount of capital invested in the United States. They’ve been looking to diversify their allocations since the current US administration made it clear they can’t rely on the US for neither security nor defence. The threat to annex part of what is today a European territory is already galvanising the EU public sector to lower its dependence on the US. The private sector is very likely to follow close behind, in our view.

Global Macro

US Treasury yields have been moving higher since October with the 10-year and 30-year yields now above their 200-day moving averages. The 2-year yield remains below its 200-day moving average but has risen 12 basis points (bps) since the start of the year, with the 2y10y curve flattening slightly. Much of this move came towards the end of last week.

Last Friday, US President Donald Trump said he did not want his economic advisor, Kevin Hassett to leave his current position, and ‘lose him’ to the Federal Reserve (Fed). Hassett was seen by markets as the candidate who – if appointed as Fed Chair – would aggressively push for rate cuts, and contribute to currency ‘debasement’, a narrative we have been arguing is overstretched. Notably, the DXY index barely reacted to the news. Trump is set to announce his Fed Chair nominee by the end of January, with Christopher Waller, Kevin Warsh and Rick Reider all under consideration.

US consumer price index (CPI) inflation surprised to the downside last week, with both CPI and core CPI unchanged since the previous month at 2.7% and 2.6%. More tariff pass-through to goods was expected, but goods inflation barely rose and is still running at just 1.4%. Housing inflation fell. The private inflation aggregator ‘Truflation’ now indicates that underlying CPI inflation is below target at c. 1.6% yoy. Indeed, reweighting the US core inflation basket ex-housing costs, brings CPI to 2.2%. Services ex-housing (super core) is now running at 2.4%, down from 4.0% this time last year.

China recorded another record trade surplus in December 2025, taking its annual 2025 trade surplus to a record USD1.2tn. Even as shipments to the US plunged under tariffs (30% lower yoy last month), the slack has been more than picked up by an increase in exports to the rest of Asia, Europe, Africa, Latin America and Russia. The knock-on effect of this huge trade surplus has been a steep increase in foreign assets in 2025, with much of the export revenues being recycled into foreign portfolio and foreign direct investment (FDI), rather being recycled back into domestic currency. Chinese private purchases of overseas securities surged USD 535bn in 2025, and its non-official sector turned net-creditor.

December saw a break in the trend, however, with a net USD 128bn portfolio inflow into Chinese assets, the largest monthly flow since 2015. Chinese onshore banks sold a net USD 100bn of FX on behalf of clients over the month, pointing towards a shift in market sentiment towards Yuan appreciation with expectations of higher fixings against expectations of a weaker USD, and ongoing rotation out of US tech stocks and into Chinese ones. We are now watching for signs of continued Yuan appreciation which could lead to a more rapid repatriation of FX.

Commodities

Brent crude prices have risen sharply over the past two days, climbing from around USD 60/bbl to USD 63/bbl, marking the largest two-day gain since October, as unrest in Iran and rising tensions between Tehran and Washington have increased geopolitical risk in the oil market. Iran is currently exporting around 2 million barrels per day, and positioning data indicate a sharp shift towards bullish oil calls, with skew now at its highest level since July 2025. While the risk of a US military response has moved higher, Trump is unlikely to tolerate a sustained spike in oil prices given the domestic inflationary implications; previous episodes, including last summer’s US strikes on Iran and fears of a closure of the Strait of Hormuz, ultimately failed to disrupt physical supply. For now, the upside in prices appears driven more by technical factors, with the market having been heavily oversold on expectations of global oversupply, leaving room for a corrective rebound as those positions unwind.

In parallel, OPEC+ has reaffirmed its decision to keep production steady through Q1 2026, maintaining flexibility around voluntary cuts and signalling a continued preference for defending prices rather than pursuing market share, particularly against a backdrop of seasonal demand weakness and rising non-OPEC supply.

Emerging Markets

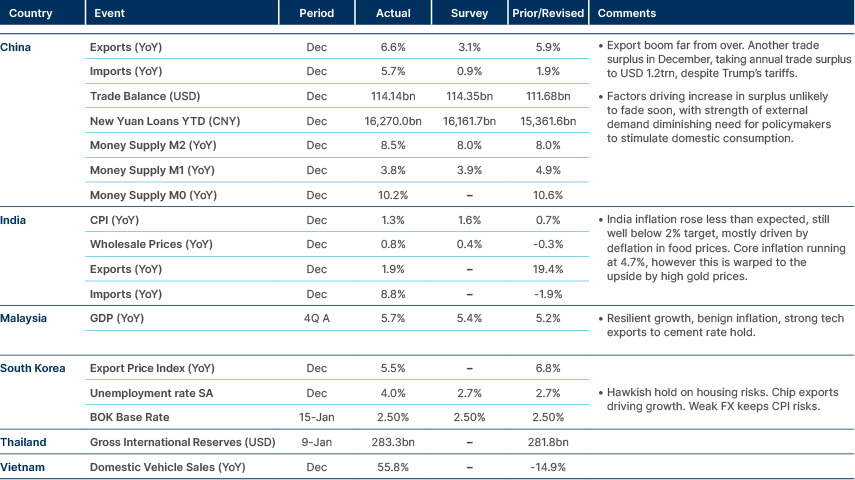

Asia

Chinese trade surplus at record USD 1.2trn in 2025.

India: Exporters raised concerns over the threat of additional US tariffs on countries trading with Iran, highlighting growing uncertainty around secondary sanctions and trade policy spillovers. While direct trade exposure is limited, the episode underscores broader risks to Indian exports amid already elevated US tariffs and fragile global demand.

South Korea: US Treasury Secretary Bessent’s rare verbal support for the Won helped stabilise the currency, reflecting US sensitivity to FX dynamics ahead of planned Korean investment flows into the US. Separately, SK Hynix announced a KRW 19trn advanced packaging facility, reinforcing South Korea’s central role in the artificial intelligence (AI)-driven semiconductor cycle and supporting medium-term investment momentum.

Pakistan: Pakistan and Morocco signed a defence cooperation memorandum of understanding covering training, joint exercises and defence industries. While largely symbolic, the agreement reflects Pakistan’s broader efforts to deepen security ties across the Muslim world amid shifting regional alignments.

Vietnam: The World Bank projects GDP growth easing to 6.3% in 2026 before reaccelerating to 6.7% in 2027, leaving Vietnam the fastest-growing major economy in East Asia. While the outlook remains positive, the World Bank cautioned that rising trade tensions and external shocks remain key downside risks for the export-driven economy.

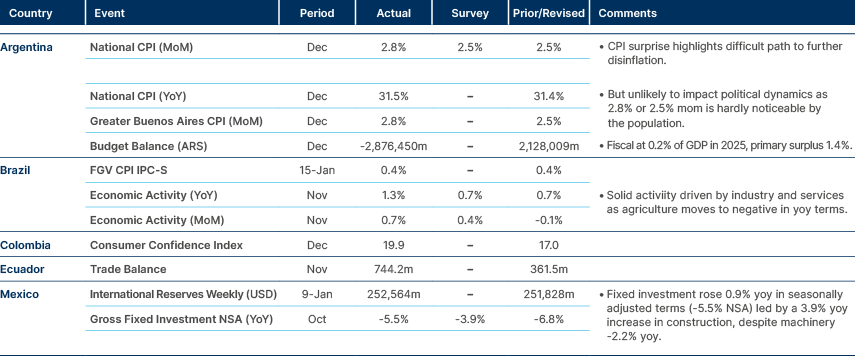

Latin America

Argentina had a budget surplus in 2025. Brazilian activity surprised to the upside.

Argentina: A record wheat and barley harvest is expected to lift exports by USD 1bn in 2026, supporting FX inflows and reserve accumulation, particularly during the Q2 peak export season. Strong agricultural performance could ease pressure on the FX market and improve the sovereign’s chances of returning to international bond markets later this year. Separately, the government eliminated the remaining 8% import tariff on mobile phones, reinforcing its push to lower domestic prices and open the economy, while increasing pressure on local assembly operations. December CPI inflation rose 2.8% mom, above expectations, but yoy inflation fell to its lowest year-end level since 2017, with recent FX stability expected to support renewed disinflation in early 2026.

Brazil: Finance Minister Fernando Haddad attributed rising public debt to high interest rates rather than fiscal slippage and signalled renewed attempts to review tax exemptions, reinforcing expectations of revenue-focused adjustment rather than spending reform. President Lula enacted the 2026 budget while vetoing part of parliamentary amendments, preserving the primary surplus target but risking renewed friction with Congress. Lula’s approval slipped modestly in January, though he continues to lead all first-round and runoff scenarios ahead of the October election.

Chile: Codelco outlined USD 4.1bn in investments to extend the life of two major copper mines by several decades, securing long-term output and reinforcing Chile’s position as a leading global producer. While the investments reduce medium-term supply risks, they underline rising capital intensity and execution challenges in the mining sector.

Mexico: President Claudia Sheinbaum accused the opposition of promoting US intervention rhetoric, signalling that sovereignty and foreign influence are likely to feature prominently in the political narrative ahead of the 2027 midterms.

Peru: Moody’s expects growth of near 3% this year, supported by high commodity prices and domestic demand, while stressing that post-election policy choices will be critical for sustaining investment and fiscal discipline. The outlook remains stable but well below the boom years of the early 2010s, underscoring the importance of structural reforms.

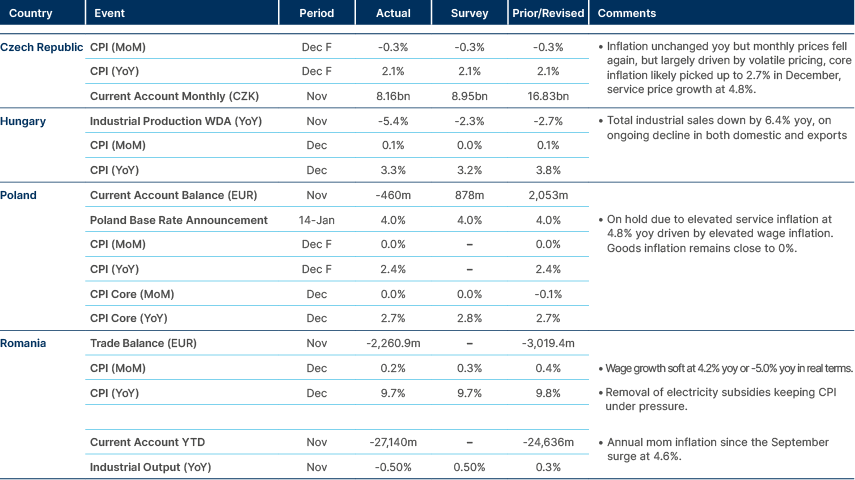

Central and Eastern Europe

Benign inflation across CEE hides underlying divergences.

Czech Republic: Central bank Deputy Governor Eva Zamrazilova reinforced a firmly hawkish message, arguing that persistent service price inflation near 5% and risks of fiscal loosening leave little scope for rate cuts in early 2026. Zamrazilova suggested that if service inflation eases and fiscal policy remains tight, cumulative easing of 25–50bps could be justified later in the year, broadly consistent with market expectations. However, she warned that fiscal expansion could quickly undermine disinflation over the 12 to 18 month policy horizon. The comments suggest a majority on the board share this view, with policy rates likely to remain structurally higher than in the pre-pandemic period and 3% seen as a lower bound.

Kazakhstan: The government expects to eliminate electricity deficits by end-Q1 2027 as capacity expansion accelerates. Electricity generation fell marginally short of consumption in 2025, but 81 projects currently under development are expected to add over 15GW of capacity, largely funded by private investment. If delivered on schedule, the expansion would move Kazakhstan into sustained generation surpluses later this decade, enabling higher exports and easing a key constraint on industrial growth.

Romania: The Treasury launched its first Fidelis retail bond issuance of 2026, offering three RON and three EUR maturities. Shorter RON tenors saw slightly lower coupons, while longer maturities were unchanged, signalling confidence in stable domestic demand for government paper. Retail funding remains a central pillar of Romania’s financing strategy, with Tezaur and Fidelis schemes together raising over RON 47bn in 2025, helping manage elevated gross financing needs amid gradual fiscal consolidation.

Ukraine: Polling suggests President Volodymyr Zelensky would lead a hypothetical presidential election, with support rebounding after a fading corruption-related fallout late last year. Former commander-in-chief Valerii Zaluzhny remains a strong alternative figure, particularly in parliamentary scenarios, underscoring latent political competition despite the absence of elections under wartime conditions. Separately, the UN reported that 2025 was the deadliest year for civilians since the invasion began, with casualties rising sharply and disproportionately affecting older populations in frontline regions, highlighting the worsening humanitarian toll of the conflict.

Middle East & Africa

No big data surprises.

Morocco: Airport passenger traffic rose 11% yoy in 2025 to a record 36.3m, driven by strong international arrivals and a boost from hosting the Africa Cup of Nations. Casablanca and Marrakech consolidated their positions as major hubs, while smaller regional airports posted double-digit growth, pointing to gradual network rebalancing. Continued tourism momentum and major airport investments ahead of the 2030 World Cup support a strong medium-term outlook, though execution and congestion risks remain.

United Arab Emirates: The central bank’s foreign assets increased 23% yoy to USD 275bn by end-November, extending an uninterrupted growth streak since late 2022. More notably, the composition of reserves has shifted decisively toward higher-yielding foreign securities, while cash and deposits abroad have fallen sharply. The reallocation points to a more sophisticated reserve management approach focused on yield optimisation, while still preserving strong external buffers.

Developed Markets

Inflation softer than feared in the US.

Japan: Prime Minister Sanae Takaichi has officially dissolved Japan’s lower house and set a snap general election for 8 February 2026, much earlier than the scheduled 2028 vote. She’s doing this to capitalise on unusually high personal approval ratings (polls show c. 70–75% range) and secure a stronger public mandate for her policy agenda, which includes fiscal measures like a temporary suspension of the 8% sales tax on food, expanded stimulus, and defence and social security reforms. The election also helps her legitimize her leadership, since she became PM through internal party processes rather than a public election. Yields on long-dated Japan Government Bonds rose to the highest levels since February 1999 after the announcement, which has been expected for more than a week.

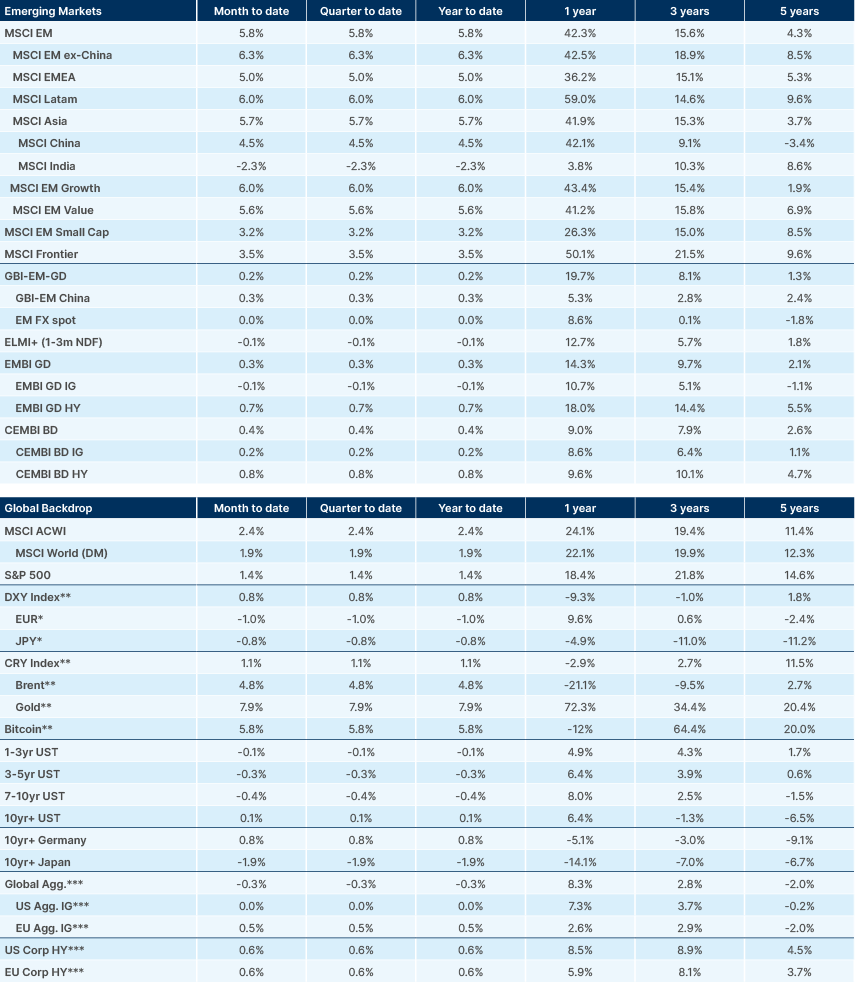

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.