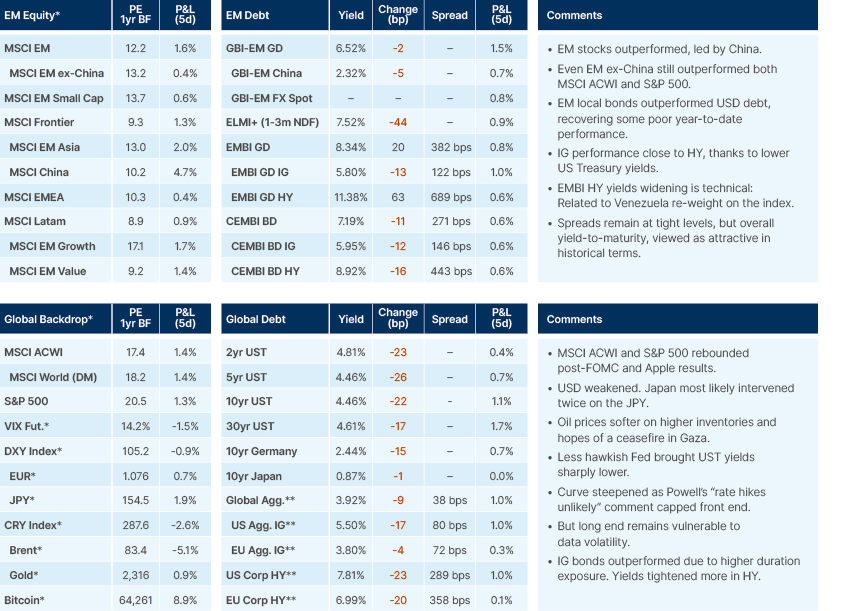

Short-term bond yields have a cap as rate hikes in the US are “unlikely”, supporting asset prices. A less hawkish message from US Federal Reserve (Fed) Chair Jerome Powell drove stocks and bond prices higher last week. The US labour market is softening, but not fast enough for imminent rate cuts, while inflation remains too elevated. No ceasefire between Hamas and Israel, so far. Emerging Markets (EM) manufacturing still outperforming Developed Markets (DM), according to Purchasing Manager Indices (PMI) surveys. China’s Politburo vowed further measures to promote economic growth. Malaysia announced a minimum wage increase. Argentina’s omnibus bill was approved by the Lower House. Panama’s general elections had a market-friendly result, but policy implementation will be challenging. Brazil, Türkiye, Egypt and Nigeria had positive rating actions last week. EM small-caps performed well in April and should be considered as an alternative to US small caps in global equity portfolios.

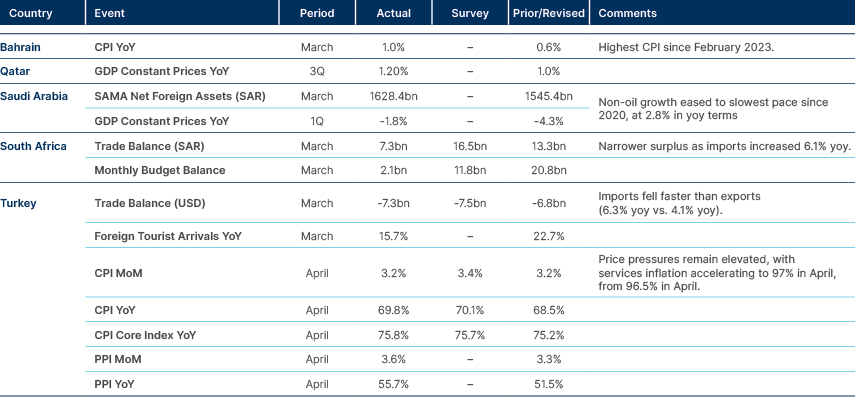

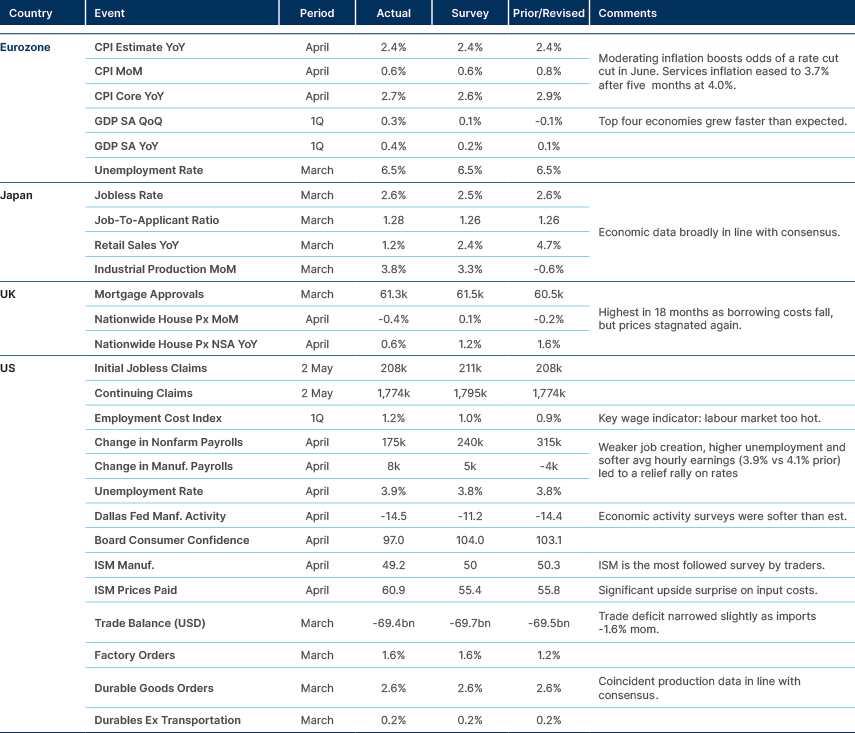

Last Week Performance and Comments

Global Macro

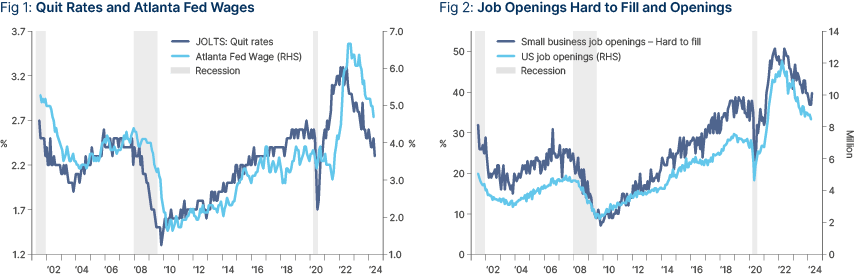

The latest US data releases indicate that the labour market is adjusting, but it remains too early to call a recession or aggressive rate cuts by the Fed as inflation remains at elevated levels. Quit rates are declining fast, suggesting wage inflation is moving towards the 3.0% - 3.5% area (Fig. 1), consistent with consumer price index (CPI) inflation at 2.0%. However, 37% of small businesses still say job openings are hard to fill, explaining why job openings remain elevated, as per Fig. 2. Some of the sticky job openings may be due to post-pandemic structural changes such as higher informal “gig economy” workers squeezing small business as well as the ease of keeping an online job opening advertisement. But hire rates are also dropping fast, suggesting some of the job openings may never be filled. The ambiguous data alongside high inflation levels suggest the bar for a rate cut in Q2 or even Q3 2024 is high, which will increase the risk of a recession in late 2024 or 2025.

The Federal Open Market Committee (FOMC) kept interest rates unchanged, as widely expected. Markets expected a hawkish message during the press conference following three months of inflation misses and resilient activity. But Powell’s main hawkish note was expressing “less confidence” on the path of inflation convergence to the 2.0% target expressed since last October. Powell said rate hikes were “unlikely” and sees higher odds that the next move on rates is lower, either if inflation declines or if a sudden weakness in the labour market takes place. This message effectively capped the two-year US Treasury yield at the 5.0% levels just before the press conference in the absence of accelerating inflation. We would agree that many more elements suggest disinflation is more likely in the quarters ahead than higher inflationary pressures. If we are wrong and the strong economy, stubborn service sector prices, and increasing supply-side price pressures remain, the long end of the curve will likely widen, effectively tightening financial conditions.

Outlook

The dovish hints provide a floor for asset prices in a recession. It also would allow assets to test new record highs on the return of a disinflation scenario that is not accompanied by a recession. The outlook is particularly bullish for EM assets which are still trading at discounted levels and rebounding (as Chinese stocks) or have suffered a correction because of higher US Treasuries (Latin American stocks and local bonds). The barbell of high-quality corporate investment grade (IG) positions and distressed sovereign debt remains highly attractive, in our view.

Nevertheless, there are reasons to be cautious in the short term, particularly on overpriced assets, such as US stocks. The ‘Fed put’ is very out of the money (i.e., it will only cut rates if a meaningful event happens, but that would likely lead to a sharp adjustment in asset prices first). The unemployment rate is close to historical lows, the S&P 500 near record highs, and credit spreads also near their lowest historical levels. Earnings per share (EPS) misses in Q1 2024 so far have been badly punished as investors are closely scrutinising capital expenditure in artificial intelligence (AI), no longer rewarding companies just for mentioning it. The only companies whose stock prices that seem to be benefiting from AI are the ones delivering front-loaded cash flows. The share prices of these companies had a tremendous run in the US.

A key risk, in our view, is a resumption of higher energy prices (which have softened in recent weeks) due to geopolitics. Another concern is the 15% rise in industrial metals year-to-date, bringing the prospect of higher cost pressure, particularly if prices keep trending higher. Conversely, a peace agreement and commodity prices declining further (oil inventories increasing) could make for a better macro environment as lower oil prices would allow yields to decline faster from currently elevated levels.

Geopolitics

Last week, the prospect of reaching a ceasefire deal between Israel and Hamas moved back and forth. In the last few days, Israel ordered civilians to evacuate parts of Rafah – the last densely populated area in the southern end of the Gaza strip that has not been attacked. Hamas claimed a deal mediated by Egypt has been reached (presumably agreed by the US), but Israel said its terms are disadvantageous. The sticking points seem to be the number of hostages released and the prospect of a permanent or temporary ceasefire.1

Israel remains under intense external pressure to agree on a ceasefire, making some deal likely, in our view. However, the fragility of a potential ceasefire agreement was depicted when the US warned the International Criminal Court of giving out potential arrest warrants for Israeli officials, as it worried this could jeopardise any progress.2 Yet, Netanyahu stated “The idea that we will stop the war before achieving all of its goals is out of the question” and “will enter Rafah and eliminate Hamas battalions there – with or without a deal, in order to achieve total victory”. Israeli politics remains fractured, and former army chief and centrist politician Benny Gantz criticised Netanyahu, stating that the hostages should be prioritised.3

US Elections

Donald Trump’s recent interview with Time Magazine gave further colour on his preferred policies should he win November’s Presidential election. On Ukraine, Trump said he would not commit to support “unless Europe starts equalising”, stating: “If Europe is not going to pay, why should we pay? They’re much more greatly affected. We have an ocean in between us. They don’t.” On immigration, Trump plans to rely on the National Guard to round up undocumented migrants, aiming to deport as many as 11m illegal foreigners. He also pledged to increase tariffs by 10% across the board and “as much as 100% to China”. He dismissed claims that tariffs will cause inflation, pointing to an average yearly inflation rate of under 2% despite tariffs. Lastly, Trump’s stance on supporting Israel remained unclear, but he criticised Netanyahu for the 7 October events and talked of his “bad experience” with him when he backed out of what was supposed to be a joint military operation of Qasem Soleimani’s assassination.4

Leading Indicators

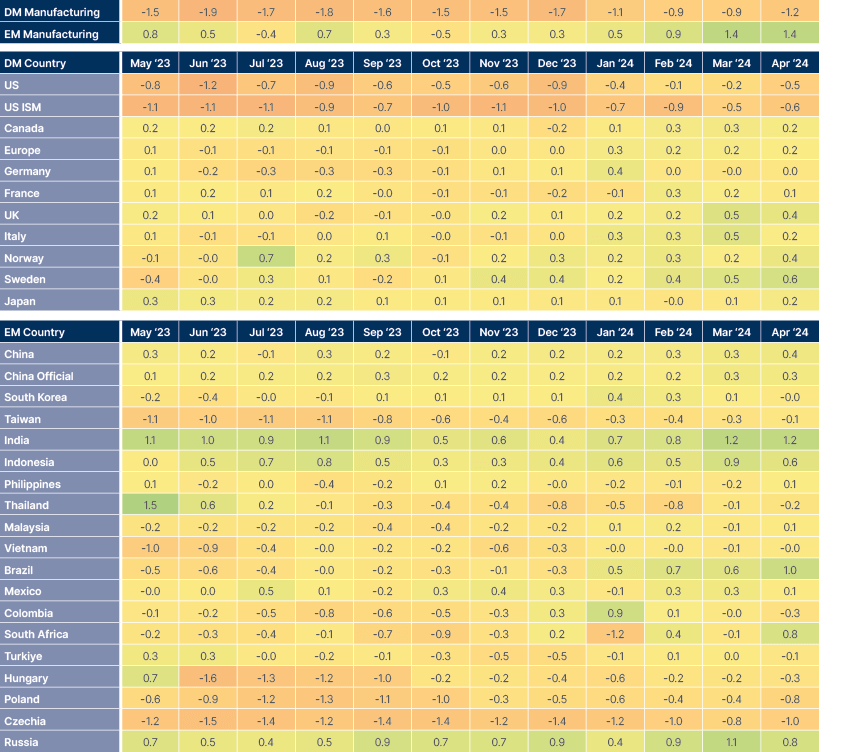

EM manufacturing PMIs outperformed DM again, led by a strong rebound in South Africa (+4.8 to 54), Brazil (+2.2 to 55.9), and the Philippines (+1.3 to 52.2). The EM PMIs softened in Eastern Europe, particularly Poland (-2.1 to 45.9), Chechia (-1.5 to 44.7) and Russia (-1.4 to 54.3). Fig. 3 shows the z-score (standard deviations from average) since December 2011, the inception of the series, excluding the Covid-19 extremes. The DM PMI drop was mostly due to the decline in the US PMI (-1.9 to 50). The ISM manufacturing (a separate survey dating back from 1947) also declined 1.1 to 49.2. Within the ISM, prices paid rose by five points to 60.9, new orders declined by 2.3 points to 49.1.

Fig 3: Manufacturing PMI: Z-Scores

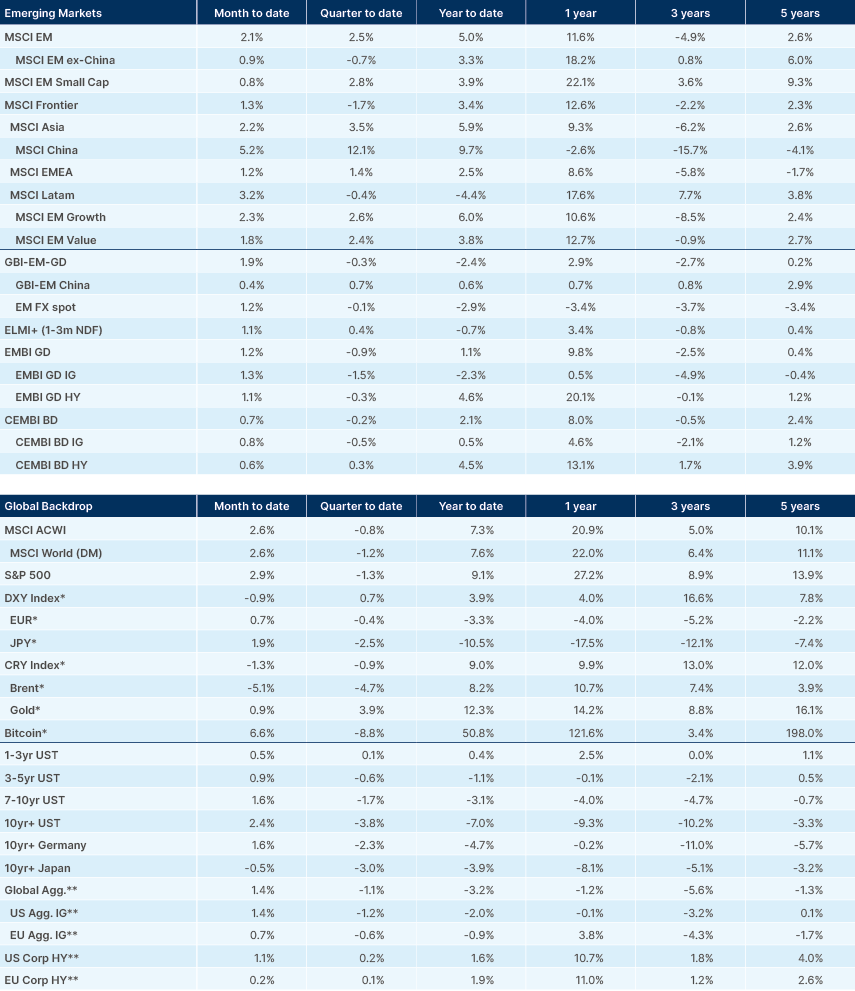

April review

Higher inflation postponing the timing of Fed cuts brought the correlation between government bonds and stocks further into positive levels. Stocks and bond prices declined as yields rose close to their highs in Q3 2023: two-year USTs rose 83bps over the last three months and breached the 5.0% level, while 10-year USTs rose 79bps over three months to trade close to 4.8%.

The MSCI All Country World index dropped 3.3% as the S&P 500 underperformed (-4.1%). In contrast, the MSCI EM rose 0.4%, led by China (+6.6%), but the MSCI EM ex-China (-1.6%) also outperformed global stocks. Chinese stocks rose 20% from their lows on the 22 January after breaking out of negative sentiment. The large People’s Bank of China (PBoC) rate cuts on 24 January, followed by a government-led support for consumption, including a subsidy for the purchase of electric vehicles, and a series of stock buybacks by government and private entities were the main reasons for the outperformance. Chinese investors have been adding exposure to buy stocks listed in Hong Kong for more than a month, but positioning surveys suggest foreign investors remain very under-allocated to Chinese stocks.

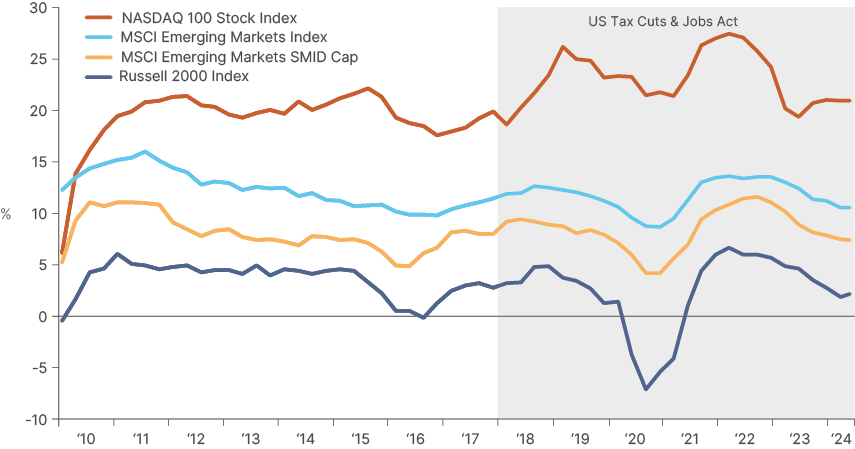

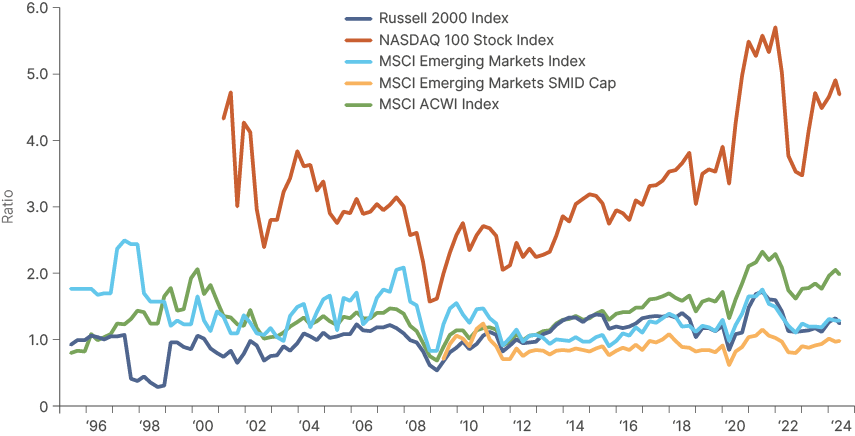

Notably, EM small caps remain an island of stability, up 2.0% in April. The global picture shows some strong contrasts. In the US, small caps have severely underperformed large stocks. This underperformance is backed by fundamentals. The profitability of US mega-cap companies has been boosted by the US Tax Cuts and Jobs Act in 2017 as the return on equity (ROE) on the Nasdaq rose from 18% on average in the previous 10 years (and 11.7% on average over the previous 20 years) to 21%, peaking at 27.5% in Q4 2021. In contrast, US small cap ROE, depicted by the Russell 2000 index on Fig. 3, remained stable at around 2%.

Fig 4: Return on Equity (%) – Selected Indices

In EM there were no tax cuts to companies, so the ROE of small cap companies remained close to its 8% average since 2010. Furthermore, Fig. 5 suggests EM valuations remain undemanding. The overall MSCI EM trades at a similar price-to-sales ratio of US stocks, despite profit margins that are 5x higher. Fig. 5 also suggests EM small cap outperformance has been backed by growth, rather than multiple expansion, as small caps still trade slightly below 1.0x sales, close to the long-term average and below MSCI EM and US small cap at 1.3x and 1.2x, respectively.

Fig 5: Price to Sales Ratio – Selected Indices

Global investors seem to overlook EM small caps in their allocations. This is proving to be a mistake as EM small cap stocks have risen by 9.3% over the last five years, outperforming both US small cap (up 6.4%) and the broad MSCI EM (up 2.6%) over the same period. Global investors are likely to be underweight US small caps and EM stocks because of the underperformance against large cap indices. An allocation to EM small cap would reduce the underexposure of both the small cap market segment and EM geography with one allocation: two birds with one stone.

In fixed income, EM corporates outperformed EM sovereign and global corporates. The Bloomberg Global Agg. And US Agg. (IG) declined 2.5%, while EM local currency bonds declined only 2.1% (of which 1.3% was due to lower EM currencies). EM corporate and sovereign IG declined 1.3% and 2.8%, respectively. Within high yield (HY), EM corporates were down only 0.3%, but sovereigns dropped 1.4%, while US HY was down 0.9% and EU HY -0.1% over the same period.

Commodity prices were virtually unchanged as industrial metals rose close to 12.0%, led by zinc, nickel, and copper prices, but energy prices declined 1.5% as oil prices were down some 2.5%. Agriculture prices declined close to 2% as the harvest rebound in Argentina led soybean prices down some 11%, compensating wheat, coffee and rice prices, up 9%, 14% and 15%, respectively. Precious metals rose 3.3% as silver increased 6% and gold 2.5%.

Emerging Markets

EM Asia

China: The Politburo meeting indicated a potential interest rate cut, reserve requirement ratio (RRR) cuts and “digesting housing stockpile and optimise new housing”. Policymakers stated high-leveraged regions should “both curb debts and maintain steady development’. They also vowed to be more active, saying “we should avoid slacking off after making good efforts to concretely consolidate and strengthen the recovery momentum of the economy”. Furthermore, President Xi Jinping will gather his party in July for a conclave, known as the Third Plenum, to discuss economic reforms. The Third Plenum typically comes in October or November, when the new leadership is set, but had been delayed to 2024.

Malaysia: Prime Minister Anwar Ibrahim will raise government salaries by more than 13% from December, as part of an MRY 10 bn (USD 2.1 bn) allocation. He stated, “The country’s inflation rate is the lowest in Asia, so we expect that a small increase may be acceptable” and hopes to counter the weak currency and rise in living costs felt by civil servants. This decision also comes ahead of a contentious by-election on 11 May in the Selangor region.5

Thailand: The government aims to raise the daily minimum wage to THB 400 nationwide from October and will be discussed at the tripartite wage committee on 14 May.6

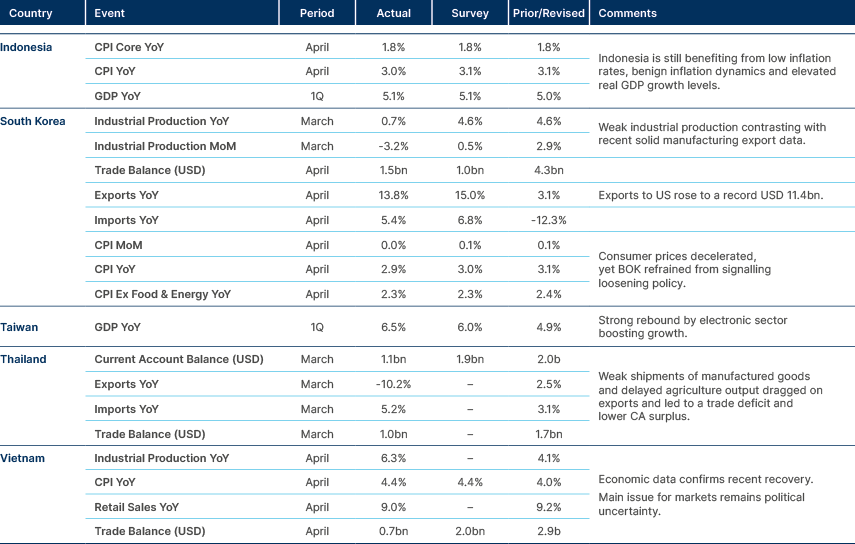

Economic data: Inflation remains well behaved in Indonesia, Korea, Vietnam. Weaker industrial production in Korea.

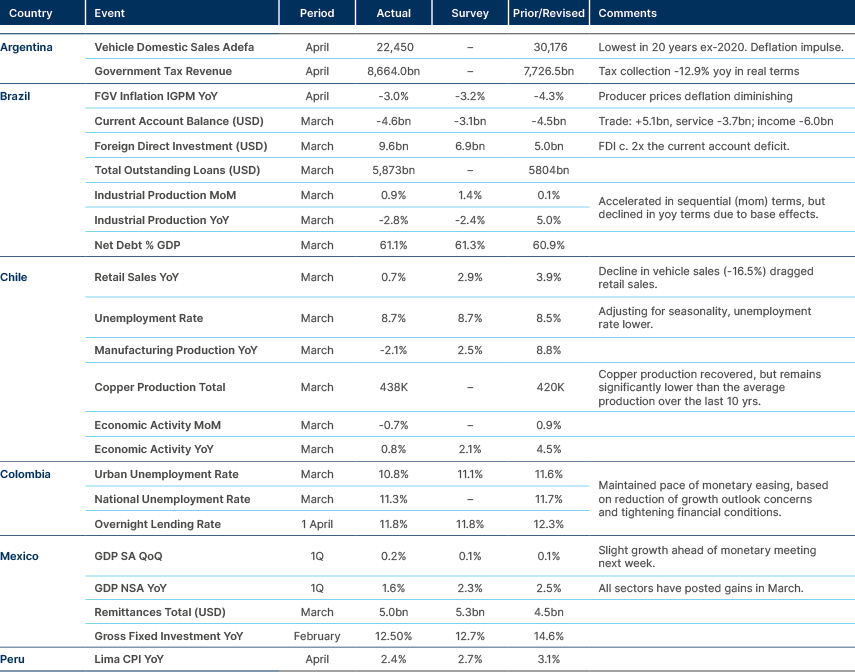

Latin America

Argentina: The Economic Ministry is discussing a new programme with the International Monetary Fund (IMF), laying out its new monetary and exchange rate plans. Minister Luis Caputo expects inflation to slow again in May.7 The Lower House approved the first chapter of President Milei’s new omnibus bill that expands his executive power over administrative, financial, economic and energy matters for one year. This includes dissolving special purpose government funds and privatising companies. These measures have now moved to discussion in the Senate.8

Brazil: Moody’s changed Brazil’s outlook to ‘positive’ and affirmed its Baa2 debt rating due to more robust growth and progress towards fiscal consolidation, boding well for Brazil’s debt burden to stabilise.

Colombia: President Gustavo Petro wrote that a package of measures is being prepared to achieve full economic reactivation.9 After the central bank lowered Colombia’s key interest rate by half a percentage point, it raised its estimate for economic growth this year to 1.4% from 0.8%. However, it cut next year’s forecast to 3.2% from 3.5%.

Panama: Presidential elections took place last weekend, and the result was market-friendly. José Raúl Mulino from the ‘Realising Goals’ Party won with 34% of the votes in a ‘first past the post’ context. Mulino was allowed to run in place of banned former president Ricardo Martinelli. Despite the market-friendly outcome, the government is likely to struggle to deliver badly-needed meaningful reforms. The Realising Goals Party will have only 13 seats out of 71 and Mulino will likely need to depend on informal alliances to give him a simple majority, making his the weakest mandate and coalition in Panama’s recent history. Crucially, it will be unpopular for Mulino to reverse the decision to close the Cobre Panama mine, responsible for c. 5% of GDP. Its original investor, First Quantum, is seeking compensation in a case that may lead to a large USD 10bn arbitration (12% GDP), according to specialists. On top of that, Panama needs a thorough fiscal adjustment and pension plan reforms to stabilise its debt/GDP ratio. The IMF forecasts a fiscal deficit of 4% of GDP and debt/GDP at 54.1% in 2024.

Venezuela: President Nicolás Maduro announced on Labour Day that he will raise minimum wages by 30% to the equivalent of USD 130 monthly, in efforts to boost support ahead of the July election.10

Economic data: Argentina is in deflation. Brazil’s external accounts are robust. Chile: soft activity and mining. Colombia cut rates by 50bps.

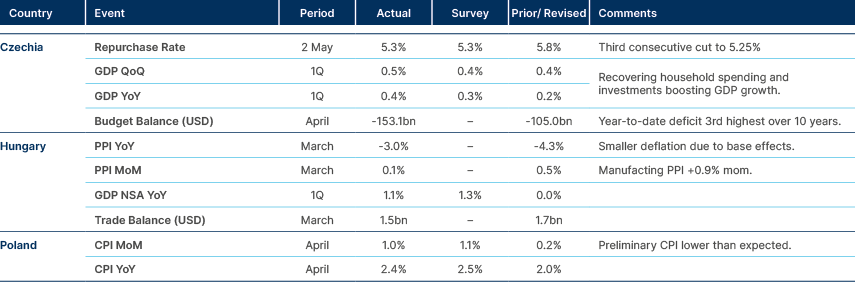

Central and Eastern Europe

Poland: The 2024-2027 fiscal plan forecasts government debt to rise to 60.5% of GDP in 2026 and 61.3% in 2027, from 53.4% expected in 2024. This exceeds the European Union’s limit of 60% of GDP in 2026. The rising debt stems from higher defence spending, aid to Ukraine, and energy subsidies. Annual inflation rate is forecasted at 5.2% in 2024, 4.1% in 2025, 3.3% in 2026 and 2.5% in 2027.11

Economic Data: Czechia cut rates 50bps. Hungary prices are soft but increasing. Poland’s CPI a bit better.

Central Asia, Middle East, and Africa

Egypt: Ratings agency Fitch upgraded Egypt’s `B-` sovereign rating outlook to positive from stable.

Nigeria: Ratings agency Fitch upgraded Nigeria’s `B-` sovereign rating outlook to positive from stable.

Türkiye: Ratings agency S&P upgraded Türkiye’s sovereign rating one notch to `B+`, with a positive outlook. S&P now has Türkiye with the same rating as Fitch and two above Moody’s. An upgrade to BB would most likely increase the number of funds and size that EM investors with risk limits based on credit rating can add to Türkiye.

Economic data: Saudi GDP improved (still contracting). Türkiye’s inflation remains unanchored.

Developed Markets

Japan: The price action and on the JPY suggests it is very likely that the Ministry of Finance intervened in the currency twice last week, in our view. The amount of the intervention was estimated to be around JPY 9.0trn, equivalent to c. 56.75bn assuming a JPY 5.5trn intervention at 159.5 and JPY 3.5trn at 157.4.12

United States: The interesting element of the wage inflation data is that the private sector is still softening, but government wages are rising. Employment growth remains relatively narrow (state and local government; healthcare; education; leisure; hospitality). However, construction and industrial jobs are also gaining momentum.

Economic Data: US labour market and confidence softening. EU CPI inflation unchanged from flash PMIs last week.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://blinks.bloomberg.com/news/stories/SCPILYTP3SHS

2. See – https://blinks.bloomberg.com/news/stories/SCPDGCT0AFB4

3. See – https://www.ft.com/content/581bee89-accb-402b-87d0-dad32c8d3aaf

4. See – https://time.com/6972021/donald-trump-2024-election-interview

5. See – https://blinks.bloomberg.com/news/stories/SCT6YXT0AFB5

6. See – https://blinks.bloomberg.com/news/stories/SCUIHBT0AFB4

7. See – https://blinks.bloomberg.com/news/stories/SCQ4Z0T1UM0W

8. See – https://blinks.bloomberg.com/news/stories/SCRB19T1UM0W

9. See – https://blinks.bloomberg.com/news/stories/SCP8LAT0G1KW

10. See – https://blinks.bloomberg.com/news/stories/SCPX59T0AFB4

11. See – https://blinks.bloomberg.com/news/stories/SCRL16DWLU68

12. See – https://blinks.bloomberg.com/news/stories/SCUPQRT1UM0W